Form Rpd-41325 - Application For Laboratory Partnership With Small Business Tax Credit

ADVERTISEMENT

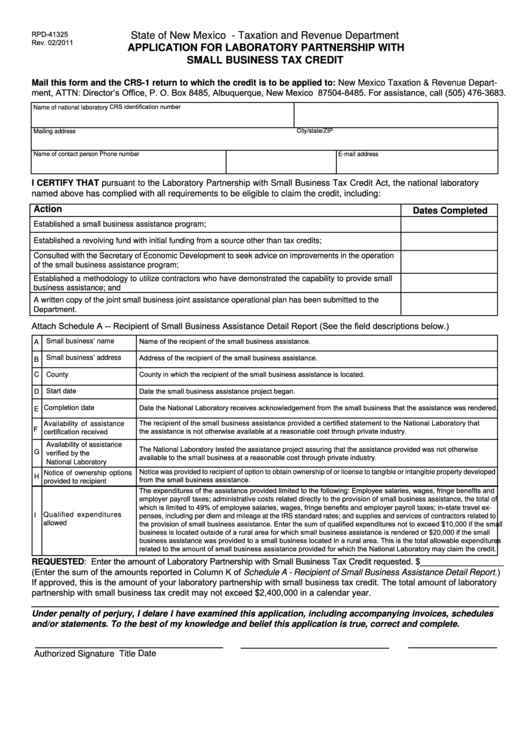

RPD-41325

State of New Mexico - Taxation and Revenue Department

Rev. 02/2011

APPLICATION FOR LABORATORY PARTNERSHIP WITH

SMALL BUSINESS TAX CREDIT

Mail this form and the CRS-1 return to which the credit is to be applied to: New Mexico Taxation & Revenue Depart-

ment, ATTN: Director’s Office, P. O. Box 8485, Albuquerque, New Mexico 87504-8485. For assistance, call (505) 476-3683.

CRS identification number

Name of national laboratory

City/state/ZIP

Mailing address

Name of contact person

Phone number

E-mail address

I CERTIFY THAT pursuant to the Laboratory Partnership with Small Business Tax Credit Act, the national laboratory

named above has complied with all requirements to be eligible to claim the credit, including:

Action

Dates Completed

Established a small business assistance program;

Established a revolving fund with initial funding from a source other than tax credits;

Consulted with the Secretary of Economic Development to seek advice on improvements in the operation

of the small business assistance program;

Established a methodology to utilize contractors who have demonstrated the capability to provide small

business assistance; and

A written copy of the joint small business joint assistance operational plan has been submitted to the

Department.

Attach Schedule A -- Recipient of Small Business Assistance Detail Report (See the field descriptions below.)

Name of the recipient of the small business assistance.

Small business’ name

A

Address of the recipient of the small business assistance.

Small business’ address

B

.

County in which the recipient of the small business assistance is located.

C

County

Date the small business assistance project began.

Start date

D

Date the National Laboratory receives acknowledgement from the small business that the assistance was rendered.

Completion date

E

The recipient of the small business assistance provided a certified statement to the National Laboratory that

Availability of assistance

F

the assistance is not otherwise available at a reasonable cost through private industry.

certification received

Availability of assistance

The National Laboratory tested the assistance project assuring that the assistance provided was not otherwise

verified by the

G

available to the small business at a reasonable cost through private industry.

National Laboratory

Notice was provided to recipient of option to obtain ownership of or license to tangible or intangible property developed

Notice of ownership options

H

from the small business assistance.

provided to recipient

The expenditures of the assistance provided limited to the following: Employee salaries, wages, fringe benefits and

employer payroll taxes; administrative costs related directly to the provision of small business assistance, the total of

which is limited to 49% of employee salaries, wages, fringe benefits and employer payroll taxes; in-state travel ex-

I

Qualified expenditures

penses, including per diem and mileage at the IRS standard rates; and supplies and services of contractors related to

the provision of small business assistance. Enter the sum of qualified expenditures not to exceed $10,000 if the small

allowed

business is located outside of a rural area for which small business assistance is rendered or $20,000 if the small

business assistance was provided to a small business located in a rural area. This is the total allowable expenditures

related to the amount of small business assistance provided for which the National Laboratory may claim the credit.

REQUESTED: Enter the amount of Laboratory Partnership with Small Business Tax Credit requested. $__________________

(Enter the sum of the amounts reported in Column K of Schedule A - Recipient of Small Business Assistance Detail Report.)

If approved, this is the amount of your laboratory partnership with small business tax credit. The total amount of laboratory

partnership with small business tax credit may not exceed $2,400,000 in a calendar year.

Under penalty of perjury, I delare I have examined this application, including accompanying invoices, schedules

and/or statements. To the best of my knowledge and belief this application is true, correct and complete.

Date

Authorized Signature

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2