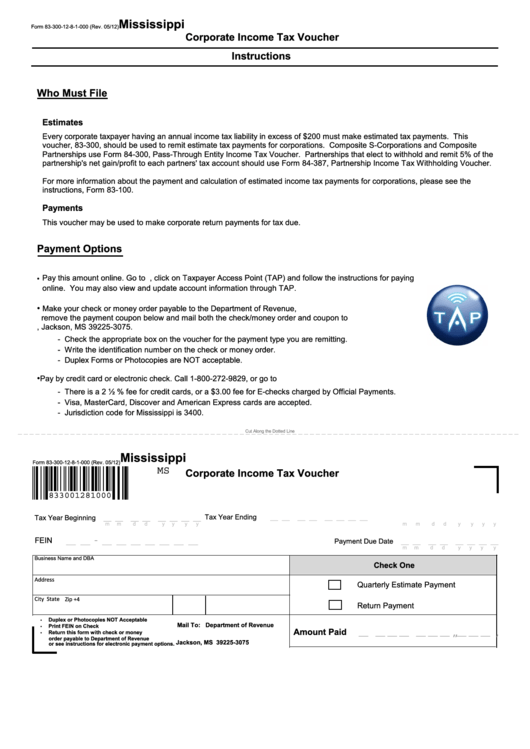

Form 83-300-12-8-1-000 - Mississippi Corporate Income Tax Voucher

ADVERTISEMENT

Mississippi

Form 83-300-12-8-1-000 (Rev. 05/12)

Corporate Income Tax Voucher

Instructions

Who Must File

Estimates

Every corporate taxpayer having an annual income tax liability in excess of $200 must make estimated tax payments. This

voucher, 83-300, should be used to remit estimate tax payments for corporations. Composite S-Corporations and Composite

Partnerships use Form 84-300, Pass-Through Entity Income Tax Voucher. Partnerships that elect to withhold and remit 5% of the

partnership's net gain/profit to each partners' tax account should use Form 84-387, Partnership Income Tax Withholding Voucher.

For more information about the payment and calculation of estimated income tax payments for corporations, please see the

instructions, Form 83-100.

Payments

This voucher may be used to make corporate return payments for tax due.

Payment Options

•

Pay this amount online. Go to , click on Taxpayer Access Point (TAP) and follow the instructions for paying

online. You may also view and update account information through TAP.

•

Make your check or money order payable to the Department of Revenue,

remove the payment coupon below and mail both the check/money order and coupon to

P.O. Box 23075, Jackson, MS 39225-3075.

- Check the appropriate box on the voucher for the payment type you are remitting.

- Write the identification number on the check or money order.

- Duplex Forms or Photocopies are NOT acceptable.

•

Pay by credit card or electronic check. Call 1-800-272-9829, or go to

- There is a 2 ½ % fee for credit cards, or a $3.00 fee for E-checks charged by Official Payments.

- Visa, MasterCard, Discover and American Express cards are accepted.

- Jurisdiction code for Mississippi is 3400.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Cut Along the Dotted Line

Mississippi

Form 83-300-12-8-1-000 (Rev. 05/12)

MS

Corporate Income Tax Voucher

833001281000

Tax Year Ending

__ __

__ __

__ __ __ __

Tax Year Beginning

__ __

__ __

__ __ __ __

m

m

d

d

y

y

y

y

m

m

d

d

y

y

y

y

-

__ __

__ __ __ __ __ __ __

FEIN

Payment Due Date

__ __

__ __

__ __ __ __

m

m

d

d

y

y

y

y

Business Name and DBA

Check One

Address

Quarterly Estimate Payment

City

State

Zip +4

Return Payment

•

Duplex or Photocopies NOT Acceptable

Mail To: Department of Revenue

Print FEIN on Check

•

Amount Paid

__ __ __ __ __ __ __ __ __ __

,

,

,

Return this form with check or money

•

P.O. Box 23075

order payable to Department of Revenue

Jackson, MS 39225-3075

or see instructions for electronic payment options.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1