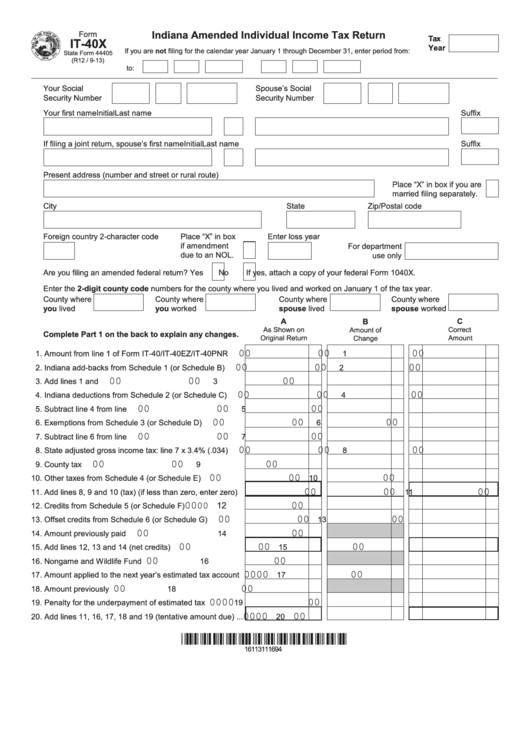

Indiana Amended Individual Income Tax Return

Form

Tax

IT-40X

Year

If you are not filing for the calendar year January 1 through December 31, enter period from:

State Form 44405

(R12 / 9-13)

to:

Your Social

Spouse’s Social

Security Number

Security Number

Your first name

Initial

Last name

Suffix

If filing a joint return, spouse’s first name

Initial

Last name

Suffix

Present address (number and street or rural route)

Place “X” in box if you are

married filing separately.

City

State

Zip/Postal code

Foreign country 2-character code

Place “X” in box

Enter loss year

if amendment

For department

due to an NOL.

use only

Are you filing an amended federal return?

Yes

No

If yes, attach a copy of your federal Form 1040X.

Enter the 2-digit county code numbers for the county where you lived and worked on January 1 of the tax year.

County where

County where

County where

County where

you lived

you worked

spouse lived

spouse worked

A

C

B

As Shown on

Amount of

Correct

Complete Part 1 on the back to explain any changes.

Original Return

Change

Amount

00

00

00

1. Amount from line 1 of Form IT-40/IT-40EZ/IT-40PNR ......

1

00

00

00

2. Indiana add-backs from Schedule 1 (or Schedule B) .......

2

00

00

00

3. Add lines 1 and 2..............................................................

3

00

00

00

4. Indiana deductions from Schedule 2 (or Schedule C) ......

4

00

00

00

5. Subtract line 4 from line 3.................................................

5

00

00

00

6. Exemptions from Schedule 3 (or Schedule D) .................

6

00

00

00

7. Subtract line 6 from line 5.................................................

7

00

00

00

8. State adjusted gross income tax: line 7 x 3.4% (.034) .....

8

00

00

00

9. County tax ........................................................................

9

00

00

00

10. Other taxes from Schedule 4 (or Schedule E)..................

10

00

00

00

11. Add lines 8, 9 and 10 (tax) (if less than zero, enter zero)

11

00

00

00

......................

12

12. Credits from Schedule 5 (or Schedule F)

00

00

00

13. Offset credits from Schedule 6 (or Schedule G) ...............

13

00

00

14. Amount previously paid ....................................................

14

00

00

00

15. Add lines 12, 13 and 14 (net credits)................................

15

00

00

16. Nongame and Wildlife Fund Donation..............................

16

00

00

00

17. Amount applied to the next year’s estimated tax account

17

00

00

18. Amount previously refunded.............................................

18

00

00

00

19. Penalty for the underpayment of estimated tax ................

19

00

00

00

20. Add lines 11, 16, 17, 18 and 19 (tentative amount due) ...

20

*16113111694*

16113111694

1

1 2

2 3

3 4

4