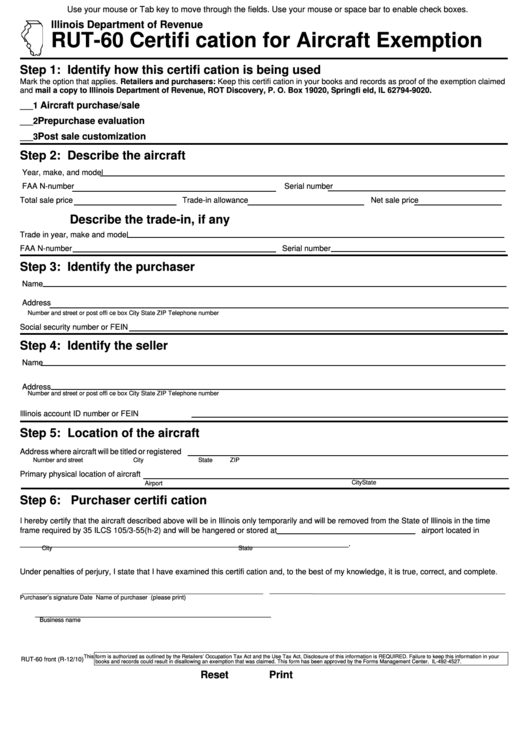

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RUT-60 Certifi cation for Aircraft Exemption

Step 1: Identify how this certifi cation is being used

Mark the option that applies. Retailers and purchasers: Keep this certifi cation in your books and records as proof of the exemption claimed

and mail a copy to Illinois Department of Revenue, ROT Discovery, P. O. Box 19020, Springfi eld, IL 62794-9020.

Aircraft purchase/sale

1

___

Prepurchase evaluation

2

___

Post sale customization

3

___

Step 2: Describe the aircraft

Year, make, and model

FAA N-number

Serial number

Total sale price

Trade-in allowance

Net sale price

Describe the trade-in, if any

Trade in year, make and model

FAA N-number

Serial number

Step 3: Identify the purchaser

Name

Address

Number and street or post offi ce box

City

State

ZIP

Telephone number

Social security number or FEIN

Step 4: Identify the seller

Name

Address

Number and street or post offi ce box

City

State

ZIP

Telephone number

Illinois account ID number or FEIN

Step 5: Location of the aircraft

Address where aircraft will be titled or registered

Number and street

City

State

ZIP

Primary physical location of aircraft

City

State

Airport

Step 6: Purchaser certifi cation

I hereby certify that the aircraft described above will be in Illinois only temporarily and will be removed from the State of Illinois in the time

frame required by 35 ILCS 105/3-55(h-2) and will be hangered or stored at

airport located in

___________________________________________________________________________.

City

State

Under penalties of perjury, I state that I have examined this certifi cation and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

____________________________________________

___________

Purchaser’s signature

Date

Name of purchaser (please print)

____________________________________________

___________

Business name

This form is authorized as outlined by the Retailers’ Occupation Tax Act and the Use Tax Act. Disclosure of this information is REQUIRED. Failure to keep this information in your

RUT-60 front (R-12/10)

books and records could result in disallowing an exemption that was claimed. This form has been approved by the Forms Management Center. IL-492-4527.

Reset

Print

1

1 2

2