Form 80-106-12-8-1-000 (Rev. 05/12)

Mississippi

Individual / Fiduciary Income Tax Voucher

Instructions

Who Must File

Estimates

Every individual taxpayer who does not have at least eighty percent (80%) of his/her annual tax liability prepaid through withholding

must make estimated tax payments if his/her annual tax liability exceeds two hundred dollars ($200). For more information about the

payment and calculation of estimated income tax payments, please see the Individual Income Tax Return Instructions, Form 80-100.

Return Payments

This voucher may be used to make return payments for tax due on the Individual Income Tax Return (Form 80-105), Non-Resident

Income Tax Return (Form 80-205), EZ Individual Income Tax Return (Form 80-110) and the Fiduciary Income Tax Return (Form

81-110).

Extension Payments

This voucher may be used to make extension payments for tax due on the Individual Income Tax Return (Form 80-105), Non-Resident

Income Tax Return (Form 80-205), EZ Individual Income Tax Return (Form 80-110) and the Fiduciary Income Tax Return (Form

81-110). This should be filed and paid on or before April 15th.

Payment Options

•

Pay this amount online. Go to , click on Taxpayer Access Point (TAP) and follow the instructions for paying

online. You may also view and update account information through TAP.

• Make your check or money order payable to the Department of Revenue, remove the payment coupon below and mail both the

check/money order and coupon to P.O. Box 23075, Jackson, MS 39225-3075.

- Check the appropriate box on the voucher for the payment type you are remitting.

- Write the identification number on the check or money order.

- Duplex Forms or Photocopies are NOT acceptable.

• Pay by credit card or electronic check. Call 1-800-272-9829, or go to

- There is a 2 ½ % fee for credit cards, or a $3.00 fee for E-checks charged by Official Payments.

- Visa, MasterCard, Discover and American Express cards are accepted.

- Jurisdiction code for Mississippi is 3400.

Cut Along the Dotted Line

__ __

__ __

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

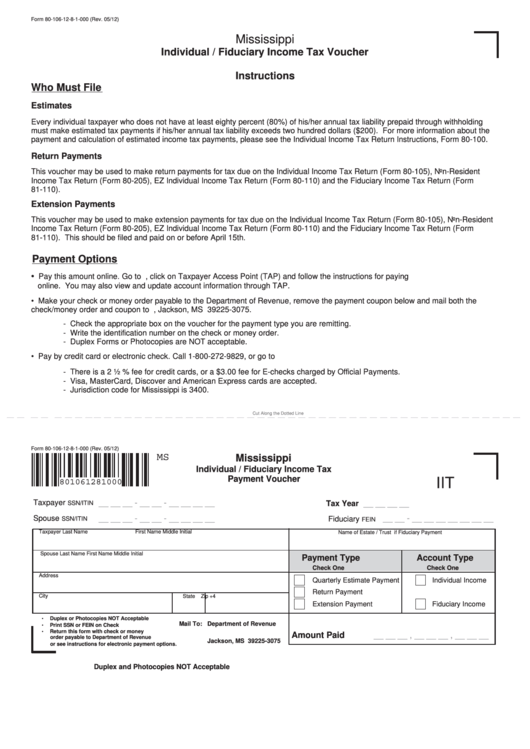

Form 80-106-12-8-1-000 (Rev. 05/12)

MS

Mississippi

Individual / Fiduciary Income Tax

Payment Voucher

801061281000

IIT

Taxpayer

__ __ __ - __ __ - __ __ __ __

__ __ __ __

Tax Year

SSN/ITIN

__ __ __ - __ __ - __ __ __ __

Spouse

__ __ - __ __ __ __ __ __ __

Fiduciary

SSN/ITIN

FEIN

Taxpayer Last Name

First Name

Middle Initial

Name of Estate / Trust if Fiduciary Payment

Spouse Last Name

First Name

Middle Initial

Payment Type

Account Type

Check One

Check One

Address

Quarterly Estimate Payment

Individual Income

Return Payment

City

State

Zip +4

Extension Payment

Fiduciary Income

•

Duplex or Photocopies NOT Acceptable

Mail To: Department of Revenue

•

Print SSN or FEIN on Check

•

Return this form with check or money

P.O. Box 23075

Amount Paid

__ __ __ , __ __ __ , __ __ __

order payable to Department of Revenue

Jackson, MS 39225-3075

or see instructions for electronic payment options.

Duplex and Photocopies NOT Acceptable

1

1