Instructions For Completing Electric Distribution Company Tax Return (Form Kwh 2) And Schedule Of Self-Assessing Purchasers (Form Kwh 2a)

ADVERTISEMENT

KWH 2B

Rev. 4/04

P.O. Box 530

Columbus, OH 43216-0530

Instructions for Completing Electric Distribution Company Tax Return (KWH 2)

and Schedule of Self-Assessing Purchasers (KWH 2A)

Reporting Periods and Due Dates

Monthly tax returns are due by the 20th day of the month following the reporting period. The last day of a customer’s billing

period will determine when the distribution of electricity and tax are to be reported. As an example, information from all billing

periods ending in June will be reported on the June return that is due by July 20th. If the due date falls on a weekend or state

holiday, the due date is the next business day.

Nontaxable Distribution

Do not report on lines 1, 2 or 3 of the return the distribution of electricity to:

1. Customers that the Department of Taxation has notifi ed you are self-assessing purchasers

2. The federal government

3. A federal facility for uranium enrichment

4. A qualifi ed regeneration meter

5. A qualifi ed end user

Qualifi ed regeneration means a process to convert electricity to a form of stored energy if such stored energy is subsequently

used to generate electricity for sale to others. A qualifi ed end user is a manufacturer using more than three million kilowatt

hours of electricity at a single location per day in the performance of an electrochemical reaction in which electrons from

direct current remain a part of the product being manufactured.

Distribution to Self-Assessing Purchasers

Distribution of electricity to self-assessing purchasers must be reported on schedule KWH 2A, which must be fi led with your

return. This form will be preprinted with the self-assessor’s name and the account number assigned by the Department

of Taxation. Enter the kilowatt hours distributed during the return period based on their billing period as explained under

Reporting Periods and Due Dates. This schedule is for informational and verifi cation purposes only, and no tax is due as a

result of this schedule.

Municipal Electric Companies

Municipal electric companies retain the tax on electricity distributed to end users within the city limits. The tax on this

distribution is to be reported to the municipal corporation. Only the distribution of electricity to users outside the city limits,

and the appropriate tax, must be reported to the state of Ohio.

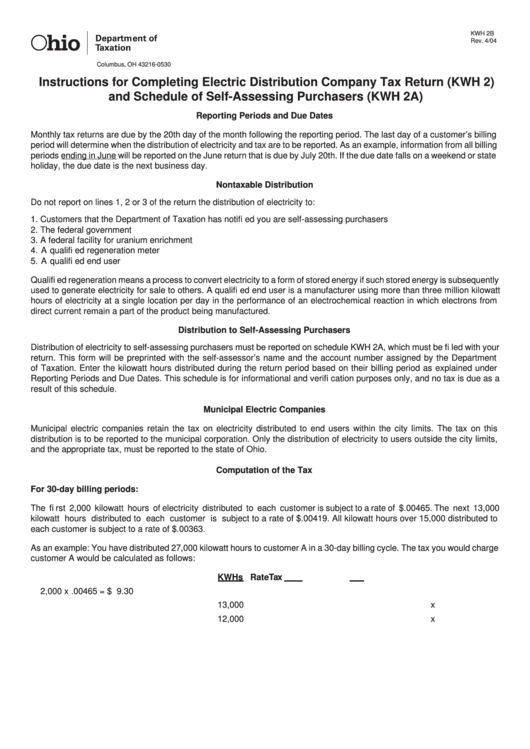

Computation of the Tax

For 30-day billing periods:

The fi rst 2,000 kilowatt hours of electricity distributed to each customer is subject to a rate of $.00465. The next 13,000

kilowatt hours distributed to each customer is subject to a rate of $.00419. All kilowatt hours over 15,000 distributed to

each customer is subject to a rate of $.00363.

As an example: You have distributed 27,000 kilowatt hours to customer A in a 30-day billing cycle. The tax you would charge

customer A would be calculated as follows:

KWHs

Rate

Tax

2,000

x

.00465

=

$ 9.30

13,000

x

.00419

=

$54.47

12,000

x

.00363

=

$43.56

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2