Form Boe-1p - Payment For Audit Partially Billed

ADVERTISEMENT

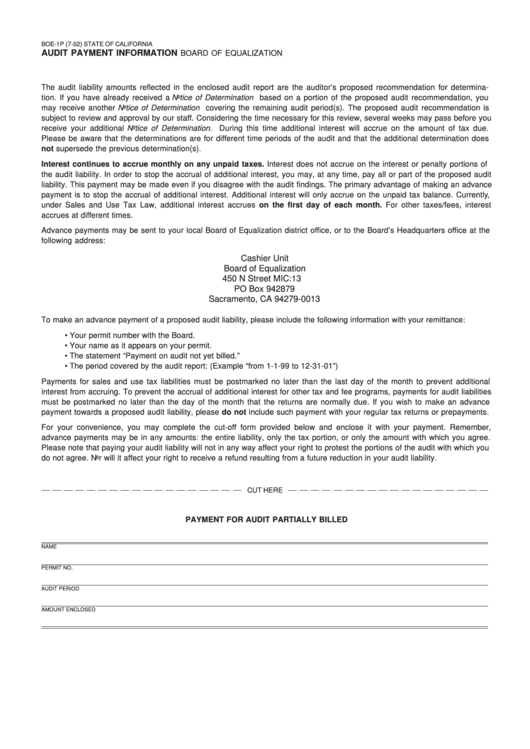

BOE-1P (7-02)

STATE OF CALIFORNIA

AUDIT PAYMENT INFORMATION

BOARD OF EQUALIZATION

The audit liability amounts reflected in the enclosed audit report are the auditor’s proposed recommendation for determina

tion. If you have already received a Notice of Determination based on a portion of the proposed audit recommendation, you

may receive another Notice of Determination covering the remaining audit period(s). The proposed audit recommendation is

subject to review and approval by our staff. Considering the time necessary for this review, several weeks may pass before you

receive your additional Notice of Determination. During this time additional interest will accrue on the amount of tax due.

Please be aware that the determinations are for different time periods of the audit and that the additional determination does

not supersede the previous determination(s).

Interest continues to accrue monthly on any unpaid taxes. Interest does not accrue on the interest or penalty portions of

the audit liability. In order to stop the accrual of additional interest, you may, at any time, pay all or part of the proposed audit

liability. This payment may be made even if you disagree with the audit findings. The primary advantage of making an advance

payment is to stop the accrual of additional interest. Additional interest will only accrue on the unpaid tax balance. Currently,

under Sales and Use Tax Law, additional interest accrues on the first day of each month. For other taxes/fees, interest

accrues at different times.

Advance payments may be sent to your local Board of Equalization district office, or to the Board’s Headquarters office at the

following address:

Cashier Unit

Board of Equalization

450 N Street MIC:13

PO Box 942879

Sacramento, CA 94279-0013

To make an advance payment of a proposed audit liability, please include the following information with your remittance:

• Your permit number with the Board.

• Your name as it appears on your permit.

• The statement “Payment on audit not yet billed.”

• The period covered by the audit report: (Example “from 1-1-99 to 12-31-01”)

Payments for sales and use tax liabilities must be postmarked no later than the last day of the month to prevent additional

interest from accruing. To prevent the accrual of additional interest for other tax and fee programs, payments for audit liabilities

must be postmarked no later than the day of the month that the returns are normally due. If you wish to make an advance

payment towards a proposed audit liability, please do not include such payment with your regular tax returns or prepayments.

For your convenience, you may complete the cut-off form provided below and enclose it with your payment. Remember,

advance payments may be in any amounts: the entire liability, only the tax portion, or only the amount with which you agree.

Please note that paying your audit liability will not in any way affect your right to protest the portions of the audit with which you

do not agree. Nor will it affect your right to receive a refund resulting from a future reduction in your audit liability.

CUT HERE

PAYMENT FOR AUDIT PARTIALLY BILLED

NAME

PERMIT NO.

AUDIT PERIOD

AMOUNT ENCLOSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1