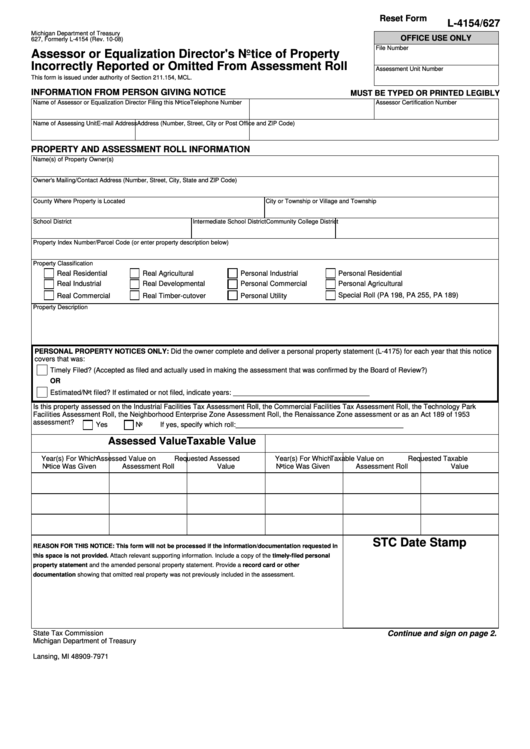

Reset Form

L-4154/627

Michigan Department of Treasury

OFFICE USE ONLY

627, Formerly L-4154 (Rev. 10-08)

File Number

Assessor or Equalization Director's Notice of Property

Incorrectly Reported or Omitted From Assessment Roll

Assessment Unit Number

This form is issued under authority of Section 211.154, MCL.

INFORMATION FROM PERSON GIVING NOTICE

MUST BE TYPED OR PRINTED LEGIBLY

Name of Assessor or Equalization Director Filing this Notice

Telephone Number

Assessor Certification Number

Name of Assessing Unit

E-mail Address

Address (Number, Street, City or Post Office and ZIP Code)

PROPERTY AND ASSESSMENT ROLL INFORMATION

Name(s) of Property Owner(s)

Owner's Mailing/Contact Address (Number, Street, City, State and ZIP Code)

County Where Property is Located

City or Township or Village and Township

School District

Intermediate School District

Community College District

Property Index Number/Parcel Code (or enter property description below)

Property Classification

Real Residential

Real Agricultural

Personal Industrial

Personal Residential

Real Industrial

Real Developmental

Personal Commercial

Personal Agricultural

Special Roll (PA 198, PA 255, PA 189)

Real Commercial

Real Timber-cutover

Personal Utility

Property Description

PERSONAL PROPERTY NOTICES ONLY: Did the owner complete and deliver a personal property statement (L-4175) for each year that this notice

covers that was:

Timely Filed? (Accepted as filed and actually used in making the assessment that was confirmed by the Board of Review?)

OR

Estimated/Not filed? If estimated or not filed, indicate years: ___________________________________

Is this property assessed on the Industrial Facilities Tax Assessment Roll, the Commercial Facilities Tax Assessment Roll, the Technology Park

Facilities Assessment Roll, the Neighborhood Enterprise Zone Assessment Roll, the Renaissance Zone assessment or as an Act 189 of 1953

assessment?

Yes

No

If yes, specify which roll:___________________________________________

Assessed Value

Taxable Value

Year(s) For Which

Assessed Value on

Requested Assessed

Year(s) For Which

Taxable Value on

Requested Taxable

Notice Was Given

Assessment Roll

Value

Notice Was Given

Assessment Roll

Value

STC Date Stamp

REASON FOR THIS NOTICE: This form will not be processed if the information/documentation requested in

this space is not provided. Attach relevant supporting information. Include a copy of the timely-filed personal

property statement and the amended personal property statement. Provide a record card or other

documentation showing that omitted real property was not previously included in the assessment.

State Tax Commission

Continue and sign on page 2.

Michigan Department of Treasury

P.O. Box 30471

Lansing, MI 48909-7971

1

1 2

2