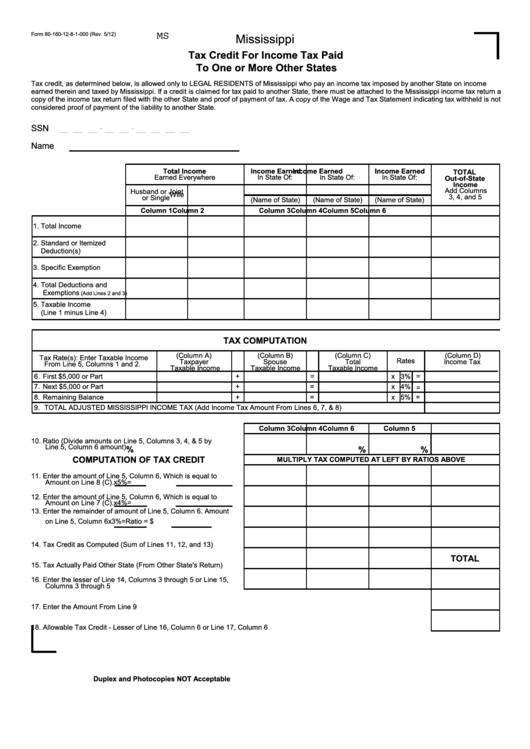

MS

Form 80-160-12-8-1-000 (Rev. 5/12)

Mississippi

Tax Credit For Income Tax Paid

To One or More Other States

Tax credit, as determined below, is allowed only to LEGAL RESIDENTS of Mississippi who pay an income tax imposed by another State on income

earned therein and taxed by Mississippi. If a credit is claimed for tax paid to another State, there must be attached to the Mississippi income tax return a

copy of the income tax return filed with the other State and proof of payment of tax. A copy of the Wage and Tax Statement indicating tax withheld is not

considered proof of payment of the liability to another State.

SSN

__ __ __ - __ __ - __ __ __ __

Name

Total Income

Income Earned

Income Earned

Income Earned

TOTAL

Earned Everywhere

In State Of:

In State Of:

In State Of:

Out-of-State

Income

Add Columns

Husband or Joint

Wife

3, 4, and 5

or Single

(Name of State)

(Name of State)

(Name of State)

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

1. Total Income

2. Standard or Itemized

Deduction(s)

3. Specific Exemption

4. Total Deductions and

Exemptions

(Add Lines 2 and 3)

5. Taxable Income

(Line 1 minus Line 4)

TAX COMPUTATION

(Column A)

(Column B)

(Column C)

(Column D)

Tax Rate(s): Enter Taxable Income

Rates

Taxpayer

Spouse

Total

Income Tax

From Line 5, Columns 1 and 2.

Taxable Income

Taxable Income

Taxable Income

6.

First $5,000 or Part

+

=

x 3%

=

7.

Next $5,000 or Part

+

=

x

4%

=

=

8.

Remaining Balance

+

=

x

5%

9.

TOTAL ADJUSTED MISSISSIPPI INCOME TAX (Add Income Tax Amount From Lines 6, 7, & 8)...........................................

Column 3

Column 4

Column 5

Column 6

10. Ratio (Divide amounts on Line 5, Columns 3, 4, & 5 by

Line 5, Column 6 amount)

%

%

%

COMPUTATION OF TAX CREDIT

MULTIPLY TAX COMPUTED AT LEFT BY RATIOS ABOVE

11. Enter the amount of Line 5, Column 6, Which is equal to

Amount on Line 8 (C).

x5%=

12. Enter the amount of Line 5, Column 6, Which is equal to

Amount on Line 7 (C).

x4%=

13. Enter the remainder of amount of Line 5, Column 6. Amount

on Line 5, Column 6

x3%=

Ratio = $

14. Tax Credit as Computed (Sum of Lines 11, 12, and 13)

TOTAL

15. Tax Actually Paid Other State (From Other State's Return)

16. Enter the lesser of Line 14, Columns 3 through 5 or Line 15,

Columns 3 through 5

17. Enter the Amount From Line 9

18. Allowable Tax Credit - Lesser of Line 16, Column 6 or Line 17, Column 6

Duplex and Photocopies NOT Acceptable

1

1