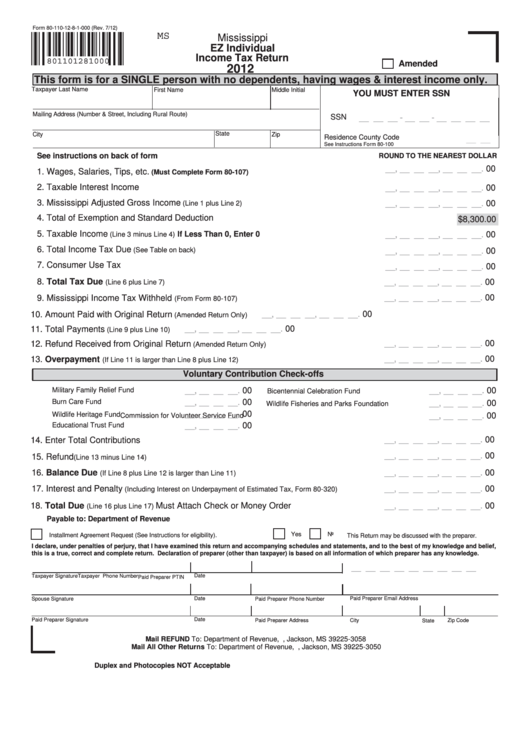

Form 80-110-12-8-1-000 (Rev. 7/12)

MS

Mississippi

EZ Individual

Income Tax Return

801101281000

Amended

2012

This form is for a SINGLE person with no dependents, having wages & interest income only.

Taxpayer Last Name

First Name

Middle Initial

YOU MUST ENTER SSN

Mailing Address (Number & Street, Including Rural Route)

SSN

__ __ __ - __ __ - __ __ __ __

State

City

Zip

Residence County Code

__ __

See Instructions Form 80-100

See instructions on back of form

ROUND TO THE NEAREST DOLLAR

__, __ __ __, __ __ __.

00

1. Wages, Salaries, Tips, etc.

(Must Complete Form 80-107)

2. Taxable Interest Income

__, __ __ __, __ __ __.

00

3. Mississippi Adjusted Gross Income

__, __ __ __, __ __ __.

00

(Line 1 plus Line 2)

4. Total of Exemption and Standard Deduction

$8,300.00

5. Taxable Income

If Less Than 0, Enter 0

__, __ __ __, __ __ __.

00

(Line 3 minus Line 4)

6. Total Income Tax Due

(See Table on back)

__, __ __ __, __ __ __.

00

7. Consumer Use Tax

__, __ __ __, __ __ __.

00

8. Total Tax Due

__, __ __ __, __ __ __.

00

(Line 6 plus Line 7)

__, __ __ __, __ __ __.

00

9. Mississippi Income Tax Withheld

(From Form 80-107)

__, __ __ __, __ __ __.

00

10. Amount Paid with Original Return

(Amended Return Only)

__, __ __ __, __ __ __.

00

11. Total Payments

(Line 9 plus Line 10)

__, __ __ __, __ __ __.

00

12. Refund Received from Original Return

(Amended Return Only)

13. Overpayment

__, __ __ __, __ __ __.

00

(If Line 11 is larger than Line 8 plus Line 12)

Voluntary Contribution Check-offs

__, __ __ __.

00

Military Family Relief Fund

__, __ __ __.

00

Bicentennial Celebration Fund

Burn Care Fund

__, __ __ __.

00

__, __ __ __.

00

Wildlife Fisheries and Parks Foundation

__, __ __ __.

00

Wildlife Heritage Fund

__, __ __ __.

00

Commission for Volunteer Service Fund

__, __ __ __.

00

Educational Trust Fund

__, __ __ __, __ __ __.

00

14. Enter Total Contributions

__, __ __ __, __ __ __.

00

15. Refund

(Line 13 minus Line 14)

16. Balance Due

__, __ __ __, __ __ __.

00

(If Line 8 plus Line 12 is larger than Line 11)

17. Interest and Penalty

__, __ __ __, __ __ __.

00

(Including Interest on Underpayment of Estimated Tax, Form 80-320)

18. Total Due

Must Attach Check or Money Order

__, __ __ __, __ __ __.

00

(Line 16 plus Line 17)

Payable to: Department of Revenue

Yes

No

Installment Agreement Request (See Instructions for eligibility).

This Return may be discussed with the preparer.

I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

this is a true, correct and complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

__ __ __ __ __ __ __ __ __

Date

Taxpayer Signature

Taxpayer Phone Number

Paid Preparer PTIN

Date

Paid Preparer Email Address

Spouse Signature

Paid Preparer Phone Number

Date

Paid Preparer Signature

Paid Preparer Address

City

Zip Code

State

Mail REFUND To: Department of Revenue, P.O. Box 23058, Jackson, MS 39225-3058

Mail All Other Returns To: Department of Revenue, P.O. Box 23050, Jackson, MS 39225-3050

Duplex and Photocopies NOT Acceptable

1

1 2

2