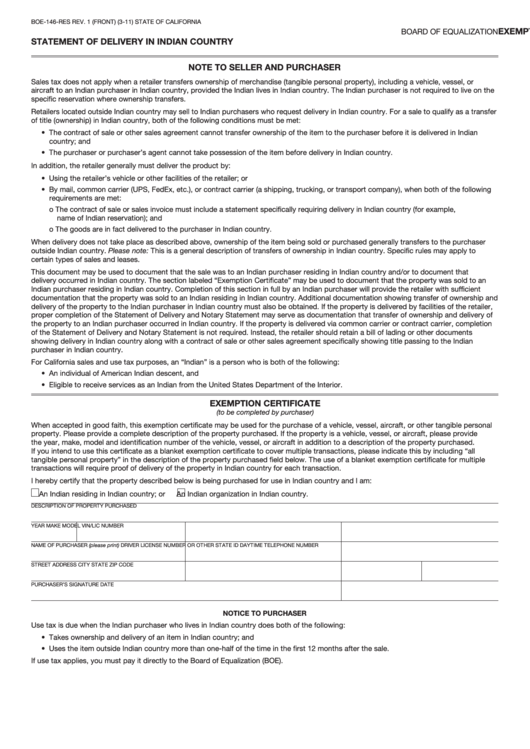

BOE-146-RES REV. 1 (FRONT) (3-11)

STATE OF CALIFORNIA

EXEMPTION CERTIFICATE AND

BOARD OF EQUALIZATION

STATEMENT OF DELIVERY IN INDIAN COUNTRY

NOTE TO SELLER AND PURCHASER

Sales tax does not apply when a retailer transfers ownership of merchandise (tangible personal property), including a vehicle, vessel, or

aircraft to an Indian purchaser in Indian country, provided the Indian lives in Indian country. The Indian purchaser is not required to live on the

specific reservation where ownership transfers.

Retailers located outside Indian country may sell to Indian purchasers who request delivery in Indian country. For a sale to qualify as a transfer

of title (ownership) in Indian country, both of the following conditions must be met:

• The contract of sale or other sales agreement cannot transfer ownership of the item to the purchaser before it is delivered in Indian

country; and

• The purchaser or purchaser’s agent cannot take possession of the item before delivery in Indian country.

In addition, the retailer generally must deliver the product by:

• Using the retailer’s vehicle or other facilities of the retailer; or

• By mail, common carrier (UPS, FedEx, etc.), or contract carrier (a shipping, trucking, or transport company), when both of the following

requirements are met:

o The contract of sale or sales invoice must include a statement specifically requiring delivery in Indian country (for example, F.O.B.

name of Indian reservation); and

o The goods are in fact delivered to the purchaser in Indian country.

When delivery does not take place as described above, ownership of the item being sold or purchased generally transfers to the purchaser

outside Indian country. Please note: This is a general description of transfers of ownership in Indian country. Specific rules may apply to

certain types of sales and leases.

This document may be used to document that the sale was to an Indian purchaser residing in Indian country and/or to document that

delivery occurred in Indian country. The section labeled “Exemption Certificate” may be used to document that the property was sold to an

Indian purchaser residing in Indian country. Completion of this section in full by an Indian purchaser will provide the retailer with sufficient

documentation that the property was sold to an Indian residing in Indian country. Additional documentation showing transfer of ownership and

delivery of the property to the Indian purchaser in Indian country must also be obtained. If the property is delivered by facilities of the retailer,

proper completion of the Statement of Delivery and Notary Statement may serve as documentation that transfer of ownership and delivery of

the property to an Indian purchaser occurred in Indian country. If the property is delivered via common carrier or contract carrier, completion

of the Statement of Delivery and Notary Statement is not required. Instead, the retailer should retain a bill of lading or other documents

showing delivery in Indian country along with a contract of sale or other sales agreement specifically showing title passing to the Indian

purchaser in Indian country.

For California sales and use tax purposes, an “Indian” is a person who is both of the following:

• An individual of American Indian descent, and

• Eligible to receive services as an Indian from the United States Department of the Interior.

EXEMPTION CERTIFICATE

(to be completed by purchaser)

When accepted in good faith, this exemption certificate may be used for the purchase of a vehicle, vessel, aircraft, or other tangible personal

property. Please provide a complete description of the property purchased. If the property is a vehicle, vessel, or aircraft, please provide

the year, make, model and identification number of the vehicle, vessel, or aircraft in addition to a description of the property purchased.

If you intend to use this certificate as a blanket exemption certificate to cover multiple transactions, please indicate this by including “all

tangible personal property” in the description of the property purchased field below. The use of a blanket exemption certificate for multiple

transactions will require proof of delivery of the property in Indian country for each transaction.

I hereby certify that the property described below is being purchased for use in Indian country and I am:

An Indian residing in Indian country; or

An Indian organization in Indian country.

DESCRIPTION OF PROPERTY PURCHASED

YEAR

MAKE

MODEL

VIN/LIC NUMBER

NAME OF PURCHASER (please print)

DRIVER LICENSE NUMBER OR OTHER STATE ID

DAYTIME TELEPHONE NUMBER

STREET ADDRESS

CITY

STATE

ZIP CODE

PURCHASER’S SIGNATURE

DATE

NOTICE TO PURCHASER

Use tax is due when the Indian purchaser who lives in Indian country does both of the following:

• Takes ownership and delivery of an item in Indian country; and

• Uses the item outside Indian country more than one-half of the time in the first 12 months after the sale.

If use tax applies, you must pay it directly to the Board of Equalization (BOE).

1

1 2

2