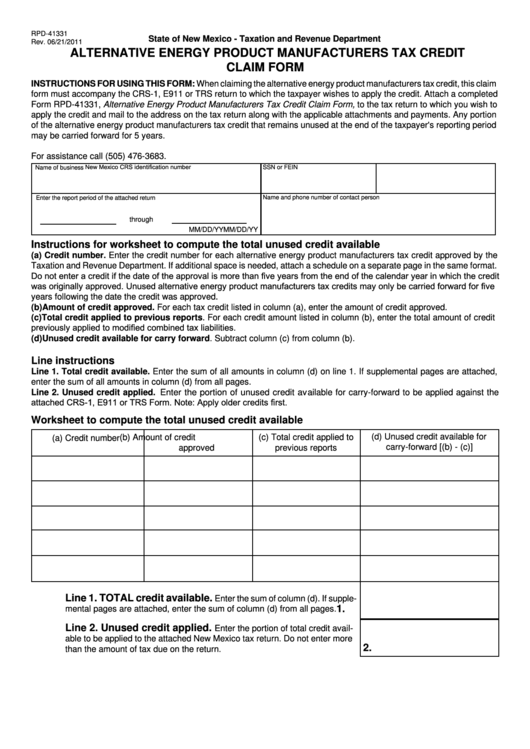

RPD-41331

State of New Mexico - Taxation and Revenue Department

Rev. 06/21/2011

ALTERNATIVE ENERGY PRODUCT MANUFACTURERS TAX CREDIT

CLAIM FORM

INSTRUCTIONS FOR USING THIS FORM: When claiming the alternative energy product manufacturers tax credit, this claim

form must accompany the CRS-1, E911 or TRS return to which the taxpayer wishes to apply the credit. Attach a completed

Form RPD-41331, Alternative Energy Product Manufacturers Tax Credit Claim Form, to the tax return to which you wish to

apply the credit and mail to the address on the tax return along with the applicable attachments and payments. Any portion

of the alternative energy product manufacturers tax credit that remains unused at the end of the taxpayer's reporting period

may be carried forward for 5 years.

For assistance call (505) 476-3683.

SSN or FEIN

New Mexico CRS identification number

Name of business

Name and phone number of contact person

Enter the report period of the attached return

through

MM/DD/YY

MM/DD/YY

Instructions for worksheet to compute the total unused credit available

(a) Credit number. Enter the credit number for each alternative energy product manufacturers tax credit approved by the

Taxation and Revenue Department. If additional space is needed, attach a schedule on a separate page in the same format.

Do not enter a credit if the date of the approval is more than five years from the end of the calendar year in which the credit

was originally approved. Unused alternative energy product manufacturers tax credits may only be carried forward for five

years following the date the credit was approved.

(b) Amount of credit approved. For each tax credit listed in column (a), enter the amount of credit approved.

(c) Total credit applied to previous reports. For each credit amount listed in column (b), enter the total amount of credit

previously applied to modified combined tax liabilities.

(d) Unused credit available for carry forward. Subtract column (c) from column (b).

Line instructions

Line 1. Total credit available. Enter the sum of all amounts in column (d) on line 1. If supplemental pages are attached,

enter the sum of all amounts in column (d) from all pages.

Line 2. Unused credit applied. Enter the portion of unused credit available for carry-forward to be applied against the

attached CRS-1, E911 or TRS Form. Note: Apply older credits first.

Worksheet to compute the total unused credit available

(d) Unused credit available for

(b) Amount of credit

(c) Total credit applied to

(a) Credit number

carry-forward [(b) - (c)]

approved

previous reports

Enter the sum of column (d). If supple-

Line 1. TOTAL credit available.

mental pages are attached, enter the sum of column (d) from all pages.

1.

Enter the portion of total credit avail-

Line 2. Unused credit applied.

able to be applied to the attached New Mexico tax return. Do not enter more

than the amount of tax due on the return.

2.

1

1 2

2