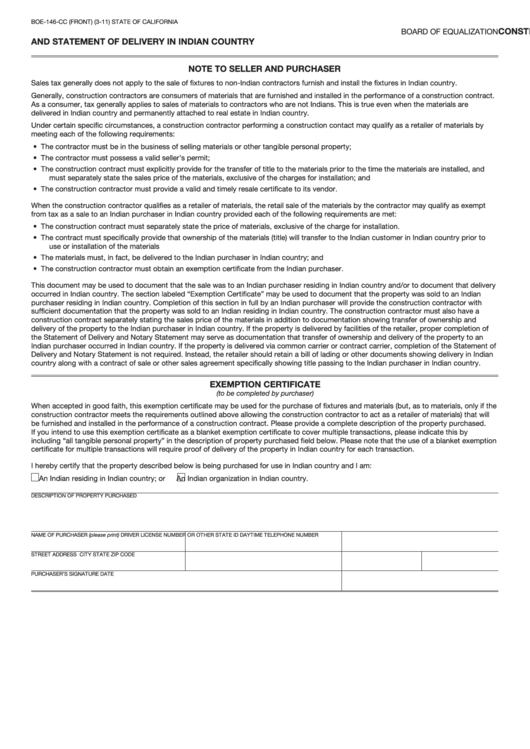

BOE-146-CC (FRONT) (3-11)

STATE OF CALIFORNIA

CONSTRUCTION CONTRACT EXEMPTION CERTIFICATE

BOARD OF EQUALIZATION

AND STATEMENT OF DELIVERY IN INDIAN COUNTRY

NOTE TO SELLER AND PURCHASER

Sales tax generally does not apply to the sale of fixtures to non-Indian contractors furnish and install the fixtures in Indian country.

Generally, construction contractors are consumers of materials that are furnished and installed in the performance of a construction contract.

As a consumer, tax generally applies to sales of materials to contractors who are not Indians. This is true even when the materials are

delivered in Indian country and permanently attached to real estate in Indian country.

Under certain specific circumstances, a construction contractor performing a construction contact may qualify as a retailer of materials by

meeting each of the following requirements:

• The contractor must be in the business of selling materials or other tangible personal property;

• The contractor must possess a valid seller’s permit;

• The construction contract must explicitly provide for the transfer of title to the materials prior to the time the materials are installed, and

must separately state the sales price of the materials, exclusive of the charges for installation; and

• The construction contractor must provide a valid and timely resale certificate to its vendor.

When the construction contractor qualifies as a retailer of materials, the retail sale of the materials by the contractor may qualify as exempt

from tax as a sale to an Indian purchaser in Indian country provided each of the following requirements are met:

• The construction contract must separately state the price of materials, exclusive of the charge for installation.

• The contract must specifically provide that ownership of the materials (title) will transfer to the Indian customer in Indian country prior to

use or installation of the materials

• The materials must, in fact, be delivered to the Indian purchaser in Indian country; and

• The construction contractor must obtain an exemption certificate from the Indian purchaser.

This document may be used to document that the sale was to an Indian purchaser residing in Indian country and/or to document that delivery

occurred in Indian country. The section labeled “Exemption Certificate” may be used to document that the property was sold to an Indian

purchaser residing in Indian country. Completion of this section in full by an Indian purchaser will provide the construction contractor with

sufficient documentation that the property was sold to an Indian residing in Indian country. The construction contractor must also have a

construction contract separately stating the sales price of the materials in addition to documentation showing transfer of ownership and

delivery of the property to the Indian purchaser in Indian country. If the property is delivered by facilities of the retailer, proper completion of

the Statement of Delivery and Notary Statement may serve as documentation that transfer of ownership and delivery of the property to an

Indian purchaser occurred in Indian country. If the property is delivered via common carrier or contract carrier, completion of the Statement of

Delivery and Notary Statement is not required. Instead, the retailer should retain a bill of lading or other documents showing delivery in Indian

country along with a contract of sale or other sales agreement specifically showing title passing to the Indian purchaser in Indian country.

EXEMPTION CERTIFICATE

(to be completed by purchaser)

When accepted in good faith, this exemption certificate may be used for the purchase of fixtures and materials (but, as to materials, only if the

construction contractor meets the requirements outlined above allowing the construction contractor to act as a retailer of materials) that will

be furnished and installed in the performance of a construction contract. Please provide a complete description of the property purchased.

If you intend to use this exemption certificate as a blanket exemption certificate to cover multiple transactions, please indicate this by

including “all tangible personal property” in the description of property purchased field below. Please note that the use of a blanket exemption

certificate for multiple transactions will require proof of delivery of the property in Indian country for each transaction.

I hereby certify that the property described below is being purchased for use in Indian country and I am:

An Indian residing in Indian country; or

An Indian organization in Indian country.

DESCRIPTION OF PROPERTY PURCHASED

NAME OF PURCHASER (please print)

DRIVER LICENSE NUMBER OR OTHER STATE ID

DAYTIME TELEPHONE NUMBER

STREET ADDRESS

CITY

STATE

ZIP CODE

PURCHASER’S SIGNATURE

DATE

1

1 2

2