Form Sc Sch.tc 9 - South Carolina Credit For Child Care Program

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC 9

DEPARTMENT OF REVENUE

(Rev. 7/20/07)

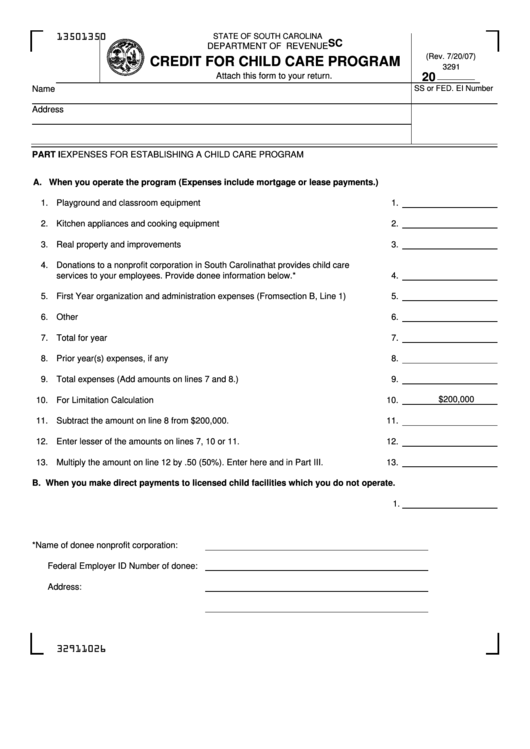

CREDIT FOR CHILD CARE PROGRAM

3291

Attach this form to your return.

20

Name

SS or FED. EI Number

Address

PART I

EXPENSES FOR ESTABLISHING A CHILD CARE PROGRAM

A. When you operate the program (Expenses include mortgage or lease payments.)

1.

Playground and classroom equipment

1.

2.

Kitchen appliances and cooking equipment

2.

3.

Real property and improvements

3.

4.

Donations to a nonprofit corporation in South Carolina that provides child care

services to your employees. Provide donee information below.*

4.

5.

First Year organization and administration expenses (From section B, Line 1)

5.

6.

Other

6.

7.

Total for year

7.

8.

Prior year(s) expenses, if any

8.

9.

Total expenses (Add amounts on lines 7 and 8.)

9.

$200,000

10.

For Limitation Calculation

10.

11.

Subtract the amount on line 8 from $200,000.

11.

12.

Enter lesser of the amounts on lines 7, 10 or 11.

12.

13.

Multiply the amount on line 12 by .50 (50%). Enter here and in Part III.

13.

B. When you make direct payments to licensed child facilities which you do not operate.

1. First Year organization and administration expenses

1.

*

Name of donee nonprofit corporation:

Federal Employer ID Number of donee:

Address:

32911026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3