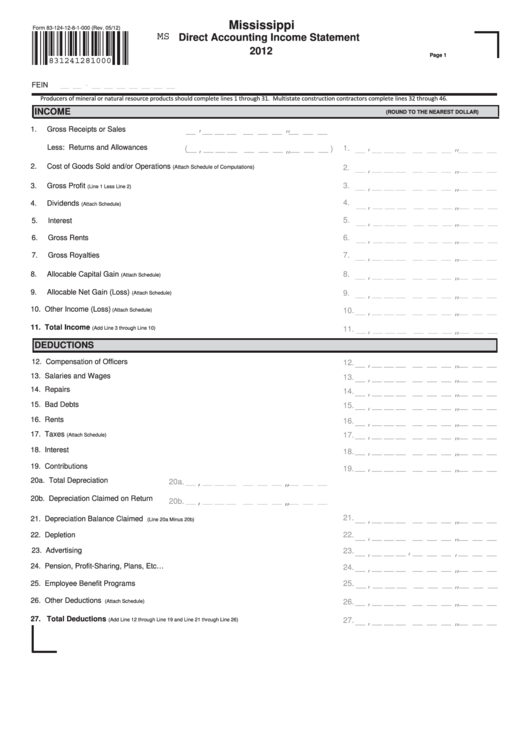

Mississippi

Form 83-124-12-8-1-000 (Rev. 05/12)

MS

Direct Accounting Income Statement

2012

Page 1

831241281000

FEIN

__ __ - __ __ __ __ __ __ __

Producers of mineral or natural resource products should complete lines 1 through 31. Multistate construction contractors complete lines 32 through 46.

INCOME

(ROUND TO THE NEAREST DOLLAR)

,

,

,

1.

Gross Receipts or Sales

__ __ __ __ __ __ __ __ __ __

,

,

,

,

,

,

Less: Returns and Allowances

1.

(

__ __ __ __ __ __ __ __ __ __

)

__ __ __ __ __ __ __ __ __ __

,

,

,

2.

Cost of Goods Sold and/or Operations

2.

(Attach Schedule of Computations)

__ __ __ __ __ __ __ __ __ __

,

,

,

3.

3.

Gross Profit

__ __ __ __ __ __ __ __ __ __

(Line 1 Less Line 2)

,

,

,

4.

4.

Dividends

__ __ __ __ __ __ __ __ __ __

(Attach Schedule)

,

,

,

5.

5.

Interest

__ __ __ __ __ __ __ __ __ __

,

,

,

6.

6.

Gross Rents

__ __ __ __ __ __ __ __ __ __

,

,

,

7.

7.

Gross Royalties

__ __ __ __ __ __ __ __ __ __

,

,

,

8.

Allocable Capital Gain

8.

__ __ __ __ __ __ __ __ __ __

(Attach Schedule)

,

,

,

9.

Allocable Net Gain (Loss)

9.

__ __ __ __ __ __ __ __ __ __

(Attach Schedule)

,

,

,

10. Other Income (Loss)

10.

__ __ __ __ __ __ __ __ __ __

(Attach Schedule)

,

,

,

11. Total Income

11.

__ __ __ __ __ __ __ __ __ __

(Add Line 3 through Line 10)

DEDUCTIONS

,

,

,

12. Compensation of Officers

12.

__ __ __ __ __ __ __ __ __ __

,

,

,

13. Salaries and Wages

13.

__ __ __ __ __ __ __ __ __ __

,

,

,

14. Repairs

14.

__ __ __ __ __ __ __ __ __ __

,

,

,

15. Bad Debts

15.

__ __ __ __ __ __ __ __ __ __

,

,

,

16. Rents

16.

__ __ __ __ __ __ __ __ __ __

,

,

,

17. Taxes

__ __ __ __ __ __ __ __ __ __

17.

(Attach Schedule)

,

,

,

18. Interest

__ __ __ __ __ __ __ __ __ __

18.

,

,

,

19. Contributions

__ __ __ __ __ __ __ __ __ __

19.

,

,

,

20a. Total Depreciation

__ __ __ __ __ __ __ __ __ __

20a.

,

,

,

20b. Depreciation Claimed on Return

__ __ __ __ __ __ __ __ __ __

20b.

,

,

,

21.

__ __ __ __ __ __ __ __ __ __

21. Depreciation Balance Claimed

(Line 20a Minus 20b)

,

,

,

22.

22. Depletion

__ __ __ __ __ __ __ __ __ __

,

,

,

23. Advertising

23.

__ __ __ __ __ __ __ __ __ __

,

,

,

24. Pension, Profit-Sharing, Plans, Etc…

24.

__ __ __ __ __ __ __ __ __ __

,

,

,

25. Employee Benefit Programs

25.

__ __ __ __ __ __ __ __ __ __

,

,

,

26. Other Deductions

__ __ __ __ __ __ __ __ __ __

26.

(Attach Schedule)

,

,

,

27. Total Deductions

(Add Line 12 through Line 19 and Line 21 through Line 26)

27.

__ __ __ __ __ __ __ __ __ __

1

1 2

2