Taxable Year Ending

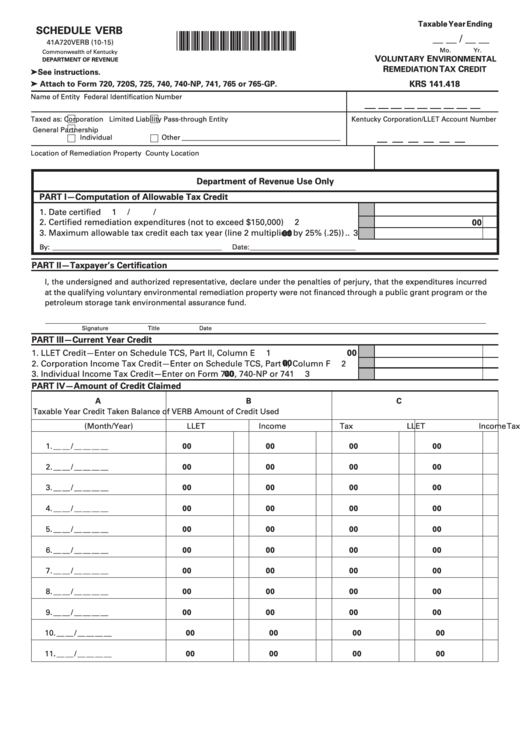

SCHEDULE VERB

*1500030229*

__ __ / __ __

41A720VERB (10-15)

Mo.

Yr.

Commonwealth of Kentucky

V

E

OLUNTARY

NVIRONMENTAL

DEPARTMENT OF REVENUE

R

T

C

EMEDIATION

AX

REDIT

➤ See instructions.

KRS 141.418

➤ Attach to Form 720, 720S, 725, 740, 740-NP , 741, 765 or 765-GP .

Name of Entity

Federal Identification Number

Taxed as:

Corporation

Limited Liability Pass-through Entity

Kentucky Corporation/LLET Account Number

General Partnership

Individual

Other _____________________________________________

Location of Remediation Property

County Location

Department of Revenue Use Only

PART I—Computation of Allowable Tax Credit

/

/

1. Date certified ...........................................................................................................

1

2. Certified remediation expenditures (not to exceed $150,000) ............................

2

00

3. Maximum allowable tax credit each tax year (line 2 multiplied by 25% (.25)) ..

3

00

By: ________________________________________________

Date: ______________________________

PART II—Taxpayer’s Certification

I, the undersigned and authorized representative, declare under the penalties of perjury, that the expenditures incurred

at the qualifying voluntary environmental remediation property were not financed through a public grant program or the

petroleum storage tank environmental assurance fund.

Signature

Title

Date

PART III—Current Year Credit

00

1. LLET Credit—Enter on Schedule TCS, Part II, Column E .........................................

1

2. Corporation Income Tax Credit—Enter on Schedule TCS, Part II, Column F ..........

2

00

3. Individual Income Tax Credit—Enter on Form 740, 740-NP or 741 .........................

3

00

PART IV—Amount of Credit Claimed

A

B

C

Taxable Year Credit Taken

Balance of VERB

Amount of Credit Used

(Month/Year)

LLET

Income Tax

LLET

Income Tax

1.

__ __ / __ __ __ __

00

00

00

00

2.

__ __ / __ __ __ __

00

00

00

00

3.

__ __ / __ __ __ __

00

00

00

00

4.

__ __ / __ __ __ __

00

00

00

00

5.

__ __ / __ __ __ __

00

00

00

00

6.

__ __ / __ __ __ __

00

00

00

00

7.

__ __ / __ __ __ __

00

00

00

00

8.

__ __ / __ __ __ __

00

00

00

00

9.

__ __ / __ __ __ __

00

00

00

00

10.

__ __ / __ __ __ __

00

00

00

00

11.

__ __ / __ __ __ __

00

00

00

00

1

1 2

2