Form Ls Wks - Ohio Individual Income Tax Lump Sum Distribution Instructions

ADVERTISEMENT

LS WKS

Rev. 8/12

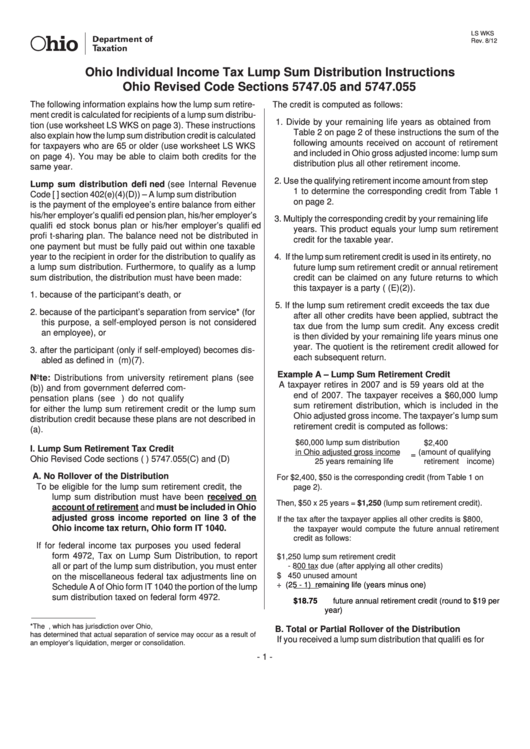

Ohio Individual Income Tax Lump Sum Distribution Instructions

Ohio Revised Code Sections 5747.05 and 5747.055

The following information explains how the lump sum retire-

The credit is computed as follows:

ment credit is calculated for recipients of a lump sum distribu-

1. Divide by your remaining life years as obtained from

tion (use worksheet LS WKS on page 3). These instructions

Table 2 on page 2 of these instructions the sum of the

also explain how the lump sum distribution credit is calculated

following amounts received on account of retirement

for taxpayers who are 65 or older (use worksheet LS WKS

and included in Ohio gross adjusted income: lump sum

on page 4). You may be able to claim both credits for the

distribution plus all other retirement income.

same year.

2. Use the qualifying retirement income amount from step

Lump sum distribution defi ned (see Internal Revenue

1 to determine the corresponding credit from Table 1

Code [I.R.C.] section 402(e)(4)(D)) – A lump sum distribution

on page 2.

is the payment of the employee’s entire balance from either

his/her employer’s qualifi ed pension plan, his/her employer’s

3. Multiply the corresponding credit by your remaining life

qualifi ed stock bonus plan or his/her employer’s qualifi ed

years. This product equals your lump sum retirement

profi t-sharing plan. The balance need not be distributed in

credit for the taxable year.

one payment but must be fully paid out within one taxable

year to the recipient in order for the distribution to qualify as

4. If the lump sum retirement credit is used in its entirety, no

a lump sum distribution. Furthermore, to qualify as a lump

future lump sum retirement credit or annual retirement

sum distribution, the distribution must have been made:

credit can be claimed on any future returns to which

this taxpayer is a party (R.C. section 5747.055(E)(2)).

1. because of the participant’s death, or

5. If the lump sum retirement credit exceeds the tax due

2. because of the participant’s separation from service* (for

after all other credits have been applied, subtract the

this purpose, a self-employed person is not considered

tax due from the lump sum credit. Any excess credit

an employee), or

is then divided by your remaining life years minus one

year. The quotient is the retirement credit allowed for

3. after the participant (only if self-employed) becomes dis-

each subsequent return.

abled as defi ned in I.R.C. section 72(m)(7).

Example A – Lump Sum Retirement Credit

Note: Distributions from university retirement plans (see

A taxpayer retires in 2007 and is 59 years old at the

I.R.C. section 403(b)) and from government deferred com-

end of 2007. The taxpayer receives a $60,000 lump

pensation plans (see I.R.C. section 457) do not qualify

sum retirement distribution, which is included in the

for either the lump sum retirement credit or the lump sum

Ohio adjusted gross income. The taxpayer’s lump sum

distribution credit because these plans are not described in

retirement credit is computed as follows:

I.R.C. section 401(a).

$60,000 lump sum distribution

$2,400

I. Lump Sum Retirement Tax Credit

in Ohio adjusted gross income

(amount of qualifying

=

Ohio Revised Code sections (R.C.) 5747.055(C) and (D)

25 years remaining life

retirement income)

A. No Rollover of the Distribution

For $2,400, $50 is the corresponding credit (from Table 1 on

To be eligible for the lump sum retirement credit, the

page 2).

lump sum distribution must have been received on

Then, $50 x 25 years = $1,250 (lump sum retirement credit).

account of retirement and must be included in Ohio

adjusted gross income reported on line 3 of the

If the tax after the taxpayer applies all other credits is $800,

Ohio income tax return, Ohio form IT 1040.

the taxpayer would compute the future annual retirement

credit as follows:

If for federal income tax purposes you used federal

form 4972, Tax on Lump Sum Distribution, to report

$1,250 lump sum retirement credit

all or part of the lump sum distribution, you must enter

- 800 tax due (after applying all other credits)

$ 450 unused amount

on the miscellaneous federal tax adjustments line on

÷ (25 - 1) remaining life (years minus one)

Schedule A of Ohio form IT 1040 the portion of the lump

sum distribution taxed on federal form 4972.

$18.75 future annual retirement credit (round to $19 per

year)

*The U.S. Sixth Circuit Court of Appeals, which has jurisdiction over Ohio,

B. Total or Partial Rollover of the Distribution

has determined that actual separation of service may occur as a result of

If you received a lump sum distribution that qualifi es for

an employer’s liquidation, merger or consolidation.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4