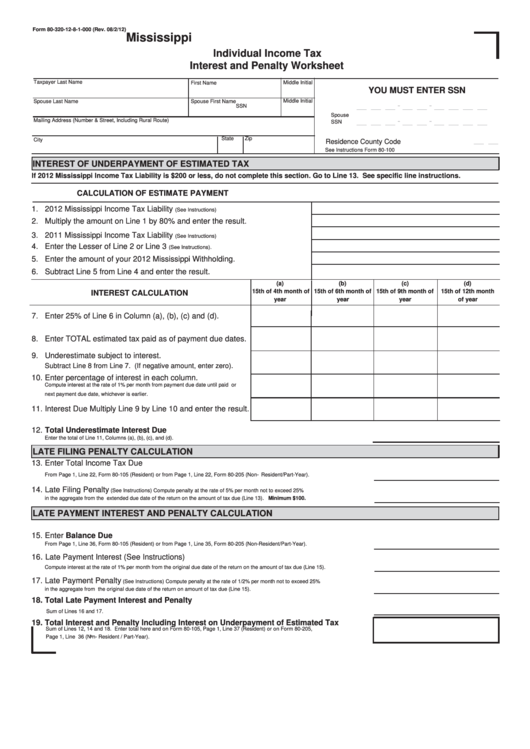

Form 80-320-12-8-1-000 (Rev. 08/2/12)

Mississippi

Individual Income Tax

Interest and Penalty Worksheet

Taxpayer Last Name

First Name

Middle Initial

YOU MUST ENTER SSN

Spouse Last Name

Spouse First Name

Middle Initial

__ __ __ - __ __ - __ __ __ __

SSN

Spouse

__ __ __ - __ __ - __ __ __ __

Mailing Address (Number & Street, Including Rural Route)

SSN

State

Zip

__ __

City

Residence County Code

See Instructions Form 80-100

INTEREST OF UNDERPAYMENT OF ESTIMATED TAX

If 2012 Mississippi Income Tax Liability is $200 or less, do not complete this section. Go to Line 13. See specific line instructions.

CALCULATION OF ESTIMATE PAYMENT

1. 2012 Mississippi Income Tax Liability

(See Instructions)

2. Multiply the amount on Line 1 by 80% and enter the result.

3. 2011 Mississippi Income Tax Liability

(See Instructions)

4. Enter the Lesser of Line 2 or Line 3

(See Instructions).

5. Enter the amount of your 2012 Mississippi Withholding.

6. Subtract Line 5 from Line 4 and enter the result.

(a)

(b)

(c)

(d)

15th of 4th month of

15th of 6th month of

15th of 9th month of

15th of 12th month

INTEREST CALCULATION

year

year

year

of year

7. Enter 25% of Line 6 in Column (a), (b), (c) and (d).

8. Enter TOTAL estimated tax paid as of payment due dates.

9. Underestimate subject to interest.

Subtract Line 8 from Line 7. (If negative amount, enter zero).

10. Enter percentage of interest in each column.

Compute interest at the rate of 1% per month from payment due date until paid or

next payment due date, whichever is earlier.

11. Interest Due Multiply Line 9 by Line 10 and enter the result.

12. Total Underestimate Interest Due

Enter the total of Line 11, Columns (a), (b), (c), and (d).

LATE FILING PENALTY CALCULATION

13. Enter Total Income Tax Due

From Page 1, Line 22, Form 80-105 (Resident) or from Page 1, Line 22, Form 80-205 (Non- Resident/Part-Year).

14. Late Filing Penalty

(See Instructions) Compute penalty at the rate of 5% per month not to exceed 25%

in the aggregate from the extended due date of the return on the amount of tax due (Line 13). Minimum $100.

LATE PAYMENT INTEREST AND PENALTY CALCULATION

15. Enter Balance Due

From Page 1, Line 36, Form 80-105 (Resident) or from Page 1, Line 35, Form 80-205 (Non-Resident/Part-Year).

.

16

Late Payment Interest (See Instructions)

Compute interest at the rate of 1% per month from the original due date of the return on the amount of tax due (Line 15).

17. Late Payment Penalty

(See Instructions) Compute penalty at the rate of 1/2% per month not to exceed 25%

in the aggregate from the original due date of the return on amount of tax due (Line 15).

18. Total Late Payment Interest and Penalty

Sum of Lines 16 and 17.

19. Total Interest and Penalty Including Interest on Underpayment of Estimated Tax

Sum of Lines 12, 14 and 18. Enter total here and on Form 80-105, Page 1, Line 37 (Resident) or on Form 80-205,

Page 1, Line 36 (Non- Resident / Part-Year).

1

1 2

2