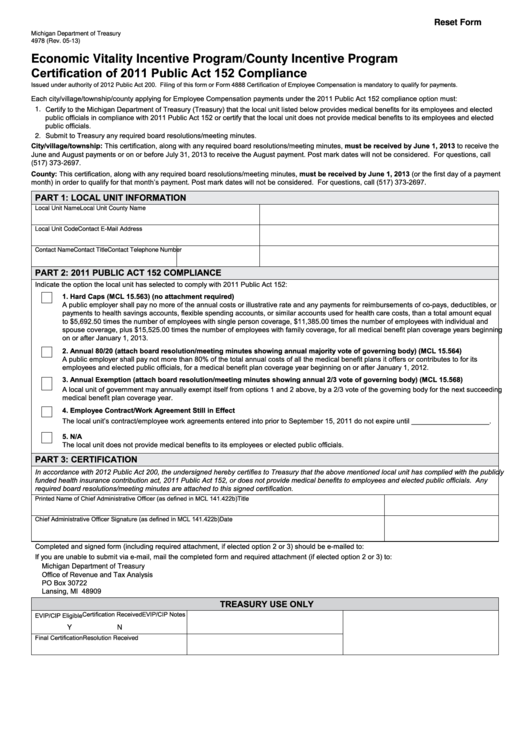

Reset Form

Michigan Department of Treasury

4978 (Rev. 05-13)

Economic Vitality Incentive Program/County Incentive Program

Certification of 2011 Public Act 152 Compliance

Issued under authority of 2012 Public Act 200. Filing of this form or Form 4888 Certification of Employee Compensation is mandatory to qualify for payments.

Each city/village/township/county applying for Employee Compensation payments under the 2011 Public Act 152 compliance option must:

1. Certify to the Michigan Department of Treasury (Treasury) that the local unit listed below provides medical benefits for its employees and elected

public officials in compliance with 2011 Public Act 152 or certify that the local unit does not provide medical benefits to its employees and elected

public officials.

2. Submit to Treasury any required board resolutions/meeting minutes.

City/village/township: This certification, along with any required board resolutions/meeting minutes, must be received by June 1, 2013 to receive the

June and August payments or on or before July 31, 2013 to receive the August payment. Post mark dates will not be considered. For questions, call

(517) 373-2697.

County: This certification, along with any required board resolutions/meeting minutes, must be received by June 1, 2013 (or the first day of a payment

month) in order to qualify for that month’s payment. Post mark dates will not be considered. For questions, call (517) 373-2697.

PART 1: LOCAL UNIT INFORMATION

Local Unit Name

Local Unit County Name

Contact E-Mail Address

Local Unit Code

Contact Name

Contact Title

Contact Telephone Number

PART 2: 2011 PUBLIC ACT 152 COMPLIANCE

Indicate the option the local unit has selected to comply with 2011 Public Act 152:

1. Hard Caps (MCL 15.563) (no attachment required)

A public employer shall pay no more of the annual costs or illustrative rate and any payments for reimbursements of co-pays, deductibles, or

payments to health savings accounts, flexible spending accounts, or similar accounts used for health care costs, than a total amount equal

to $5,692.50 times the number of employees with single person coverage, $11,385.00 times the number of employees with individual and

spouse coverage, plus $15,525.00 times the number of employees with family coverage, for all medical benefit plan coverage years beginning

on or after January 1, 2013.

2. Annual 80/20 (attach board resolution/meeting minutes showing annual majority vote of governing body) (MCL 15.564)

A public employer shall pay not more than 80% of the total annual costs of all the medical benefit plans it offers or contributes to for its

employees and elected public officials, for a medical benefit plan coverage year beginning on or after January 1, 2012.

3. Annual Exemption (attach board resolution/meeting minutes showing annual 2/3 vote of governing body) (MCL 15.568)

A local unit of government may annually exempt itself from options 1 and 2 above, by a 2/3 vote of the governing body for the next succeeding

medical benefit plan coverage year.

4. Employee Contract/Work Agreement Still in Effect

The local unit’s contract/employee work agreements entered into prior to September 15, 2011 do not expire until ____________________.

5. N/A

The local unit does not provide medical benefits to its employees or elected public officials.

PART 3: CERTIFICATION

In accordance with 2012 Public Act 200, the undersigned hereby certifies to Treasury that the above mentioned local unit has complied with the publicly

funded health insurance contribution act, 2011 Public Act 152, or does not provide medical benefits to employees and elected public officials. Any

required board resolutions/meeting minutes are attached to this signed certification.

Printed Name of Chief Administrative Officer (as defined in MCL 141.422b)

Title

Chief Administrative Officer Signature (as defined in MCL 141.422b)

Date

Completed and signed form (including required attachment, if elected option 2 or 3) should be e-mailed to: TreasRevenueSharing@michigan.gov.

If you are unable to submit via e-mail, mail the completed form and required attachment (if elected option 2 or 3) to:

Michigan Department of Treasury

Office of Revenue and Tax Analysis

PO Box 30722

Lansing, MI 48909

TREASURY USE ONLY

Certification Received

EVIP/CIP Notes

EVIP/CIP Eligible

Y

N

Final Certification

Resolution Received

1

1