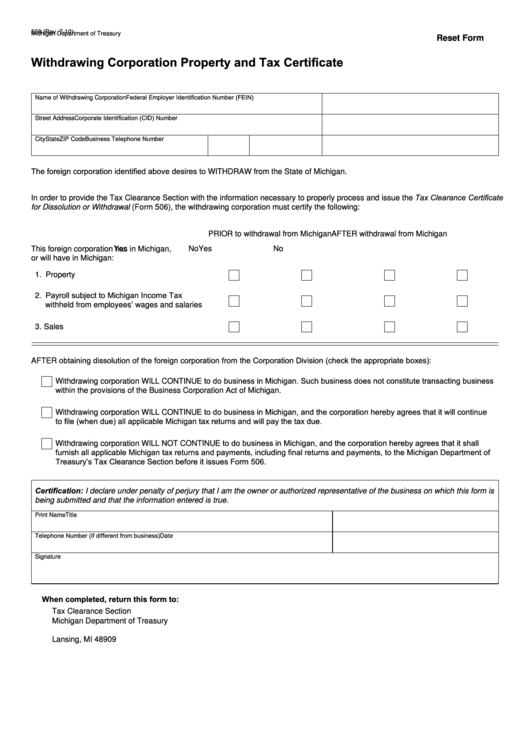

Michigan Department of Treasury

Reset Form

508 (Rev. 7-10)

Withdrawing Corporation Property and Tax Certificate

Federal Employer Identification Number (FEIN)

Name of Withdrawing Corporation

Corporate Identification (CID) Number

Street Address

Business Telephone Number

City

State

ZIP Code

The foreign corporation identified above desires to WIThDRAW from the State of Michigan.

In order to provide the Tax Clearance Section with the information necessary to properly process and issue the Tax Clearance Certificate

for Dissolution or Withdrawal (Form 506), the withdrawing corporation must certify the following:

PRIOR to withdrawal from Michigan

AFTER withdrawal from Michigan

This foreign corporation has in Michigan,

Yes

No

Yes

No

or will have in Michigan:

1. Property

2. Payroll subject to Michigan Income Tax

withheld from employees’ wages and salaries

3. Sales

AFTER obtaining dissolution of the foreign corporation from the Corporation Division (check the appropriate boxes):

Withdrawing corporation WIll CONTINuE to do business in Michigan. Such business does not constitute transacting business

within the provisions of the Business Corporation Act of Michigan.

Withdrawing corporation WIll CONTINuE to do business in Michigan, and the corporation hereby agrees that it will continue

to file (when due) all applicable Michigan tax returns and will pay the tax due.

Withdrawing corporation WIll NOT CONTINuE to do business in Michigan, and the corporation hereby agrees that it shall

furnish all applicable Michigan tax returns and payments, including final returns and payments, to the Michigan Department of

Treasury’s Tax Clearance Section before it issues Form 506.

Certification: I declare under penalty of perjury that I am the owner or authorized representative of the business on which this form is

being submitted and that the information entered is true.

Print Name

Title

Telephone Number (if different from business)

Date

Signature

When completed, return this form to:

Tax Clearance Section

Michigan Department of Treasury

P.O. Box 30168

lansing, MI 48909

1

1