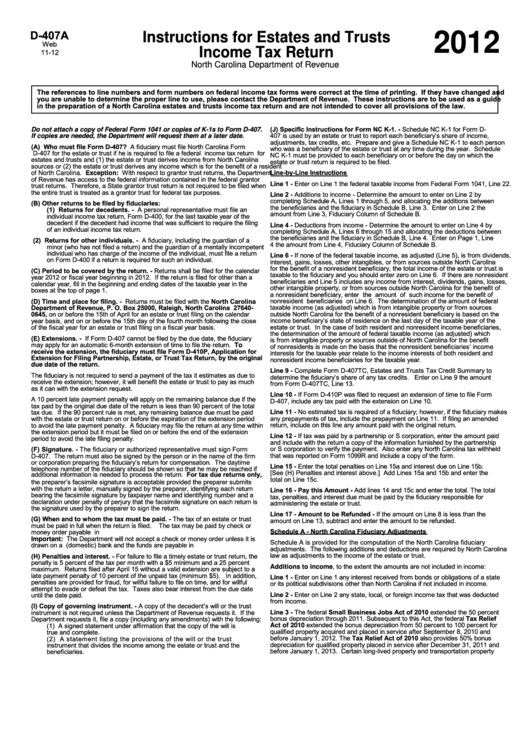

Instructions For Form D-407a - Estates And Trusts Income Tax Return - 2012

ADVERTISEMENT

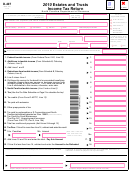

D-407A

2012

Instructions for Estates and Trusts

Web

Income Tax Return

11-12

North Carolina Department of Revenue

The references to line numbers and form numbers on federal income tax forms were correct at the time of printing. If they have changed and

you are unable to determine the proper line to use, please contact the Department of Revenue. These instructions are to be used as a guide

in the preparation of a North Carolina estates and trusts income tax return and are not intended to cover all provisions of the law.

(J) Specific Instructions for Form NC K-1. - Schedule NC K-1 for Form D-

Do not attach a copy of Federal Form 1041 or copies of K-1s to Form D-407.

407 is used by an estate or trust to report each beneficiary’s share of income,

If copies are needed, the Department will request them at a later date.

adjustments, tax credits, etc. Prepare and give a Schedule NC K-1 to each person

(A) Who must file Form D-407? A fiduciary must file North Carolina Form

who was a beneficiary of the estate or trust at any time during the year. Schedule

D-407 for the estate or trust if he is required to file a federal income tax return for

NC K-1 must be provided to each beneficiary on or before the day on which the

estates and trusts and (1) the estate or trust derives income from North Carolina

estate or trust return is required to be filed.

sources or (2) the estate or trust derives any income which is for the benefit of a resident

of North Carolina. Exception: With respect to grantor trust returns, the Department

Line-by-Line Instructions

of Revenue has access to the federal information contained in the federal grantor

Line 1 - Enter on Line 1 the federal taxable income from Federal Form 1041, Line 22.

trust returns. Therefore, a State grantor trust return is not required to be filed when

the entire trust is treated as a grantor trust for federal tax purposes.

Line 2 - Additions to income - Determine the amount to enter on Line 2 by

completing Schedule A, Lines 1 through 5, and allocating the additions between

(B) Other returns to be filed by fiduciaries:

the beneficiaries and the fiduciary in Schedule B, Line 3. Enter on Line 2 the

(1) Returns for decedents. - A personal representative must file an

amount from Line 3, Fiduciary Column of Schedule B.

individual income tax return, Form D-400, for the last taxable year of the

decedent if the decedent had income that was sufficient to require the filing

Line 4 - Deductions from income - Determine the amount to enter on Line 4 by

of an individual income tax return.

completing Schedule A, Lines 6 through 15 and allocating the deductions between

the beneficiaries and the fiduciary in Schedule B, Line 4. Enter on Page 1, Line

(2) Returns for other individuals. - A fiduciary, including the guardian of a

4 the amount from Line 4, Fiduciary Column of Schedule B.

minor (who has not filed a return) and the guardian of a mentally incompetent

individual who has charge of the income of the individual, must file a return

Line 6 - If none of the federal taxable income, as adjusted (Line 5), is from dividends,

on Form D-400 if a return is required for such an individual.

interest, gains, losses, other intangibles, or from sources outside North Carolina

for the benefit of a nonresident beneficiary, the total income of the estate or trust is

(C) Period to be covered by the return. - Returns shall be filed for the calendar

taxable to the fiduciary and you should enter zero on Line 6. If there are nonresident

year 2012 or fiscal year beginning in 2012. If the return is filed for other than a

beneficiaries and Line 5 includes any income from interest, dividends, gains, losses,

calendar year, fill in the beginning and ending dates of the taxable year in the

other intangible property, or from sources outside North Carolina for the benefit of

boxes at the top of page 1.

a nonresident beneficiary, enter the amount of such income for the benefit of

(D) Time and place for filing. - Returns must be filed with the North Carolina

nonresident beneficiaries on Line 6. The determination of the amount of federal

Department of Revenue, P. O. Box 25000, Raleigh, North Carolina 27640-

taxable income (as adjusted) which is from intangible property or from sources

0645, on or before the 15th of April for an estate or trust filing on the calendar

outside North Carolina for the benefit of a nonresident beneficiary is based on the

year basis, and on or before the 15th day of the fourth month following the close

income beneficiary’s state of residence on the last day of the taxable year of the

estate or trust. In the case of both resident and nonresident income beneficiaries,

of the fiscal year for an estate or trust filing on a fiscal year basis.

the determination of the amount of federal taxable income (as adjusted) which

(E) Extensions. - If Form D-407 cannot be filed by the due date, the fiduciary

is from intangible property or sources outside of North Carolina for the benefit

may apply for an automatic 6-month extension of time to file the return. To

of nonresidents is made on the basis that the nonresident beneficiaries’ income

receive the extension, the fiduciary must file Form D-410P, Application for

interests for the taxable year relate to the income interests of both resident and

Extension for Filing Partnership, Estate, or Trust Tax Return, by the original

nonresident income beneficiaries for the taxable year.

due date of the return.

Line 9 - Complete Form D-407TC, Estates and Trusts Tax Credit Summary to

The fiduciary is not required to send a payment of the tax it estimates as due to

determine the fiduciary’s share of any tax credits. Enter on Line 9 the amount

receive the extension; however, it will benefit the estate or trust to pay as much

from Form D-407TC, Line 13.

as it can with the extension request.

Line 10 - If Form D-410P was filed to request an extension of time to file Form

A 10 percent late payment penalty will apply on the remaining balance due if the

D-407, include any tax paid with the extension on Line 10.

tax paid by the original due date of the return is less than 90 percent of the total

Line 11 - No estimated tax is required of a fiduciary; however, if the fiduciary makes

tax due. If the 90 percent rule is met, any remaining balance due must be paid

any prepayments of tax, include the prepayment on Line 11. If filing an amended

with the estate or trust return on or before the expiration of the extension period

return, include on this line any amount paid with the original return.

to avoid the late payment penalty. A fiduciary may file the return at any time within

the extension period but it must be filed on or before the end of the extension

Line 12 - If tax was paid by a partnership or S corporation, enter the amount paid

period to avoid the late filing penalty.

and include with the return a copy of the information furnished by the partnership

or S corporation to verify the payment. Also enter any North Carolina tax withheld

(F) Signature. - The fiduciary or authorized representative must sign Form

that was reported on Form 1099R and include a copy of the form.

D-407. The return must also be signed by the person or in the name of the firm

or corporation preparing the fiduciary’s return for compensation. The daytime

Line 15 - Enter the total penalties on Line 15a and interest due on Line 15b.

telephone number of the fiduciary should be shown so that he may be reached if

[See (H) Penalties and interest above.] Add Lines 15a and 15b and enter the

additional information is needed to process the return. For tax due returns only,

total on Line 15c.

the preparer’s facsimile signature is acceptable provided the preparer submits

with the return a letter, manually signed by the preparer, identifying each return

Line 16 - Pay this Amount - Add lines 14 and 15c and enter the total. The total

bearing the facsimile signature by taxpayer name and identifying number and a

tax, penalties, and interest due must be paid by the fiduciary responsible for

declaration under penalty of perjury that the facsimile signature on each return is

administering the estate or trust.

the signature used by the preparer to sign the return.

Line 17 - Amount to be Refunded - If the amount on Line 8 is less than the

(G) When and to whom the tax must be paid. - The tax of an estate or trust

amount on Line 13, subtract and enter the amount to be refunded.

must be paid in full when the return is filed.

The tax may be paid by check or

Schedule A - North Carolina Fiduciary Adjustments

money order payable in U.S. dollars to the North Carolina Department of Revenue.

Important: The Department will not accept a check or money order unless it is

Schedule A is provided for the computation of the North Carolina fiduciary

drawn on a U.S. (domestic) bank and the funds are payable in U.S. dollars.

adjustments. The following additions and deductions are required by North Carolina

law as adjustments to the income of the estate or trust.

(H) Penalties and interest. - For failure to file a timely estate or trust return, the

penalty is 5 percent of the tax per month with a $5 minimum and a 25 percent

Additions to income, to the extent the amounts are not included in income:

maximum. Returns filed after April 15 without a valid extension are subject to a

late payment penalty of 10 percent of the unpaid tax (minimum $5). In addition,

Line 1 - Enter on Line 1 any interest received from bonds or obligations of a state

penalties are provided for fraud, for willful failure to file on time, and for willful

or its political subdivisions other than North Carolina if not included in income.

attempt to evade or defeat the tax. Taxes also bear interest from the due date

Line 2 - Enter on Line 2 any state, local, or foreign income tax that was deducted

until the date paid.

from income.

(I) Copy of governing instrument. - A copy of the decedent’s will or the trust

Line 3 - The federal Small Business Jobs Act of 2010 extended the 50 percent

instrument is not required unless the Department of Revenue requests it. If the

bonus depreciation through 2011. Subsequent to this Act, the federal Tax Relief

Department requests it, file a copy (including any amendments) with the following:

Act of 2010 extended the bonus depreciation from 50 percent to 100 percent for

(1) A signed statement under affirmation that the copy of the will is

qualified property acquired and placed in service after September 8, 2010 and

true and complete.

before January 1, 2012. The Tax Relief Act of 2010 also provides 50% bonus

(2) A statement listing the provisions of the will or the trust

depreciation for qualified property placed in service after December 31, 2011 and

instrument that divides the income among the estate or trust and the

before January 1, 2013. Certain long-lived property and transportation property

beneficiaries.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2