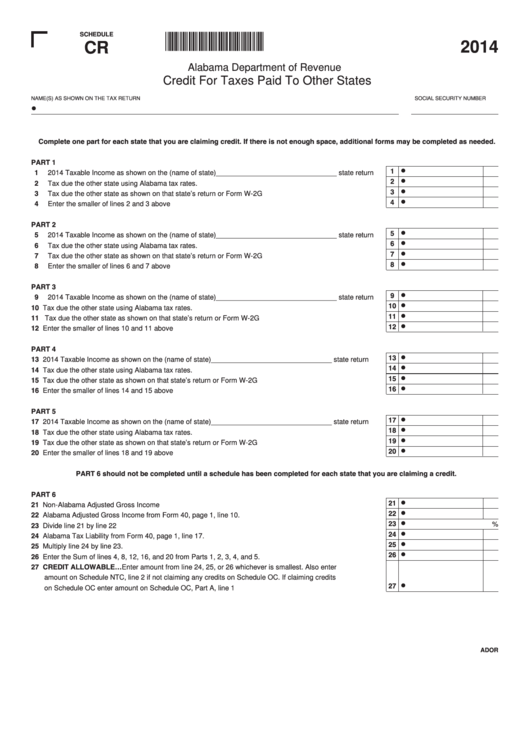

Schedule Cr - Alabama Credit For Taxes Paid To Other States - 2014

ADVERTISEMENT

SCHEDULE

140006CR

2 14

CR

Alabama Department of Revenue

Credit For Taxes Paid To Other States

NAME(S) AS SHOWN ON THE TAX RETURN

SOCIAL SECURITY NUMBER

•

•

Complete one part for each state that you are claiming credit. If there is not enough space, additional forms may be completed as needed.

PART 1

1

1 2014 Taxable Income as shown on the (name of state)_______________________________ state return . . . .

•

2

2 Tax due the other state using Alabama tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

3

3 Tax due the other state as shown on that state’s return or Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

4

4 Enter the smaller of lines 2 and 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

PART 2

5

5 2014 Taxable Income as shown on the (name of state)_______________________________ state return . . . .

•

6

6 Tax due the other state using Alabama tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

7

7 Tax due the other state as shown on that state’s return or Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

8

8 Enter the smaller of lines 6 and 7 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

PART 3

9

9 2014 Taxable Income as shown on the (name of state)_______________________________ state return . . . .

•

10

10 Tax due the other state using Alabama tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

11

11 Tax due the other state as shown on that state’s return or Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

12

12 Enter the smaller of lines 10 and 11 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

PART 4

13

13 2014 Taxable Income as shown on the (name of state)_______________________________ state return . . . .

•

14

14 Tax due the other state using Alabama tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

15

15 Tax due the other state as shown on that state’s return or Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

16

16 Enter the smaller of lines 14 and 15 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

PART 5

17

17 2014 Taxable Income as shown on the (name of state)_______________________________ state return . . . .

•

18

18 Tax due the other state using Alabama tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

19

19 Tax due the other state as shown on that state’s return or Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

20

20 Enter the smaller of lines 18 and 19 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

PART 6 should not be completed until a schedule has been completed for each state that you are claiming a credit.

PART 6

21

21 Non-Alabama Adjusted Gross Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

22

22 Alabama Adjusted Gross Income from Form 40, page 1, line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

23

23 Divide line 21 by line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

24

%

24 Alabama Tax Liability from Form 40, page 1, line 17.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

25

25 Multiply line 24 by line 23.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

26

26 Enter the Sum of lines 4, 8, 12, 16, and 20 from Parts 1, 2, 3, 4, and 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

27 CREDIT ALLOWABLE…Enter amount from line 24, 25, or 26 whichever is smallest. Also enter

27

amount on Schedule NTC, line 2 if not claiming any credits on Schedule OC. If claiming credits

•

on Schedule OC enter amount on Schedule OC, Part A, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DOR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1