Form Rpd-41323 - Gross Receipts Tax Credit For Certain Unpaid Doctor Services

ADVERTISEMENT

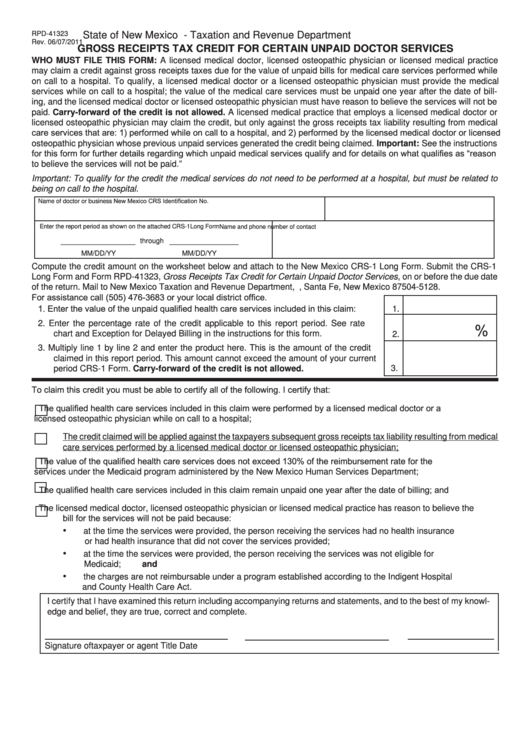

RPD-41323

State of New Mexico - Taxation and Revenue Department

Rev. 06/07/2011

GROSS RECEIPTS TAX CREDIT FOR CERTAIN UNPAID DOCTOR SERVICES

WHO MUST FILE THIS FORM: A licensed medical doctor, licensed osteopathic physician or licensed medical practice

may claim a credit against gross receipts taxes due for the value of unpaid bills for medical care services performed while

on call to a hospital. To qualify, a licensed medical doctor or a licensed osteopathic physician must provide the medical

services while on call to a hospital; the value of the medical care services must be unpaid one year after the date of bill-

ing, and the licensed medical doctor or licensed osteopathic physician must have reason to believe the services will not be

paid. Carry-forward of the credit is not allowed. A licensed medical practice that employs a licensed medical doctor or

licensed osteopathic physician may claim the credit, but only against the gross receipts tax liability resulting from medical

care services that are: 1) performed while on call to a hospital, and 2) performed by the licensed medical doctor or licensed

osteopathic physician whose previous unpaid services generated the credit being claimed. Important: See the instructions

for this form for further details regarding which unpaid medical services qualify and for details on what qualifies as “reason

to believe the services will not be paid.”

Important: To qualify for the credit the medical services do not need to be performed at a hospital, but must be related to

being on call to the hospital.

New Mexico CRS Identification No.

Name of doctor or business

Enter the report period as shown on the attached CRS-1 Long Form

Name and phone number of contact

_____________

____________

through

MM/DD/YY

MM/DD/YY

Compute the credit amount on the worksheet below and attach to the New Mexico CRS-1 Long Form. Submit the CRS-1

Long Form and Form RPD-41323, Gross Receipts Tax Credit for Certain Unpaid Doctor Services, on or before the due date

of the return. Mail to New Mexico Taxation and Revenue Department, P.O. Box 25128, Santa Fe, New Mexico 87504-5128.

For assistance call (505) 476-3683 or your local district office.

1. Enter the value of the unpaid qualified health care services included in this claim:

1.

2. Enter the percentage rate of the credit applicable to this report period. See rate

%

chart and Exception for Delayed Billing in the instructions for this form.

2.

3. Multiply line 1 by line 2 and enter the product here. This is the amount of the credit

claimed in this report period. This amount cannot exceed the amount of your current

period CRS-1 Form. Carry-forward of the credit is not allowed.

3.

To claim this credit you must be able to certify all of the following. I certify that:

The qualified health care services included in this claim were performed by a licensed medical doctor or a

licensed osteopathic physician while on call to a hospital;

The credit claimed will be applied against the taxpayers subsequent gross receipts tax liability resulting from medical

care services performed by a licensed medical doctor or licensed osteopathic physician;

The value of the qualified health care services does not exceed 130% of the reimbursement rate for the

services under the Medicaid program administered by the New Mexico Human Services Department;

The qualified health care services included in this claim remain unpaid one year after the date of billing; and

The licensed medical doctor, licensed osteopathic physician or licensed medical practice has reason to believe the

bill for the services will not be paid because:

•

at the time the services were provided, the person receiving the services had no health insurance

or had health insurance that did not cover the services provided;

•

at the time the services were provided, the person receiving the services was not eligible for

Medicaid; and

•

the charges are not reimbursable under a program established according to the Indigent Hospital

and County Health Care Act.

I certify that I have examined this return including accompanying returns and statements, and to the best of my knowl-

edge and belief, they are true, correct and complete.

Signature of taxpayer or agent

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2