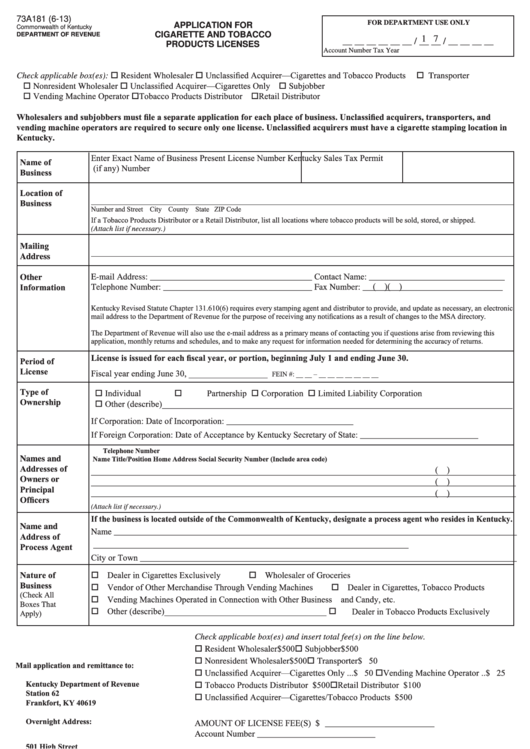

73A181 (6-13)

FOR DEPARTMENT USE ONLY

APPLICATION FOR

Commonwealth of Kentucky

CIGARETTE AND TOBACCO

DEPARTMENT OF REVENUE

1 7

__ __ __ __ __ __ / __ __ / __ __ __ __

PRODUCTS LICENSES

Account Number

Tax

Year

Unclassified Acquirer—Cigarettes and Tobacco Products Transporter

Check applicable box(es): Resident Wholesaler

Nonresident Wholesaler Unclassified Acquirer—Cigarettes Only Subjobber

Vending Machine Operator Tobacco Products Distributor Retail Distributor

Wholesalers and subjobbers must file a separate application for each place of business. Unclassified acquirers, transporters, and

vending machine operators are required to secure only one license. Unclassified acquirers must have a cigarette stamping location in

Kentucky.

Enter Exact Name of Business

Present License Number

Kentucky Sales Tax Permit

Name of

(if any)

Number

Business

Location of

Business

Number and Street

City

County

State

ZIP Code

If a Tobacco Products Distributor or a Retail Distributor, list all locations where tobacco products will be sold, stored, or shipped.

(Attach list if necessary.)

Mailing

Address

P.O. Box or Number and Street

City

County

State

ZIP Code

Contact Name: _______________________________

E-mail Address: _____________________________________

Other

(

)

(

)

Information

Telephone Number: __________________________________

Fax Number: ________________________________

Kentucky Revised Statute Chapter 131.610(6) requires every stamping agent and distributor to provide, and update as necessary, an electronic

mail address to the Department of Revenue for the purpose of receiving any notifications as a result of changes to the MSA directory.

The Department of Revenue will also use the e-mail address as a primary means of contacting you if questions arise from reviewing this

application, monthly returns and schedules, and to make any request for information needed for determining the accuracy of returns.

License is issued for each fiscal year, or portion, beginning July 1 and ending June 30.

Period of

License

Fiscal year ending June 30, __________________

FEIN #: __ __ – __ __ __ __ __ __ __

Type of

Individual

Partnership

Corporation

Limited Liability Corporation

Ownership

Other (describe)________________________________________________________________________________

If Corporation: Date of Incorporation: _____________________________

If Foreign Corporation: Date of Acceptance by Kentucky Secretary of State: ___________________________

Telephone Number

Name

Title/Position

Home Address

Social Security Number

(Include area code)

Names and

Addresses of

(

)

_________________________________________________________________________________________________

(

)

Owners or

_________________________________________________________________________________________________

Principal

(

)

_________________________________________________________________________________________________

Officers

(Attach list if necessary.)

If the business is located outside of the Commonwealth of Kentucky, designate a process agent who resides in Kentucky.

Name and

Name ____________________________________________________________________________________________

Address of

P.O. Box or Number and Street ________________________________________________________________________

Process Agent

City or Town ______________________________________________________________________________________

Nature of

Dealer in Cigarettes Exclusively

Wholesaler of Groceries

Business

Vendor of Other Merchandise Through Vending Machines

Dealer in Cigarettes, Tobacco Products

(Check All

Vending Machines Operated in Connection with Other Business

and Candy, etc.

Boxes That

Other (describe)_____________________________________

Dealer in Tobacco Products Exclusively

Apply)

Check applicable box(es) and insert total fee(s) on the line below.

Resident Wholesaler ..................................$500

Subjobber ............................ $500

Nonresident Wholesaler ............................$500

Transporter ........................... $ 50

Mail application and remittance to:

Unclassified Acquirer—Cigarettes Only ...$ 50

Vending Machine Operator .. $ 25

Kentucky Department of Revenue

Tobacco Products Distributor ....................$500

Retail Distributor ................ $100

Station 62

Unclassified Acquirer—Cigarettes/Tobacco Products .............................................. $500

Frankfort, KY 40619

Overnight Address:

AMOUNT OF LICENSE FEE(S).............................. $ _________________________

Account Number ___________________________

501 High Street

Frankfort, KY 40601-2103

10% Penalty (if applicable) .......................................

_________________________

Total Remittance ........................................................ $ _________________________

Make check payable to Kentucky State Treasurer.

(Complete Second and Third Page)

1

1 2

2 3

3