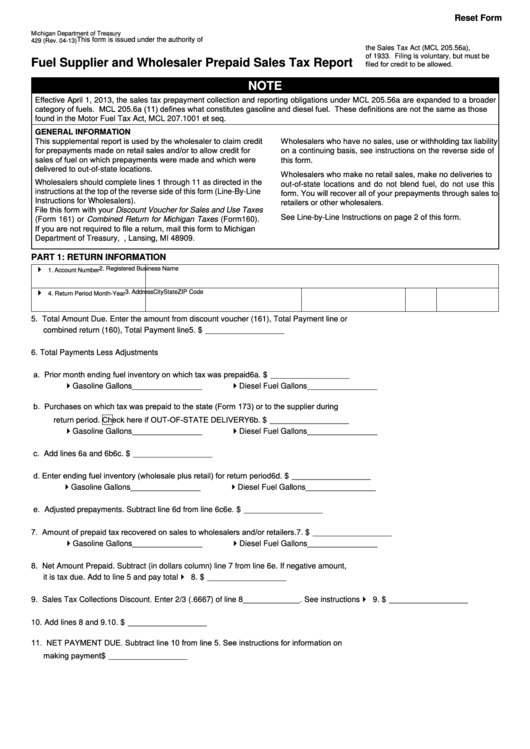

Reset Form

Michigan Department of Treasury

This form is issued under the authority of

429 (Rev. 04-13)

the Sales Tax Act (MCL 205.56a), P.A. 167

of 1933. Filing is voluntary, but must be

Fuel Supplier and Wholesaler Prepaid Sales Tax Report

filed for credit to be allowed.

NOTE

Effective April 1, 2013, the sales tax prepayment collection and reporting obligations under MCL 205.56a are expanded to a broader

category of fuels. MCL 205.6a (11) defines what constitutes gasoline and diesel fuel. These definitions are not the same as those

found in the Motor Fuel Tax Act, MCL 207.1001 et seq.

GENERAL INFORMATION

This supplemental report is used by the wholesaler to claim credit

Wholesalers who have no sales, use or withholding tax liability

for prepayments made on retail sales and/or to allow credit for

on a continuing basis, see instructions on the reverse side of

sales of fuel on which prepayments were made and which were

this form.

delivered to out-of-state locations.

Wholesalers who make no retail sales, make no deliveries to

Wholesalers should complete lines 1 through 11 as directed in the

out-of-state locations and do not blend fuel, do not use this

form. You will recover all of your prepayments through sales to

instructions at the top of the reverse side of this form (Line-By-Line

retailers or other wholesalers.

Instructions for Wholesalers).

File this form with your Discount Voucher for Sales and Use Taxes

See Line-by-Line Instructions on page 2 of this form.

(Form 161) or Combined Return for Michigan Taxes (Form 160).

If you are not required to file a return, mail this form to Michigan

Department of Treasury, P.O. Box 30427, Lansing, MI 48909.

PART 1: RETURN INFORMATION

2. Registered Business Name

1. Account Number

3. Address

City

State

ZIP Code

4. Return Period Month-Year

5. Total Amount Due. Enter the amount from discount voucher (161), Total Payment line or

combined return (160), Total Payment line ................................................................................................. 5. $ __________________

6. Total Payments Less Adjustments

a. Prior month ending fuel inventory on which tax was prepaid ............................................................... 6a. $ __________________

Gasoline Gallons________________

Diesel Fuel Gallons________________

b. Purchases on which tax was prepaid to the state (Form 173) or to the supplier during

Check here if OUT-OF-STATE DELIVERY .............................................................. 6b. $ __________________

return period.

Gasoline Gallons________________

Diesel Fuel Gallons________________

c. Add lines 6a and 6b ..............................................................................................................................6c. $ __________________

d. Enter ending fuel inventory (wholesale plus retail) for return period .................................................... 6d. $ __________________

Gasoline Gallons________________

Diesel Fuel Gallons________________

e. Adjusted prepayments. Subtract line 6d from line 6c ........................................................................... 6e. $ __________________

7. Amount of prepaid tax recovered on sales to wholesalers and/or retailers. ............................................... 7. $ __________________

Gasoline Gallons________________

Diesel Fuel Gallons________________

8. Net Amount Prepaid. Subtract (in dollars column) line 7 from line 6e. If negative amount,

it is tax due. Add to line 5 and pay total ................................................................................................

8. $ __________________

9. Sales Tax Collections Discount. Enter 2/3 (.6667) of line 8_____________. See instructions .............

9. $ __________________

10. Add lines 8 and 9. ..................................................................................................................................... 10. $ __________________

11. NET PAYMENT DUE. Subtract line 10 from line 5. See instructions for information on

making payment.........................................................................................................................................11. $ __________________

1

1 2

2