Reset Form

DTE 140M-W5

Rev. 8/08

O.R.C. §5705.03(B)

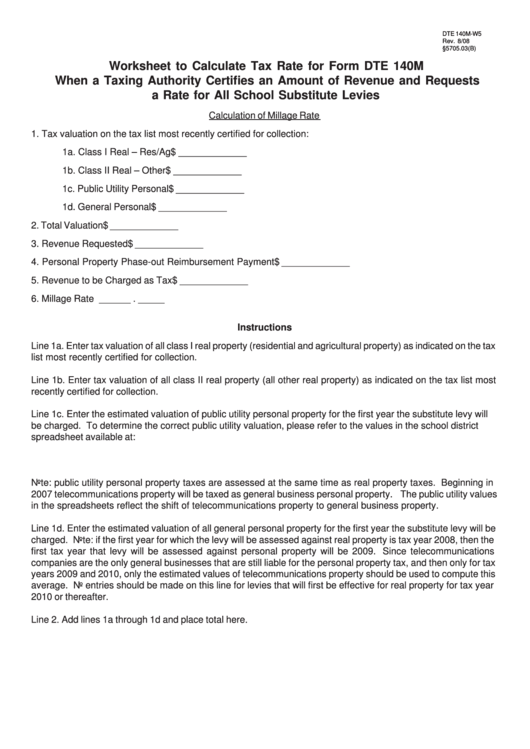

Worksheet to Calculate Tax Rate for Form DTE 140M

When a Taxing Authority Certifies an Amount of Revenue and Requests

a Rate for All School Substitute Levies

Calculation of Millage Rate

1. Tax valuation on the tax list most recently certified for collection:

1a. Class I Real – Res/Ag

$ _____________

1b. Class II Real – Other

$ _____________

1c. Public Utility Personal

$ _____________

1d. General Personal

$ _____________

2. Total Valuation

$ _____________

3. Revenue Requested

$ _____________

4. Personal Property Phase-out Reimbursement Payment

$ _____________

5. Revenue to be Charged as Tax

$ _____________

6. Millage Rate

______ . _____

Instructions

Line 1a. Enter tax valuation of all class I real property (residential and agricultural property) as indicated on the tax

list most recently certified for collection.

Line 1b. Enter tax valuation of all class II real property (all other real property) as indicated on the tax list most

recently certified for collection.

Line 1c. Enter the estimated valuation of public utility personal property for the first year the substitute levy will

be charged. To determine the correct public utility valuation, please refer to the values in the school district

spreadsheet available at:

Note: public utility personal property taxes are assessed at the same time as real property taxes. Beginning in

2007 telecommunications property will be taxed as general business personal property. The public utility values

in the spreadsheets reflect the shift of telecommunications property to general business property.

Line 1d. Enter the estimated valuation of all general personal property for the first year the substitute levy will be

charged. Note: if the first year for which the levy will be assessed against real property is tax year 2008, then the

first tax year that levy will be assessed against personal property will be 2009. Since telecommunications

companies are the only general businesses that are still liable for the personal property tax, and then only for tax

years 2009 and 2010, only the estimated values of telecommunications property should be used to compute this

average. No entries should be made on this line for levies that will first be effective for real property for tax year

2010 or thereafter.

Line 2. Add lines 1a through 1d and place total here.

1

1 2

2