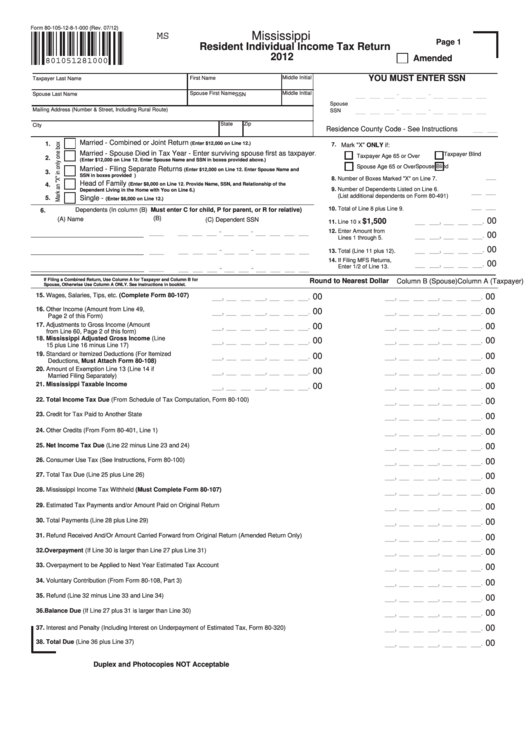

Form 80-105-12-8-1-000 (Rev. 07/12)

MS

Mississippi

Page 1

Resident Individual Income Tax Return

2012

Amended

801051281000

YOU MUST ENTER SSN

First Name

Middle Initial

Taxpayer Last Name

Middle Initial

__ __ __ - __ __ - __ __ __ __

Spouse First Name

Spouse Last Name

SSN

Spouse

__ __ __ - __ __ - __ __ __ __

Mailing Address (Number & Street, Including Rural Route)

SSN

State

Zip

City

__ __

Residence County Code - See Instructions

Married - Combined or Joint Return

1.

(Enter $12,000 on Line 12.)

7.

Mark "X" ONLY if:

Married - Spouse Died in Tax Year - Enter surviving spouse first as taxpayer

.

Taxpayer Blind

Taxpayer Age 65 or Over

2.

(Enter $12,000 on Line 12. Enter Spouse Name and SSN in boxes provided above.)

Spouse Age 65 or Over

Spouse Blind

Married - Filing Separate Returns

(Enter $12,000 on Line 12. Enter Spouse Name and

3.

__

SSN in boxes provided above. Cannot change from Joint to Separate after due date.)

8. Number of Boxes Marked "X" on Line 7.

Head of Family

(Enter $8,000 on Line 12. Provide Name, SSN, and Relationship of the

4.

9. Number of Dependents Listed on Line 6.

__ __

Dependent Living in the Home with You on Line 6.)

(List additional dependents on Form 80-491)

5.

Single -

(Enter $6,000 on Line 12.)

__ __

10. Total of Line 8 plus Line 9.

Dependents (In column (B) Must enter C for child, P for parent, or R for relative)

6.

(B)

(A) Name

(C) Dependent SSN

__ __, __ __ __.

00

$1,500

11. Line 10 x

___

__ __ __ - __ __ - __ __ __ __

12. Enter Amount from

__ __, __ __ __.

00

Lines 1 through 5.

__ __, __ __ __.

00

___

__ __ __ - __ __ - __ __ __ __

13. Total (Line 11 plus 12).

14. If Filing MFS Returns,

__ __, __ __ __.

00

___

__ __ __ - __ __ - __ __ __ __

Enter 1/2 of Line 13.

If Filing a Combined Return, Use Column A for Taxpayer and Column B for

Round to Nearest Dollar

Column A (Taxpayer)

Column B (Spouse)

Spouse, Otherwise Use Column A ONLY. See instructions in booklet.

15. Wages, Salaries, Tips, etc. (Complete Form 80-107)

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

16. Other Income (Amount from Line 49,

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

Page 2 of this Form)

17. Adjustments to Gross Income (Amount

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

from Line 60, Page 2 of this form)

18. Mississippi Adjusted Gross Income (Line

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

15 plus Line 16 minus Line 17)

19. Standard or Itemized Deductions (For Itemized

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

Deductions , Must Attach Form 80-108)

20. Amount of Exemption Line 13 (Line 14 if

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

Married Filing Separately)

21. Mississippi Taxable Income

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

22. Total Income Tax Due (From Schedule of Tax Computation, Form 80-100)

__, __ __ __, __ __ __.

00

23. Credit for Tax Paid to Another State

__, __ __ __, __ __ __.

00

24. Other Credits (From Form 80-401, Line 1)

__, __ __ __, __ __ __.

00

25. Net Income Tax Due (Line 22 minus Line 23 and 24)

__, __ __ __, __ __ __.

00

26. Consumer Use Tax (See Instructions, Form 80-100)

__, __ __ __, __ __ __.

00

27. Total Tax Due (Line 25 plus Line 26)

__, __ __ __, __ __ __.

00

28. Mississippi Income Tax Withheld (Must Complete Form 80-107)

__, __ __ __, __ __ __.

00

29. Estimated Tax Payments and/or Amount Paid on Original Return

__, __ __ __, __ __ __.

00

30. Total Payments (Line 28 plus Line 29)

__, __ __ __, __ __ __.

00

31. Refund Received And/Or Amount Carried Forward from Original Return (Amended Return Only)

__, __ __ __, __ __ __.

00

32. Overpayment (If Line 30 is larger than Line 27 plus Line 31)

__, __ __ __, __ __ __.

00

33. Overpayment to be Applied to Next Year Estimated Tax Account

__, __ __ __, __ __ __.

00

34. Voluntary Contribution (From Form 80-108, Part 3)

__, __ __ __, __ __ __.

00

35. Refund (Line 32 minus Line 33 and Line 34)

__, __ __ __, __ __ __.

00

36. Balance Due (If Line 27 plus 31 is larger than Line 30)

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

37. Interest and Penalty (Including Interest on Underpayment of Estimated Tax, Form 80-320)

38. Total Due (Line 36 plus Line 37)

__, __ __ __, __ __ __.

00

Duplex and Photocopies NOT Acceptable

1

1 2

2