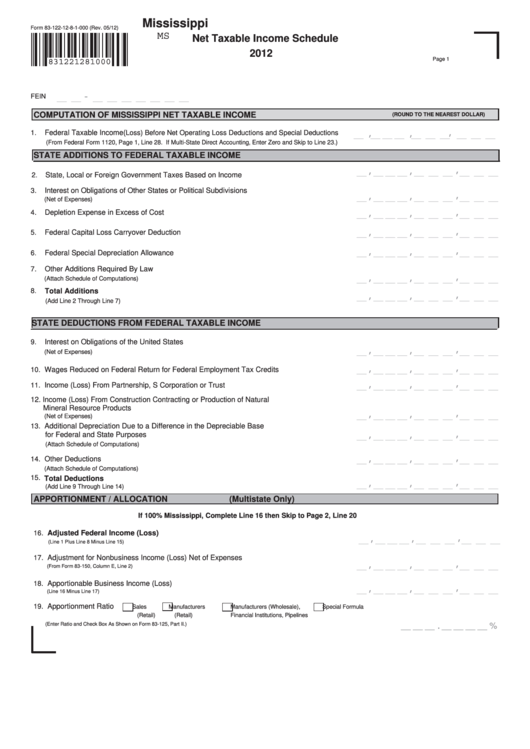

Mississippi

Form 83-122-12-8-1-000 (Rev. 05/12)

MS

Net Taxable Income Schedule

2012

831221281000

Page 1

-

FEIN

__ __

__ __ __ __ __ __ __

COMPUTATION OF MISSISSIPPI NET TAXABLE INCOME

(ROUND TO THE NEAREST DOLLAR)

,

,

,

1.

Federal Taxable Income(

Loss) Before Net Operating Loss Deductions and Special Deductions

__ __ __ __ __ __ __ __ __ __

(From Federal Form 1120, Page 1, Line 28. If Multi-State Direct Accounting, Enter Zero and Skip to Line 23.)

STATE ADDITIONS TO FEDERAL TAXABLE INCOME

,

,

,

__ __ __ __ __ __ __ __ __ __

State, Local or Foreign Government Taxes Based on Income

2.

.

Interest on Obligations of Other States or Political Subdivisions

3

,

,

,

__ __ __ __ __ __ __ __ __ __

(Net of Expenses)

,

,

,

4

.

Depletion Expense in Excess of Cost

__ __ __ __ __ __ __ __ __ __

,

,

,

Federal Capital Loss Carryover Deduction

5.

__ __ __ __ __ __ __ __ __ __

,

,

,

__ __ __ __ __ __ __ __ __ __

Federal Special Depreciation Allowance

6.

.

Other Additions Required By Law

7

,

,

,

(Attach Schedule of Computations)

__ __ __ __ __ __ __ __ __ __

8.

Total Additions

,

,

,

__ __ __ __ __ __ __ __ __ __

(Add Line 2 Through Line 7)

STATE DEDUCTIONS FROM FEDERAL TAXABLE INCOME

Interest on Obligations of the United States

9.

,

,

,

__ __ __ __ __ __ __ __ __ __

(Net of Expenses)

,

,

,

Wages Reduced on Federal Return for Federal Employment Tax Credits

__ __ __ __ __ __ __ __ __ __

10.

,

,

,

. Income (Loss) From Partnership, S Corporation or Trust

__ __ __ __ __ __ __ __ __ __

11

12. Income (Loss) From Construction Contracting or Production of Natural

Mineral Resource Products

,

,

,

__ __ __ __ __ __ __ __ __ __

(Net of Expenses)

Additional Depreciation Due to a Difference in the Depreciable Base

13.

,

,

,

for Federal and State Purposes

__ __ __ __ __ __ __ __ __ __

(Attach Schedule of Computations)

,

,

,

14.

Other Deductions

__ __ __ __ __ __ __ __ __ __

(Attach Schedule of Computations)

15.

Total Deductions

,

,

,

__ __ __ __ __ __ __ __ __ __

(Add Line 9 Through Line 14)

APPORTIONMENT / ALLOCATION

(Multistate Only)

If 100% Mississippi, Complete Line 16 then Skip to Page 2, Line 20

. Adjusted Federal Income (Loss)

16

,

,

,

__ __ __ __ __ __ __ __ __ __

(Line 1 Plus Line 8 Minus Line 15)

. Adjustment for Nonbusiness Income (Loss) Net of Expenses

17

,

,

,

__ __ __ __ __ __ __ __ __ __

(From Form 83-150, Column E, Line 2)

Apportionable Business Income (Loss)

18.

,

,

,

__ __ __ __ __ __ __ __ __ __

(Line 16 Minus Line 17)

Apportionment Ratio

19.

Sales

Manufacturers

Manufacturers (Wholesale),

Special Formula

(Retail)

(Retail)

Financial Institutions, Pipelines

.

(Enter Ratio and Check Box As Shown on Form 83-125, Part II.)

__ __ __ __ __ __ __ %

1

1 2

2