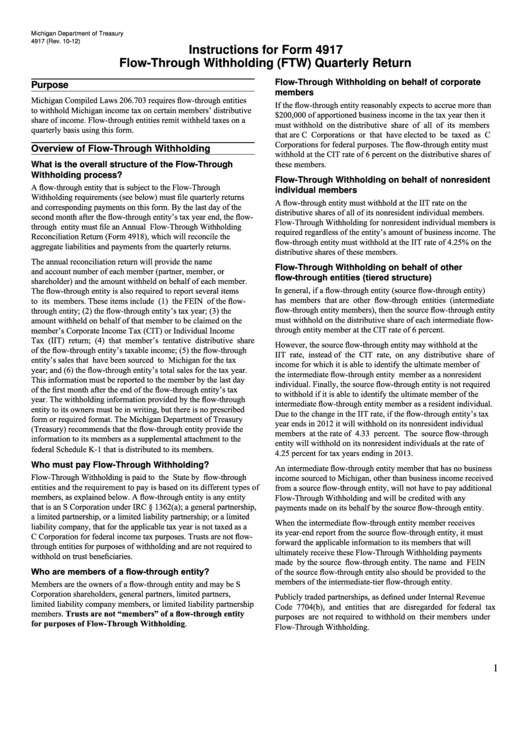

Instructions For Form 4917 - Flow-Through Withholding (Ftw) Quarterly Return

ADVERTISEMENT

Michigan Department of Treasury

4917 (Rev. 10-12)

Instructions for Form 4917

Flow-Through Withholding (FTW) Quarterly Return

Flow-Through Withholding on behalf of corporate

Purpose

members

Michigan Compiled Laws 206.703 requires flow-through entities

If the flow-through entity reasonably expects to accrue more than

to withhold Michigan income tax on certain members’ distributive

$200,000 of apportioned business income in the tax year then it

share of income. Flow-through entities remit withheld taxes on a

must withhold on the distributive share of all of its members

quarterly basis using this form.

that are C Corporations or that have elected to be taxed as C

Corporations for federal purposes. The flow-through entity must

Overview of Flow-Through Withholding

withhold at the CIT rate of 6 percent on the distributive shares of

these members.

What is the overall structure of the Flow-Through

Withholding process?

Flow-Through Withholding on behalf of nonresident

A flow-through entity that is subject to the Flow-Through

individual members

Withholding requirements (see below) must file quarterly returns

A flow-through entity must withhold at the IIT rate on the

and corresponding payments on this form. By the last day of the

distributive shares of all of its nonresident individual members.

second month after the flow-through entity’s tax year end, the flow-

Flow-Through Withholding for nonresident individual members is

through entity must file an Annual Flow-Through Withholding

required regardless of the entity’s amount of business income. The

Reconciliation Return (Form 4918), which will reconcile the

flow-through entity must withhold at the IIT rate of 4.25% on the

aggregate liabilities and payments from the quarterly returns.

distributive shares of these members.

The annual reconciliation return will provide the name

Flow-Through Withholding on behalf of other

and account number of each member (partner, member, or

flow-through entities (tiered structure)

shareholder) and the amount withheld on behalf of each member.

In general, if a flow-through entity (source flow-through entity)

The flow-through entity is also required to report several items

has members that are other flow-through entities (intermediate

to its members. These items include (1) the FEIN of the flow-

flow-through entity members), then the source flow-through entity

through entity; (2) the flow-through entity’s tax year; (3) the

must withhold on the distributive share of each intermediate flow-

amount withheld on behalf of that member to be claimed on the

through entity member at the CIT rate of 6 percent.

member’s Corporate Income Tax (CIT) or Individual Income

Tax (IIT) return; (4) that member’s tentative distributive share

However, the source flow-through entity may withhold at the

of the flow-through entity’s taxable income; (5) the flow-through

IIT rate, instead of the CIT rate, on any distributive share of

entity’s sales that have been sourced to Michigan for the tax

income for which it is able to identify the ultimate member of

year; and (6) the flow-through entity’s total sales for the tax year.

the intermediate flow-through entity member as a nonresident

This information must be reported to the member by the last day

individual. Finally, the source flow-through entity is not required

of the first month after the end of the flow-through entity’s tax

to withhold if it is able to identify the ultimate member of the

year. The withholding information provided by the flow-through

intermediate flow-through entity member as a resident individual.

entity to its owners must be in writing, but there is no prescribed

Due to the change in the IIT rate, if the flow-through entity’s tax

form or required format. The Michigan Department of Treasury

year ends in 2012 it will withhold on its nonresident individual

(Treasury) recommends that the flow-through entity provide the

members at the rate of 4.33 percent. The source flow-through

information to its members as a supplemental attachment to the

entity will withhold on its nonresident individuals at the rate of

federal Schedule K-1 that is distributed to its members.

4.25 percent for tax years ending in 2013.

Who must pay Flow-Through Withholding?

An intermediate flow-through entity member that has no business

Flow-Through Withholding is paid to the State by flow-through

income sourced to Michigan, other than business income received

entities and the requirement to pay is based on its different types of

from a source flow-through entity, will not have to pay additional

members, as explained below. A flow-through entity is any entity

Flow-Through Withholding and will be credited with any

that is an S Corporation under IRC § 1362(a); a general partnership,

payments made on its behalf by the source flow-through entity.

a limited partnership, or a limited liability partnership; or a limited

When the intermediate flow-through entity member receives

liability company, that for the applicable tax year is not taxed as a

its year-end report from the source flow-through entity, it must

C Corporation for federal income tax purposes. Trusts are not flow-

forward the applicable information to its members that will

through entities for purposes of withholding and are not required to

ultimately receive these Flow-Through Withholding payments

withhold on trust beneficiaries.

made by the source flow-through entity. The name and FEIN

Who are members of a flow-through entity?

of the source flow-through entity also should be provided to the

members of the intermediate-tier flow-through entity.

Members are the owners of a flow-through entity and may be S

Corporation shareholders, general partners, limited partners,

Publicly traded partnerships, as defined under Internal Revenue

limited liability company members, or limited liability partnership

Code 7704(b), and entities that are disregarded for federal tax

members. Trusts are not “members” of a flow-through entity

purposes are not required to withhold on their members under

for purposes of Flow-Through Withholding.

Flow-Through Withholding.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3