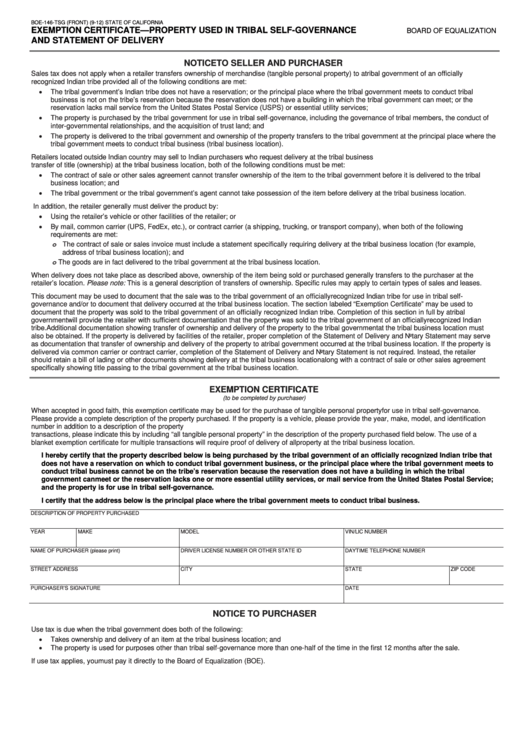

BOE-146-TSG (FRONT) (9-12)

STATE OF CALIFORNIA

EXEMPTION CERTIFICATE—PROPERTY USED IN TRIBAL SELF-GOVERNANCE

BOARD OF EQUALIZATION

AND STATEMENT OF DELIVERY

NOTICE TO SELLER AND PURCHASER

Sales tax does not apply when a retailer transfers ownership of merchandise (tangible personal property) to a tribal government of an officially

recognized Indian tribe provided all of the following conditions are met:

•

The tribal government’s Indian tribe does not have a reservation; or the principal place where the tribal government meets to conduct tribal

business is not on the tribe’s reservation because the reservation does not have a building in which the tribal government can meet; or the

reservation lacks mail service from the United States Postal Service (USPS) or essential utility services;

•

The property is purchased by the tribal government for use in tribal self-governance, including the governance of tribal members, the conduct of

inter-governmental relationships, and the acquisition of trust land; and

•

The property is delivered to the tribal government and ownership of the property transfers to the tribal government at the principal place where the

tribal government meets to conduct tribal business (tribal business location).

Retailers located outside Indian country may sell to Indian purchasers who request delivery at the tribal business location. For a sale to qualify as a

transfer of title (ownership) at the tribal business location, both of the following conditions must be met:

•

The contract of sale or other sales agreement cannot transfer ownership of the item to the tribal government before it is delivered to the tribal

business location; and

•

The tribal government or the tribal government’s agent cannot take possession of the item before delivery at the tribal business location.

In addition, the retailer generally must deliver the product by:

•

Using the retailer’s vehicle or other facilities of the retailer; or

•

By mail, common carrier (UPS, FedEx, etc.), or contract carrier (a shipping, trucking, or transport company), when both of the following

requirements are met:

o The contract of sale or sales invoice must include a statement specifically requiring delivery at the tribal business location (for example, F.O.B.

address of tribal business location); and

o The goods are in fact delivered to the tribal government at the tribal business location.

When delivery does not take place as described above, ownership of the item being sold or purchased generally transfers to the purchaser at the

retailer’s location. Please note: This is a general description of transfers of ownership. Specific rules may apply to certain types of sales and leases.

This document may be used to document that the sale was to the tribal government of an officially recognized Indian tribe for use in tribal self-

governance and/or to document that delivery occurred at the tribal business location. The section labeled “Exemption Certificate” may be used to

document that the property was sold to the tribal government of an officially recognized Indian tribe. Completion of this section in full by a tribal

government will provide the retailer with sufficient documentation that the property was sold to the tribal government of an officially recognized Indian

tribe. Additional documentation showing transfer of ownership and delivery of the property to the tribal government at the tribal business location must

also be obtained. If the property is delivered by facilities of the retailer, proper completion of the Statement of Delivery and Notary Statement may serve

as documentation that transfer of ownership and delivery of the property to a tribal government occurred at the tribal business location. If the property is

delivered via common carrier or contract carrier, completion of the Statement of Delivery and Notary Statement is not required. Instead, the retailer

should retain a bill of lading or other documents showing delivery at the tribal business location along with a contract of sale or other sales agreement

specifically showing title passing to the tribal government at the tribal business location.

EXEMPTION CERTIFICATE

(to be completed by purchaser)

When accepted in good faith, this exemption certificate may be used for the purchase of tangible personal property for use in tribal self-governance.

Please provide a complete description of the property purchased. If the property is a vehicle, please provide the year, make, model, and identification

number in addition to a description of the property purchased. If you intend to use this certificate as a blanket exemption certificate to cover multiple

transactions, please indicate this by including “all tangible personal property” in the description of the property purchased field below. The use of a

blanket exemption certificate for multiple transactions will require proof of delivery of all property at the tribal business location.

I hereby certify that the property described below is being purchased by the tribal government of an officially recognized Indian tribe that

does not have a reservation on which to conduct tribal government business, or the principal place where the tribal government meets to

conduct tribal business cannot be on the tribe’s reservation because the reservation does not have a building in which the tribal

government can meet or the reservation lacks one or more essential utility services, or mail service from the United States Postal Service;

and the property is for use in tribal self-governance.

I certify that the address below is the principal place where the tribal government meets to conduct tribal business.

DESCRIPTION OF PROPERTY PURCHASED

YEAR

MAKE

MODEL

VIN/LIC NUMBER

NAME OF PURCHASER (please print)

DRIVER LICENSE NUMBER OR OTHER STATE ID

DAYTIME TELEPHONE NUMBER

STREET ADDRESS

CITY

STATE

ZIP CODE

PURCHASER’S SIGNATURE

DATE

NOTICE TO PURCHASER

Use tax is due when the tribal government does both of the following:

•

Takes ownership and delivery of an item at the tribal business location; and

•

The property is used for purposes other than tribal self-governance more than one-half of the time in the first 12 months after the sale.

If use tax applies, you must pay it directly to the Board of Equalization (BOE).

1

1 2

2