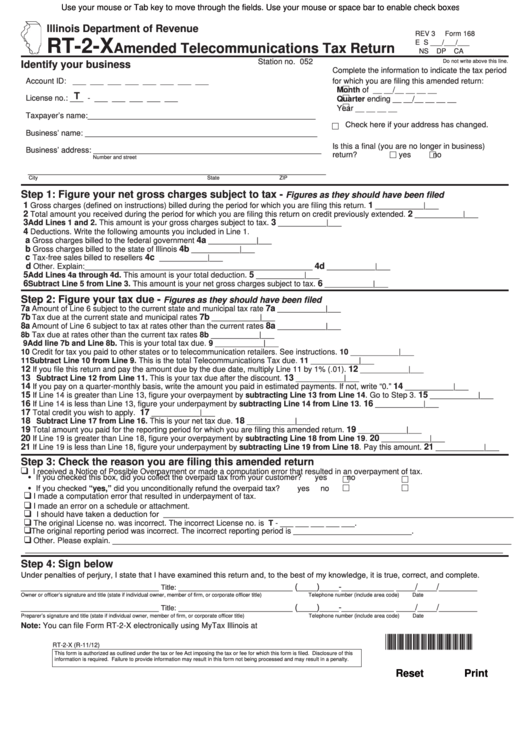

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 3

Form 168

RT-2-X

E S ___/___/___

Amended Telecommunications Tax Return

NS

DP

CA

Station no. 052

Do not write above this line.

Identify your business

Complete the information to indicate the tax period

for which you are filing this amended return:

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

Month of __ __/__ __ __ __

T

License no.: ___ - ___ ___ ___ ___ ___

Quarter ending __ __/__ __ __ __

Year __ __ __ __

Taxpayer’s name:____________________________________________________

Check here if your address has changed.

Business’ name: _____________________________________________________

Is this a final (you are no longer in business)

Business’ address: ____________________________________________________

return?

yes

no

Number and street

____________________________________________________________________

City

State

ZIP

Step 1:

Figure your net gross charges subject to tax -

Figures as they should have been filed

1

1

Gross charges (defined on instructions) billed during the period for which you are filing this return.

___________|___

2

2

Total amount you received during the period for which you are filing this return on credit previously extended.

___________|___

3

3

Add Lines 1 and 2. This amount is your gross charges subject to tax.

___________|___

4

Deductions. Write the following amounts you included in Line 1.

a

4a

Gross charges billed to the federal government

___________|___

b

4b

Gross charges billed to the state of Illinois

___________|___

c

4c

Tax-free sales billed to resellers

___________|___

d

4d

Other. Explain:____________________________________________________

___________|___

5

5

Add Lines 4a through 4d. This amount is your total deduction.

___________|___

6

6

Subtract Line 5 from Line 3. This amount is your net gross charges subject to tax.

___________|___

Step 2:

Figure your tax due -

Figures as they should have been filed

7a

7a

Amount of Line 6 subject to the current state and municipal tax rate

___________|___

7b

7b

Tax due at the current state and municipal rates

___________|___

8a

8a

Amount of Line 6 subject to tax at rates other than the current rates

___________|___

8b Tax due at rates other than the current tax rates

8b ___________|___

9 Add line 7b and Line 8b. This is your total tax due.

9 ___________|___

10 Credit for tax you paid to other states or to telecommunication retailers. See instructions.

10 ___________|___

11 Subtract Line 10 from Line 9. This is the total Telecommunications Tax due.

11 ___________|___

12

12

If you file this return and pay the amount due by the due date, multiply Line 11 by 1% (.01).

___________|___

13

13

Subtract Line 12 from Line 11. This is your tax due after the discount.

___________|___

14

14

If you pay on a quarter-monthly basis, write the amount you paid in estimated payments. If not, write “0.”

___________|___

15

15

If Line 14 is greater than Line 13, figure your overpayment by subtracting Line 13 from Line 14. Go to Step 3.

___________|___

16

16

If Line 14 is less than Line 13, figure your underpayment by subtracting Line 14 from Line 13.

___________|___

17

17

Total credit you wish to apply.

___________|___

18

18

Subtract Line 17 from Line 16. This is your net tax due.

___________|___

19

19

Total amount you paid for the reporting period for which you are filing this amended return.

___________|___

20

20

If Line 19 is greater than Line 18, figure your overpayment by subtracting Line 18 from Line 19.

___________|___

21

21

If Line 19 is less than Line 18, figure your underpayment by subtracting Line 19 from Line 18. Pay this amount.

___________|___

Step 3:

Check the reason you are filing this amended return

❑

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

• If you checked this box, did you collect the overpaid tax from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid tax?

yes

no

❑

I made a computation error that resulted in underpayment of tax.

❑

I made an error on a schedule or attachment.

❑

I should have taken a deduction for ________________________________________________________________________________

❑

The original License no. was incorrect. The incorrect License no. is T - ___ ___ ___ ___ ___.

❑

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

❑

Other. Please explain. ___________________________________________________________________________________________

_____________________________________________________________________________________________________________

Step 4:

Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Owner or officer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Preparer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

Note: You can file Form RT-2-X electronically using MyTax Illinois at tax.illinois.gov.

*216801110*

RT-2-X (R-11/12)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset

Print

1

1