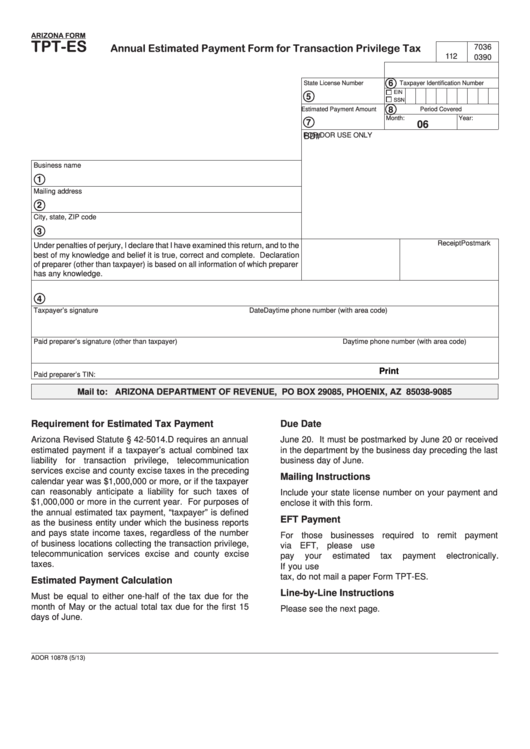

ARIZONA FORM

TPT-ES

Annual Estimated Payment Form for Transaction Privilege Tax

7036

112

0390

6

State License Number

Taxpayer Identification Number

EIN

5

SSN

8

Estimated Payment Amount

Period Covered

Month:

Year:

7

06

FOR DOR USE ONLY

BD#

Business name

1

Mailing address

2

City, state, ZIP code

3

Postmark

Receipt

Under penalties of perjury, I declare that I have examined this return, and to the

best of my knowledge and belief it is true, correct and complete. Declaration

of preparer (other than taxpayer) is based on all information of which preparer

has any knowledge.

4

Taxpayer’s signature

Date

Daytime phone number (with area code)

Paid preparer’s signature (other than taxpayer)

Daytime phone number (with area code)

Print

Paid preparer’s TIN:

Mail to: ARIZONA DEPARTMENT OF REVENUE, PO BOX 29085, PHOENIX, AZ 85038-9085

Requirement for Estimated Tax Payment

Due Date

Arizona Revised Statute § 42-5014.D requires an annual

June 20. It must be postmarked by June 20 or received

estimated payment if a taxpayer’s actual combined tax

in the department by the business day preceding the last

liability for transaction privilege, telecommunication

business day of June.

services excise and county excise taxes in the preceding

Mailing Instructions

calendar year was $1,000,000 or more, or if the taxpayer

can reasonably anticipate a liability for such taxes of

Include your state license number on your payment and

$1,000,000 or more in the current year. For purposes of

enclose it with this form.

the annual estimated tax payment, “taxpayer” is defined

EFT Payment

as the business entity under which the business reports

and pays state income taxes, regardless of the number

For those businesses required to remit payment

of business locations collecting the transaction privilege,

via EFT, please use aztaxes.gov to report and

telecommunication services excise and county excise

pay

your

estimated

tax

payment

electronically.

taxes.

If you use aztaxes.gov to report and pay your estimated

tax, do not mail a paper Form TPT-ES.

Estimated Payment Calculation

Line-by-Line Instructions

Must be equal to either one-half of the tax due for the

month of May or the actual total tax due for the first 15

Please see the next page.

days of June.

ADOR 10878 (5/13)

1

1 2

2