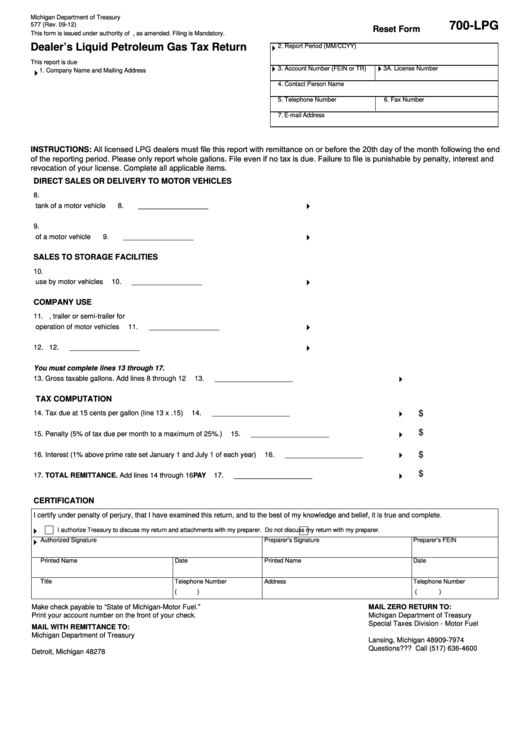

Michigan Department of Treasury

700-LPG

577 (Rev. 09-12)

Reset Form

This form is issued under authority of P.A. 403 of 2000, as amended. Filing is Mandatory.

Dealer’s Liquid Petroleum Gas Tax Return

2. Report Period (MM/CCYY)

This report is due

3. Account Number (FEIN or TR)

3A. License Number

1. Company Name and Mailing Address

4. Contact Person Name

5. Telephone Number

6. Fax Number

7. E-mail Address

INSTRUCTIONS: All licensed LPG dealers must file this report with remittance on or before the 20th day of the month following the end

of the reporting period. Please only report whole gallons. File even if no tax is due. Failure to file is punishable by penalty, interest and

revocation of your license. Complete all applicable items.

DIRECT SALES OR DELIVERY TO MOTOR VEHICLES

8. L.P. gas sold or delivered by placing into a permanently attached fuel supply

tank of a motor vehicle .................................................................................................

8. __________________

9. L.P. gas sold or delivered by exchanging or replacing the fuel supply tank

of a motor vehicle ........................................................................................................

9. __________________

SALES TO STORAGE FACILITIES

10. L.P. gas delivered into a storage facility used exclusively for resale to or for

use by motor vehicles ..................................................................................................

10. __________________

COMPANY USE

11. L.P. gas withdrawn from cargo container of truck, trailer or semi-trailer for

operation of motor vehicles ..........................................................................................

11. __________________

12. L.P. gas delivered to company-owned motor vehicles .................................................

12. __________________

You must complete lines 13 through 17.

13. Gross taxable gallons. Add lines 8 through 12 .............................................................................................................

13. ____________________

TAX COMPUTATION

$

14. Tax due at 15 cents per gallon (line 13 x .15) ...............................................................................................................

14. ____________________

$

15. Penalty (5% of tax due per month to a maximum of 25%.) ..........................................................................................

15. ____________________

$

16. Interest (1% above prime rate set January 1 and July 1 of each year) ........................................................................

16. ____________________

$

17. TOTAL REMITTANCE. Add lines 14 through 16 ...................................................................................................PAY

17. ____________________

CERTIFICATION

I certify under penalty of perjury, that I have examined this return, and to the best of my knowledge and belief, it is true and complete.

I authorize Treasury to discuss my return and attachments with my preparer.

Do not discuss my return with my preparer.

Authorized Signature

Preparer’s Signature

Preparer’s FEIN

Printed Name

Date

Printed Name

Date

Title

Telephone Number

Address

Telephone Number

(

)

(

)

Make check payable to “State of Michigan-Motor Fuel.”

MAIL ZERO RETURN TO:

Print your account number on the front of your check.

Michigan Department of Treasury

Special Taxes Division - Motor Fuel

MAIL WITH REMITTANCE TO:

P.O. Box 30474

Michigan Department of Treasury

Lansing, Michigan 48909-7974

P.O. Box 77401

Questions??? Call (517) 636-4600

Detroit, Michigan 48278

1

1