DTE 140M-W4

Reset Form

Rev. 12/08

O.R.C. §5705.03(B)

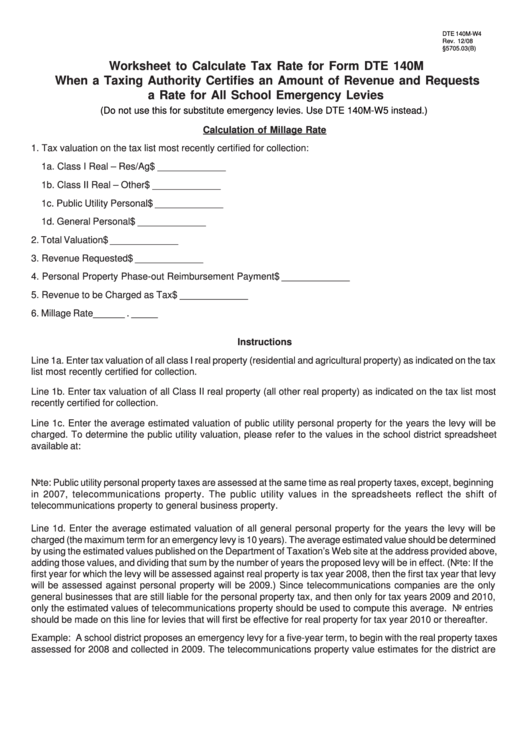

Worksheet to Calculate Tax Rate for Form DTE 140M

When a Taxing Authority Certifies an Amount of Revenue and Requests

a Rate for All School Emergency Levies

(Do not use this for substitute emergency levies. Use DTE 140M-W5 instead.)

Calculation of Millage Rate

1. Tax valuation on the tax list most recently certified for collection:

1a. Class I Real – Res/Ag

$ _____________

1b. Class II Real – Other

$ _____________

1c. Public Utility Personal

$ _____________

1d. General Personal

$ _____________

2. Total Valuation

$ _____________

3. Revenue Requested

$ _____________

4. Personal Property Phase-out Reimbursement Payment

$ _____________

5. Revenue to be Charged as Tax

$ _____________

6. Millage Rate

______ . _____

Instructions

Line 1a. Enter tax valuation of all class I real property (residential and agricultural property) as indicated on the tax

list most recently certified for collection.

Line 1b. Enter tax valuation of all Class II real property (all other real property) as indicated on the tax list most

recently certified for collection.

Line 1c. Enter the average estimated valuation of public utility personal property for the years the levy will be

charged. To determine the public utility valuation, please refer to the values in the school district spreadsheet

available at:

Note: Public utility personal property taxes are assessed at the same time as real property taxes, except, beginning

in 2007, telecommunications property. The public utility values in the spreadsheets reflect the shift of

telecommunications property to general business property.

Line 1d. Enter the average estimated valuation of all general personal property for the years the levy will be

charged (the maximum term for an emergency levy is 10 years). The average estimated value should be determined

by using the estimated values published on the Department of Taxation’s Web site at the address provided above,

adding those values, and dividing that sum by the number of years the proposed levy will be in effect. (Note: If the

first year for which the levy will be assessed against real property is tax year 2008, then the first tax year that levy

will be assessed against personal property will be 2009.) Since telecommunications companies are the only

general businesses that are still liable for the personal property tax, and then only for tax years 2009 and 2010,

only the estimated values of telecommunications property should be used to compute this average. No entries

should be made on this line for levies that will first be effective for real property for tax year 2010 or thereafter.

Example: A school district proposes an emergency levy for a five-year term, to begin with the real property taxes

assessed for 2008 and collected in 2009. The telecommunications property value estimates for the district are

1

1 2

2