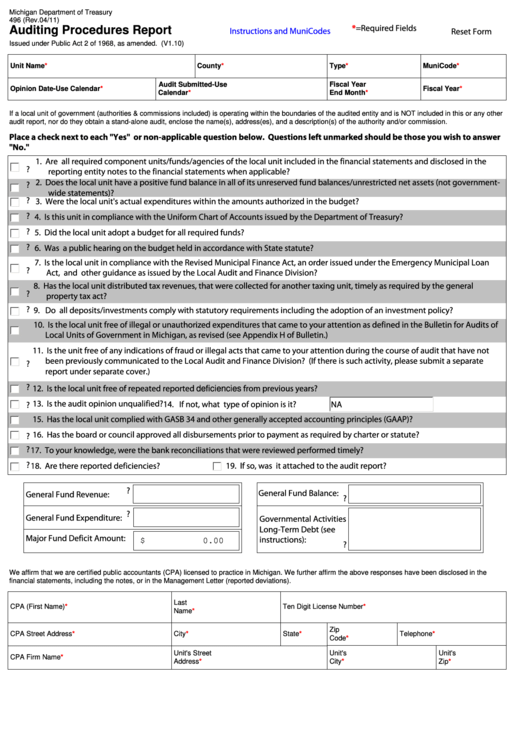

Michigan Department of Treasury

496 (Rev.04/11)

*=Required Fields

Auditing Procedures Report

Instructions and MuniCodes

Reset Form

Issued under Public Act 2 of 1968, as amended. (V1.10)

Unit

Name*

County*

Type*

MuniCode*

Audit Submitted-Use

Fiscal Year

Opinion Date-Use

Calendar*

Fiscal

Year*

Calendar*

End

Month*

If a local unit of government (authorities & commissions included) is operating within the boundaries of the audited entity and is NOT included in this or any other

audit report, nor do they obtain a stand-alone audit, enclose the name(s), address(es), and a description(s) of the authority and/or commission.

Place a check next to each "Yes" or non-applicable question below. Questions left unmarked should be those you wish to answer

"No."

1. Are all required component units/funds/agencies of the local unit included in the financial statements and disclosed in the

?

reporting entity notes to the financial statements when applicable?

2. Does the local unit have a positive fund balance in all of its unreserved fund balances/unrestricted net assets (not government-

?

wide statements)?

?

3. Were the local unit's actual expenditures within the amounts authorized in the budget?

?

4. Is this unit in compliance with the Uniform Chart of Accounts issued by the Department of Treasury?

?

5. Did the local unit adopt a budget for all required funds?

?

6. Was a public hearing on the budget held in accordance with State statute?

7. Is the local unit in compliance with the Revised Municipal Finance Act, an order issued under the Emergency Municipal Loan

?

Act, and other guidance as issued by the Local Audit and Finance Division?

8. Has the local unit distributed tax revenues, that were collected for another taxing unit, timely as required by the general

?

property tax act?

?

9. Do all deposits/investments comply with statutory requirements including the adoption of an investment policy?

10. Is the local unit free of illegal or unauthorized expenditures that came to your attention as defined in the Bulletin for Audits of

Local Units of Government in Michigan, as revised (see Appendix H of Bulletin.)

11. Is the unit free of any indications of fraud or illegal acts that came to your attention during the course of audit that have not

been previously communicated to the Local Audit and Finance Division? (If there is such activity, please submit a separate

?

report under separate cover.)

?

12. Is the local unit free of repeated reported deficiencies from previous years?

13. Is the audit opinion unqualified?

NA

?

14. If not, what type of opinion is it?

15. Has the local unit complied with GASB 34 and other generally accepted accounting principles (GAAP)?

16. Has the board or council approved all disbursements prior to payment as required by charter or statute?

?

?

17. To your knowledge, were the bank reconciliations that were reviewed performed timely?

?

19. If so, was it attached to the audit report?

18. Are there reported deficiencies?

?

General Fund Balance:

General Fund Revenue:

?

?

General Fund Expenditure:

Governmental Activities

Long-Term Debt (see

Major Fund Deficit Amount:

instructions):

$

0.00

?

We affirm that we are certified public accountants (CPA) licensed to practice in Michigan. We further affirm the above responses have been disclosed in the

financial statements, including the notes, or in the Management Letter (reported deviations).

Last

CPA (First

Name)*

Ten Digit License

Number*

Name*

Zip

CPA Street

Address*

City*

State*

Telephone*

Code*

Unit's Street

Unit's

Unit's

CPA Firm

Name*

Address*

City*

Zip*

1

1