Reset Form

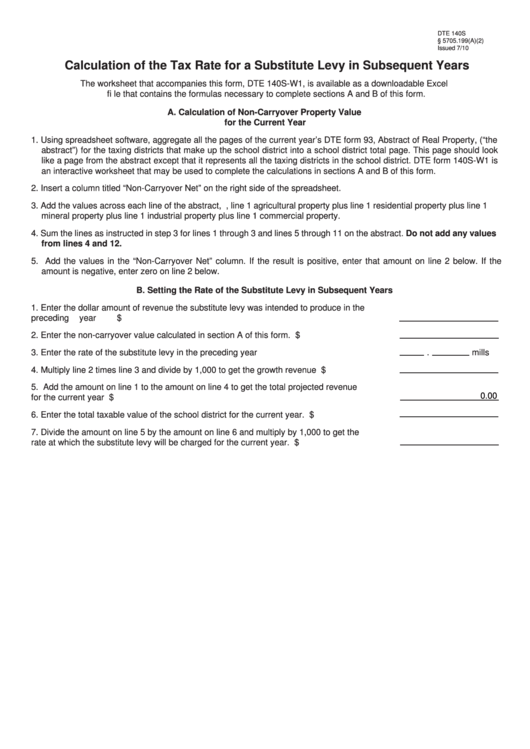

DTE 140S

R.C. § 5705.199(A)(2)

Issued 7/10

Calculation of the Tax Rate for a Substitute Levy in Subsequent Years

The worksheet that accompanies this form, DTE 140S-W1, is available as a downloadable Excel

fi le that contains the formulas necessary to complete sections A and B of this form.

A. Calculation of Non-Carryover Property Value

for the Current Year

1. Using spreadsheet software, aggregate all the pages of the current year’s DTE form 93, Abstract of Real Property, (“the

abstract”) for the taxing districts that make up the school district into a school district total page. This page should look

like a page from the abstract except that it represents all the taxing districts in the school district. DTE form 140S-W1 is

an interactive worksheet that may be used to complete the calculations in sections A and B of this form.

2. Insert a column titled “Non-Carryover Net” on the right side of the spreadsheet.

3. Add the values across each line of the abstract, i.e., line 1 agricultural property plus line 1 residential property plus line 1

mineral property plus line 1 industrial property plus line 1 commercial property.

4. Sum the lines as instructed in step 3 for lines 1 through 3 and lines 5 through 11 on the abstract. Do not add any values

from lines 4 and 12.

5. Add the values in the “Non-Carryover Net” column. If the result is positive, enter that amount on line 2 below. If the

amount is negative, enter zero on line 2 below.

B. Setting the Rate of the Substitute Levy in Subsequent Years

1. Enter the dollar amount of revenue the substitute levy was intended to produce in the

preceding year ........................................................................................................................ $

2. Enter the non-carryover value calculated in section A of this form. ......................................... $

3. Enter the rate of the substitute levy in the preceding year ......................................................

.

mills

4. Multiply line 2 times line 3 and divide by 1,000 to get the growth revenue ............................. $

5. Add the amount on line 1 to the amount on line 4 to get the total projected revenue

0.00

for the current year .................................................................................................................. $

6. Enter the total taxable value of the school district for the current year. ................................... $

7. Divide the amount on line 5 by the amount on line 6 and multiply by 1,000 to get the

rate at which the substitute levy will be charged for the current year. ..................................... $

1

1