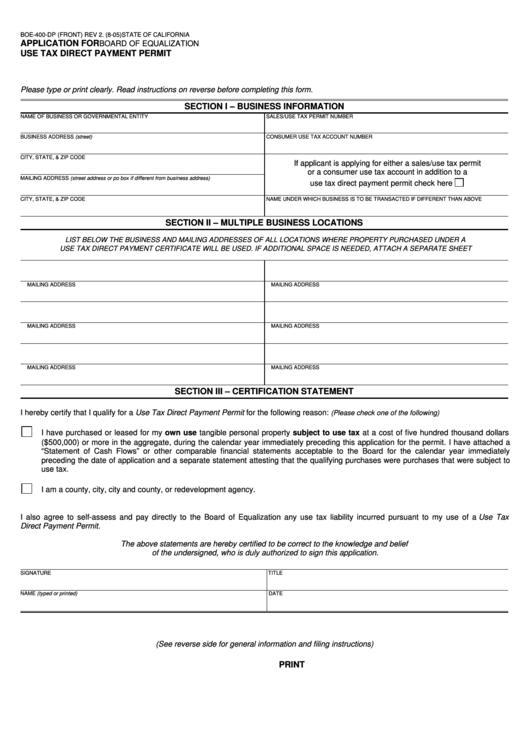

BOE-400-DP (FRONT) REV 2. (8-05)

STATE OF CALIFORNIA

APPLICATION FOR

BOARD OF EQUALIZATION

USE TAX DIRECT PAYMENT PERMIT

Please type or print clearly. Read instructions on reverse before completing this form.

SECTION I – BUSINESS INFORMATION

NAME OF BUSINESS OR GOVERNMENTAL ENTITY

SALES/USE TAX PERMIT NUMBER

BUSINESS ADDRESS (street)

CONSUMER USE TAX ACCOUNT NUMBER

CITY, STATE, & ZIP CODE

If applicant is applying for either a sales/use tax permit

or a consumer use tax account in addition to a

MAILING ADDRESS (street address or po box if different from business address)

use tax direct payment permit check here

CITY, STATE, & ZIP CODE

NAME UNDER WHICH BUSINESS IS TO BE TRANSACTED IF DIFFERENT THAN ABOVE

SECTION II – MULTIPLE BUSINESS LOCATIONS

LIST BELOW THE BUSINESS AND MAILING ADDRESSES OF ALL LOCATIONS WHERE PROPERTY PURCHASED UNDER A

USE TAX DIRECT PAYMENT CERTIFICATE WILL BE USED. IF ADDITIONAL SPACE IS NEEDED, ATTACH A SEPARATE SHEET

1. BUSINESS ADDRESS

4. BUSINESS ADDRESS

MAILING ADDRESS

MAILING ADDRESS

2. BUSINESS ADDRESS

5. BUSINESS ADDRESS

MAILING ADDRESS

MAILING ADDRESS

3. BUSINESS ADDRESS

6. BUSINESS ADDRESS

MAILING ADDRESS

MAILING ADDRESS

SECTION III – CERTIFICATION STATEMENT

I hereby certify that I qualify for a Use Tax Direct Payment Permit for the following reason:

(Please check one of the following)

I have purchased or leased for my own use tangible personal property subject to use tax at a cost of five hundred thousand dollars

($500,000) or more in the aggregate, during the calendar year immediately preceding this application for the permit. I have attached a

“Statement of Cash Flows” or other comparable financial statements acceptable to the Board for the calendar year immediately

preceding the date of application and a separate statement attesting that the qualifying purchases were purchases that were subject to

use tax.

I am a county, city, city and county, or redevelopment agency.

I also agree to self-assess and pay directly to the Board of Equalization any use tax liability incurred pursuant to my use of a Use Tax

Direct Payment Permit.

The above statements are hereby certified to be correct to the knowledge and belief

of the undersigned, who is duly authorized to sign this application.

SIGNATURE

TITLE

NAME (typed or printed)

DATE

(See reverse side for general information and filing instructions)

CLEAR

PRINT

1

1 2

2