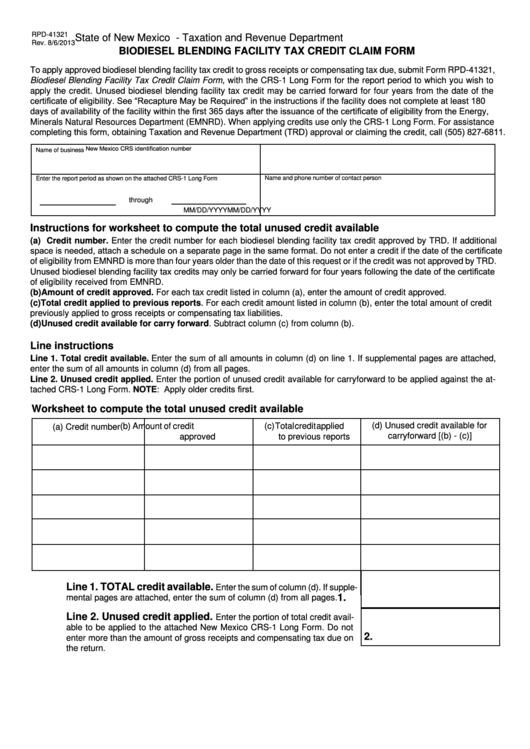

State of New Mexico - Taxation and Revenue Department

RPD-41321

Rev. 8/6/2013

BIODIESEL BLENDING FACILITY TAX CREDIT CLAIM FORM

To apply approved biodiesel blending facility tax credit to gross receipts or compensating tax due, submit Form RPD-41321,

Biodiesel Blending Facility Tax Credit Claim Form, with the CRS-1 Long Form for the report period to which you wish to

apply the credit. Unused biodiesel blending facility tax credit may be carried forward for four years from the date of the

certificate of eligibility. See “Recapture May be Required” in the instructions if the facility does not complete at least 180

days of availability of the facility within the first 365 days after the issuance of the certificate of eligibility from the Energy,

Minerals Natural Resources Department (EMNRD). When applying credits use only the CRS-1 Long Form. For assistance

completing this form, obtaining Taxation and Revenue Department (TRD) approval or claiming the credit, call (505) 827-6811.

New Mexico CRS identification number

Name of business

Name and phone number of contact person

Enter the report period as shown on the attached CRS-1 Long Form

through

MM/DD/YYYY

MM/DD/YYYY

Instructions for worksheet to compute the total unused credit available

(a) Credit number. Enter the credit number for each biodiesel blending facility tax credit approved by TRD. If additional

space is needed, attach a schedule on a separate page in the same format. Do not enter a credit if the date of the certificate

of eligibility from EMNRD is more than four years older than the date of this request or if the credit was not approved by TRD.

Unused biodiesel blending facility tax credits may only be carried forward for four years following the date of the certificate

of eligibility received from EMNRD.

(b) Amount of credit approved. For each tax credit listed in column (a), enter the amount of credit approved.

(c) Total credit applied to previous reports. For each credit amount listed in column (b), enter the total amount of credit

previously applied to gross receipts or compensating tax liabilities.

(d) Unused credit available for carry forward. Subtract column (c) from column (b).

Line instructions

Line 1. Total credit available. Enter the sum of all amounts in column (d) on line 1. If supplemental pages are attached,

enter the sum of all amounts in column (d) from all pages.

Line 2. Unused credit applied. Enter the portion of unused credit available for carryforward to be applied against the at-

tached CRS-1 Long Form. NOTE: Apply older credits first.

Worksheet to compute the total unused credit available

(d) Unused credit available for

(c) Total credit applied

(b) Amount of credit

(a) Credit number

carryforward [(b) - (c)]

approved

to previous reports

Enter the sum of column (d). If supple-

Line 1. TOTAL credit available.

mental pages are attached, enter the sum of column (d) from all pages.

1.

Enter the portion of total credit avail-

Line 2. Unused credit applied.

able to be applied to the attached New Mexico CRS-1 Long Form. Do not

enter more than the amount of gross receipts and compensating tax due on

2.

the return.

1

1 2

2