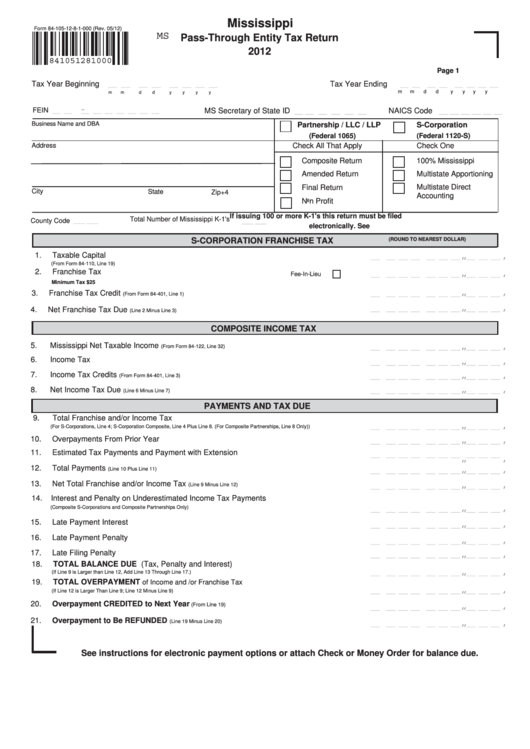

Mississippi

Form 84-105-12-8-1-000 (Rev. 05/12)

MS

Pass-Through Entity Tax Return

2012

841051281000

Page 1

Tax Year Beginning

__ __

__ __

__ __ __ __

Tax Year Ending

__ __

__ __

__ __ __ __

m

m

d

d

y

y

y

y

m

m

d

d

y

y

y

y

-

FEIN

__ __

__ __ __ __ __ __ __

MS Secretary of State ID

__ __ __ __ __ __

NAICS Code

__ __ __ __ __ __

Business Name and DBA

Partnership / LLC / LLP

S-Corporation

(Federal 1065)

(Federal 1120-S)

Address

Check All That Apply

Check One

Composite Return

100% Mississippi

Amended Return

Multistate Apportioning

Final Return

Multistate Direct

City

State

Zip+4

Accounting

Non Profit

If issuing 100 or more K-1's this return must be filed

___ ___

Total Number of Mississippi K-1's

County Code

___ ___

electronically. See for information.

S-CORPORATION FRANCHISE TAX

(ROUND TO NEAREST DOLLAR)

,

,

,

1.

Taxable Capital

___

___ ___ ___

___ ___ ___

___ ___ ___

(From Form 84-110, Line 19)

,

,

,

2.

Franchise Tax

Fee-In-Lieu

___

___ ___ ___

___ ___ ___

___ ___ ___

Minimum Tax $25

,

,

,

3.

Franchise Tax Credit

(From Form 84-401, Line 1)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

4.

Net Franchise Tax Due

___

___ ___ ___

___ ___ ___

___ ___ ___

(Line 2 Minus Line 3)

COMPOSITE INCOME TAX

,

,

,

5.

Mississippi Net Taxable Income

(From Form 84-122, Line 32)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

6.

Income Tax

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

7.

Income Tax Credits

(From Form 84-401, Line 3)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

8.

Net Income Tax Due

(Line 6 Minus Line 7)

___

___ ___ ___

___ ___ ___

___ ___ ___

PAYMENTS AND TAX DUE

9.

Total Franchise and/or Income Tax

,

,

,

(For S-Corporations, Line 4; S-Corporation Composite, Line 4 Plus Line 8. (For Composite Partnerships, Line 8 Only))

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

10.

Overpayments From Prior Year

___

___ ___ ___

___ ___ ___

___ ___ ___

11.

Estimated Tax Payments and Payment with Extension

,

,

,

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

12.

Total Payments

(Line 10 Plus Line 11)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

13.

Net Total Franchise and/or Income Tax

(Line 9 Minus Line 12)

___

___ ___ ___

___ ___ ___

___ ___ ___

14.

Interest and Penalty on Underestimated Income Tax Payments

,

,

,

(Composite S-Corporations and Composite Partnerships Only)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

15.

Late Payment Interest

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

16.

Late Payment Penalty

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

17.

Late Filing Penalty

___

___ ___ ___

___ ___ ___

___ ___ ___

18.

TOTAL BALANCE DUE (Tax, Penalty and Interest)

,

,

,

(If Line 9 is Larger than Line 12, Add Line 13 Through Line 17.)

___

___ ___ ___

___ ___ ___

___ ___ ___

19.

TOTAL OVERPAYMENT

of Income and /or Franchise Tax

,

,

,

(If Line 12 is Larger Than Line 9; Line 12 Minus Line 9)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

20.

Overpayment CREDITED to Next Year

(From Line 19)

___

___ ___ ___

___ ___ ___

___ ___ ___

,

,

,

21.

Overpayment to Be REFUNDED

(Line 19 Minus Line 20)

___

___ ___ ___

___ ___ ___

___ ___ ___

See instructions for electronic payment options or attach Check or Money Order for balance due.

1

1 2

2 3

3 4

4 5

5