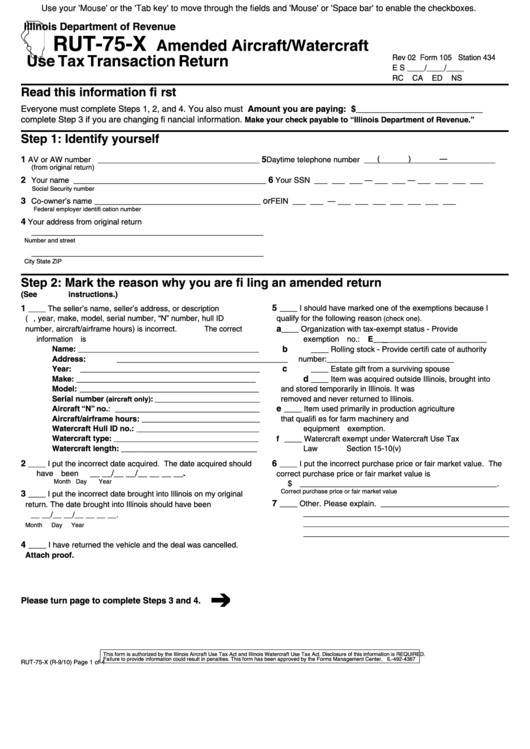

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RUT-75-X

Amended Aircraft/Watercraft

Rev 02 Form 105 Station 434

Use Tax Transaction Return

E S ____/____/____

RC

CA

ED

NS

Read this information fi rst

Everyone must complete Steps 1, 2, and 4. You also must

Amount you are paying: $

_____________________________

complete Step 3 if you are changing fi nancial information.

Make your check payable to “Illinois Department of Revenue.”

Step 1: Identify yourself

1

5

(

)

—

AV or AW number _____________________________________

Daytime telephone number ______________________________

(from original return)

2

6

Your name ____________________________________________

Your SSN ___ ___ ___ — ___ ___ — ___ ___ ___ ___

Social Security number

3

or

Co-owner’s name ______________________________________

FEIN

___ ___ — ___ ___ ___ ___ ___ ___ ___

Federal employer identifi cation number

4

Your address from original return

_____________________________________________________

Number and street

_____________________________________________________

City

State

ZIP

Step 2: Mark the reason why you are fi ling an amended return

(See instructions.)

5

1

____ I should have marked one of the exemptions because I

____ The seller’s name, seller’s address, or description

(i.e., year, make, model, serial number, “N” number, hull ID

qualify for the following reason

(check one).

a

number, aircraft/airframe hours) is incorrect. The correct

____ Organization with tax-exempt status - Provide

information is

exemption no.: E__________________________

b

Name: _________________________________________

____ Rolling stock - Provide certifi cate of authority

Address: _______________________________________

number:_____________________________

c

Year:

_________________________________________

____ Estate gift from a surviving spouse

d

Make: _________________________________________

____ Item was acquired outside Illinois, brought into

Model: _________________________________________

and stored temporarily in Illinois. It was

Serial number

: ________________________

removed and never returned to Illinois.

(aircraft only)

e

Aircraft “N” no.: _________________________________

____ Item used primarily in production agriculture

Aircraft/airframe hours: ___________________________

that qualifi es for farm machinery and

Watercraft Hull ID no.: ____________________________

equipment exemption.

Watercraft type: _________________________________

f ____ Watercraft exempt under Watercraft Use Tax

Watercraft length: _______________________________

Law Section 15-10(v)

2

6

____ I put the incorrect date acquired. The date acquired should

____ I put the incorrect purchase price or fair market value. The

__ __/__ __/__ __ __ __.

have been

correct purchase price or fair market value is

Month

Day

Year

$ _____________________________________________.

Correct purchase price or fair market value

3

____ I put the incorrect date brought into Illinois on my original

7

____ Other. Please explain. ______________________________

return. The date brought into Illinois should have been

_______________________________________________

__ __/__ __/__ __ __ __.

_______________________________________________

Month

Day

Year

_______________________________________________

4

____ I have returned the vehicle and the deal was cancelled.

Attach proof.

Please turn page to complete Steps 3 and 4.

This form is authorized by the Illinois Aircraft Use Tax Act and Illinois Watercraft Use Tax Act. Disclosure of this information is REQUIRED.

Failure to provide information could result in penalties. This form has been approved by the Forms Management Center.

IL-492-4367

RUT-75-X (R-9/10)

Page 1 of 4

1

1 2

2 3

3 4

4