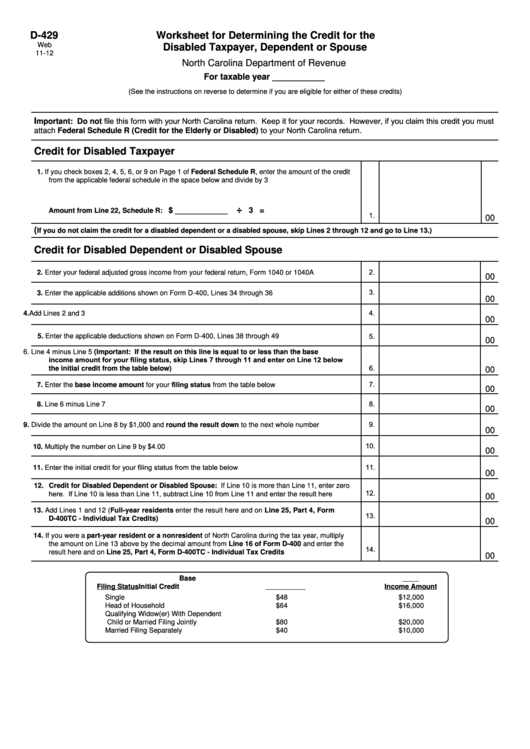

Form D-429 - Worksheet For Determining The Credit For The Disabled Taxpayer, Dependent Or Spouse

ADVERTISEMENT

D-429

Worksheet for Determining the Credit for the

Web

Disabled Taxpayer, Dependent or Spouse

11-12

North Carolina Department of Revenue

For taxable year ___________

(See the instructions on reverse to determine if you are eligible for either of these credits)

mportant: Do not file this form with your North Carolina return. Keep it for your records. However, if you claim this credit you must

I

attach Federal Schedule R (Credit for the Elderly or Disabled) to your North Carolina return.

Credit for Disabled Taxpayer

1. If you check boxes 2, 4, 5, 6, or 9 on Page 1 of Federal Schedule R, enter the amount of the credit

from the applicable federal schedule in the space below and divide by 3

÷

$ ____________

3 =

Amount from Line 22, Schedule R:

1.

00

(

If you do not claim the credit for a disabled dependent or a disabled spouse, skip Lines 2 through 12 and go to Line 13.)

Credit for Disabled Dependent or Disabled Spouse

2.

2. Enter your federal adjusted gross income from your federal return, Form 1040 or 1040A

00

3.

3. Enter the applicable additions shown on Form D-400, Lines 34 through 36

00

4.

4. Add Lines 2 and 3

00

5.

5. Enter the applicable deductions shown on Form D-400, Lines 38 through 49

00

6. Line 4 minus Line 5 (Important: If the result on this line is equal to or less than the base

income amount for your filing status, skip Lines 7 through 11 and enter on Line 12 below

6.

the initial credit from the table below)

00

7. Enter the base income amount for your filing status from the table below

7.

00

8.

8. Line 6 minus Line 7

00

9.

9. Divide the amount on Line 8 by $1,000 and round the result down to the next whole number

00

10.

10. Multiply the number on Line 9 by $4.00

00

11. Enter the initial credit for your filing status from the table below

11.

00

12. Credit for Disabled Dependent or Disabled Spouse: If Line 10 is more than Line 11, enter zero

12.

here. If Line 10 is less than Line 11, subtract Line 10 from Line 11 and enter the result here

00

13. Add Lines 1 and 12 (Full-year residents enter the result here and on Line 25, Part 4, Form

13.

D-400TC - Individual Tax Credits)

00

14. If you were a part-year resident or a nonresident of North Carolina during the tax year, multiply

the amount on Line 13 above by the decimal amount from Line 16 of Form D-400 and enter the

14.

result here and on Line 25, Part 4, Form D-400TC - Individual Tax Credits

00

Base

Filing Status

Initial Credit

Income Amount

Single

$48

$12,000

Head of Household

$64

$16,000

Qualifying Widow(er) With Dependent

Child or Married Filing Jointly

$80

$20,000

Married Filing Separately

$40

$10,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2