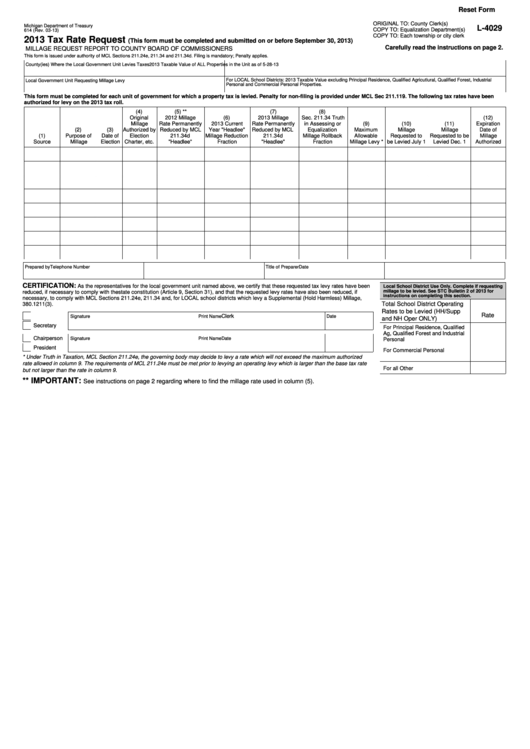

Reset Form

ORIGINAL TO: County Clerk(s)

Michigan Department of Treasury

L-4029

COPY TO: Equalization Department(s)

614 (Rev. 03-13)

COPY TO: Each township or city clerk

2013 Tax Rate Request

(This form must be completed and submitted on or before September 30, 2013)

Carefully read the instructions on page 2.

MILLAGE REQUEST REPORT TO COUNTY BOARD OF COMMISSIONERS

This form is issued under authority of MCL Sections 211.24e, 211.34 and 211.34d. Filing is mandatory; Penalty applies.

County(ies) Where the Local Government Unit Levies Taxes

2013 Taxable Value of ALL Properties in the Unit as of 5-28-13

For LOCAL School Districts: 2013 Taxable Value excluding Principal Residence, Qualified Agricutlural, Qualified Forest, Industrial

Local Government Unit Requesting Millage Levy

Personal and Commercial Personal Properties.

This form must be completed for each unit of government for which a property tax is levied. Penalty for non-filing is provided under MCL Sec 211.119. The following tax rates have been

authorized for levy on the 2013 tax roll.

(4)

(5) **

(7)

(8)

Original

2012 Millage

(6)

2013 Millage

Sec. 211.34 Truth

(12)

Millage

Rate Permanently

2013 Current

Rate Permanently

in Assessing or

(9)

(10)

(11)

Expiration

(2)

(3)

Authorized by

Reduced by MCL

Year "Headlee"

Reduced by MCL

Equalization

Maximum

Millage

Millage

Date of

(1)

Purpose of

Date of

Election

211.34d

Millage Reduction

211.34d

Millage Rollback

Allowable

Requested to

Requested to be

Millage

Source

Millage

Election

Charter, etc.

"Headlee"

Fraction

"Headlee"

Fraction

Millage Levy *

be Levied July 1

Levied Dec. 1

Authorized

Prepared by

Telephone Number

Title of Preparer

Date

CERTIFICATION:

As the representatives for the local government unit named above, we certify that these requested tax levy rates have been

Local School District Use Only. Complete if requesting

millage to be levied. See STC Bulletin 2 of 2013 for

reduced, if necessary to comply with thestate constitution (Article 9, Section 31), and that the requested levy rates have also been reduced, if

instructions on completing this section.

necessary, to comply with MCL Sections 211.24e, 211.34 and, for LOCAL school districts which levy a Supplemental (Hold Harmless) Millage,

Total School District Operating

380.1211(3).

Rates to be Levied (HH/Supp

Rate

Clerk

Signature

Print Name

Date

and NH Oper ONLY)

Secretary

For Principal Residence, Qualified

Ag, Qualified Forest and Industrial

Chairperson

Signature

Print Name

Date

Personal

President

For Commercial Personal

* Under Truth in Taxation, MCL Section 211.24e, the governing body may decide to levy a rate which will not exceed the maximum authorized

rate allowed in column 9. The requirements of MCL 211.24e must be met prior to levying an operating levy which is larger than the base tax rate

For all Other

but not larger than the rate in column 9.

** IMPORTANT:

See instructions on page 2 regarding where to find the millage rate used in column (5).

1

1 2

2