Instructions For Completing Form 81-110 - Fiduciary Income Tax Return For Estates And Trusts

ADVERTISEMENT

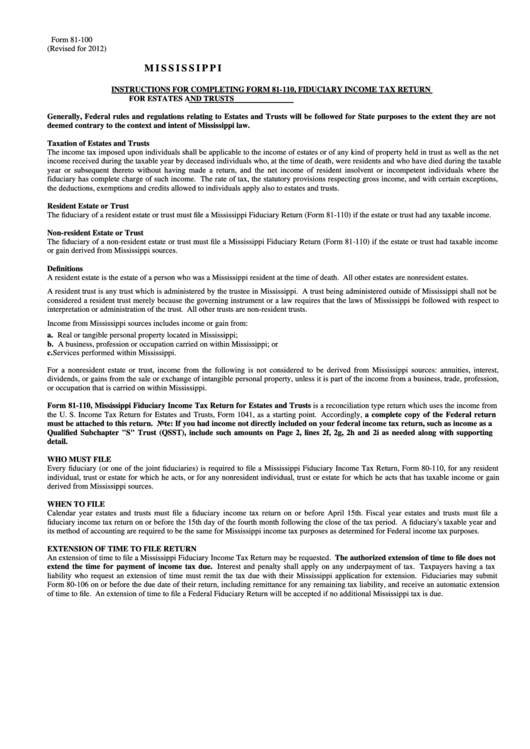

Form 81-100

(Revised for 2012)

MISSISSIPPI

INSTRUCTIONS FOR COMPLETING FORM 81-110, FIDUCIARY INCOME TAX RETURN

FOR ESTATES AND TRUSTS

Generally, Federal rules and regulations relating to Estates and Trusts will be followed for State purposes to the extent they are not

deemed contrary to the context and intent of Mississippi law.

Taxation of Estates and Trusts

The income tax imposed upon individuals shall be applicable to the income of estates or of any kind of property held in trust as well as the net

income received during the taxable year by deceased individuals who, at the time of death, were residents and who have died during the taxable

year or subsequent thereto without having made a return, and the net income of resident insolvent or incompetent individuals where the

fiduciary has complete charge of such income. The rate of tax, the statutory provisions respecting gross income, and with certain exceptions,

the deductions, exemptions and credits allowed to individuals apply also to estates and trusts.

Resident Estate or Trust

The fiduciary of a resident estate or trust must file a Mississippi Fiduciary Return (Form 81-110) if the estate or trust had any taxable income.

Non-resident Estate or Trust

The fiduciary of a non-resident estate or trust must file a Mississippi Fiduciary Return (Form 81-110) if the estate or trust had taxable income

or gain derived from Mississippi sources.

Definitions

A resident estate is the estate of a person who was a Mississippi resident at the time of death. All other estates are nonresident estates.

A resident trust is any trust which is administered by the trustee in Mississippi. A trust being administered outside of Mississippi shall not be

considered a resident trust merely because the governing instrument or a law requires that the laws of Mississippi be followed with respect to

interpretation or administration of the trust. All other trusts are non-resident trusts.

Income from Mississippi sources includes income or gain from:

a. Real or tangible personal property located in Mississippi;

b. A business, profession or occupation carried on within Mississippi; or

c. Services performed within Mississippi.

For a nonresident estate or trust, income from the following is not considered to be derived from Mississippi sources: annuities, interest,

dividends, or gains from the sale or exchange of intangible personal property, unless it is part of the income from a business, trade, profession,

or occupation that is carried on within Mississippi.

Form 81-110, Mississippi Fiduciary Income Tax Return for Estates and Trusts is a reconciliation type return which uses the income from

the U. S. Income Tax Return for Estates and Trusts, Form 1041, as a starting point. Accordingly, a complete copy of the Federal return

must be attached to this return. Note: If you had income not directly included on your federal income tax return, such as income as a

Qualified Subchapter "S" Trust (QSST), include such amounts on Page 2, lines 2f, 2g, 2h and 2i as needed along with supporting

detail.

WHO MUST FILE

Every fiduciary (or one of the joint fiduciaries) is required to file a Mississippi Fiduciary Income Tax Return, Form 80-110, for any resident

individual, trust or estate for which he acts, or for any nonresident individual, trust or estate for which he acts that has taxable income or gain

derived from Mississippi sources.

WHEN TO FILE

Calendar year estates and trusts must file a fiduciary income tax return on or before April 15th. Fiscal year estates and trusts must file a

fiduciary income tax return on or before the 15th day of the fourth month following the close of the tax period. A fiduciary's taxable year and

its method of accounting are required to be the same for Mississippi income tax purposes as determined for Federal income tax purposes.

EXTENSION OF TIME TO FILE RETURN

An extension of time to file a Mississippi Fiduciary Income Tax Return may be requested. The authorized extension of time to file does not

extend the time for payment of income tax due. Interest and penalty shall apply on any underpayment of tax. Taxpayers having a tax

liability who request an extension of time must remit the tax due with their Mississippi application for extension. Fiduciaries may submit

Form 80-106 on or before the due date of their return, including remittance for any remaining tax liability, and receive an automatic extension

of time to file. An extension of time to file a Federal Fiduciary Return will be accepted if no additional Mississippi tax is due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4