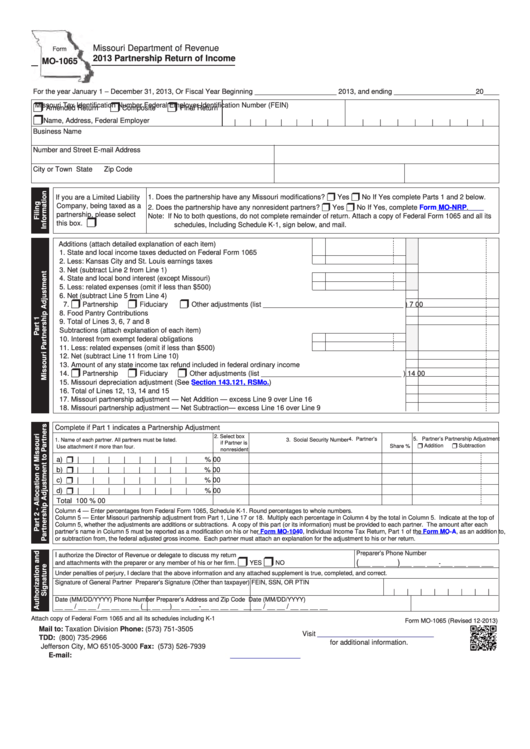

Missouri Department of Revenue

Form

2013 Partnership Return of Income

MO-1065

For the year January 1 – December 31, 2013, Or Fiscal Year Beginning _____________________ 2013, and ending _____________________20____

r

r

r

Missouri Tax Identification Number

Federal Employer Identification Number (FEIN)

Amended Return

Composite

Final Return

r

Name, Address, Federal Employer I.D. Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name

Number and Street

E-mail Address

City or Town

State

Zip Code

r

r

If you are a Limited Liability

1. Does the partnership have any Missouri modifications?

Yes

No If Yes complete Parts 1 and 2 below.

r

r

Company, being taxed as a

2. Does the partnership have any nonresident partners?

Yes

No If Yes, complete

Form

MO-NRP.

partnership, please select

Note: If No to both questions, do not complete remainder of return. Attach a copy of Federal Form 1065 and all its

r

this box.

schedules, Including Schedule K-1, sign below, and mail.

Additions (attach detailed explanation of each item)

1. State and local income taxes deducted on Federal Form 1065 ........................

1

00

2. Less: Kansas City and St. Louis earnings taxes ................................................

2

00

3. Net (subtract Line 2 from Line 1) ......................................................................................................................... 3

00

4. State and local bond interest (except Missouri) .................................................

4

00

5. Less: related expenses (omit if less than $500) ................................................

5

00

6. Net (subtract Line 5 from Line 4) .......................................................................................................................

6

00

r

r

r

7.

Partnership

Fiduciary

Other adjustments (list ____________________________________ ) 7

00

8. Food Pantry Contributions .................................................................................................................................

8

00

9. Total of Lines 3, 6, 7 and 8 ................................................................................................................................

9

00

Subtractions (attach explanation of each item)

10. Interest from exempt federal obligations ............................................................ 10

00

11. Less: related expenses (omit if less than $500) ................................................ 11

00

12. Net (subtract Line 11 from Line 10) ................................................................................................................... 12

00

13. Amount of any state income tax refund included in federal ordinary income .................................................... 13

00

r

r

r

14.

Partnership

Fiduciary

Other adjustments (list ____________________________________ ) 14

00

15. Missouri depreciation adjustment (See

Section 143.121,

RSMo.) ................................................................... 15

00

16. Total of Lines 12, 13, 14 and 15 ........................................................................................................................ 16

00

17. Missouri partnership adjustment — Net Addition — excess Line 9 over Line 16 .............................................. 17

00

18. Missouri partnership adjustment — Net Subtraction — excess Line 16 over Line 9 ......................................... 18

00

Complete if Part 1 indicates a Partnership Adjustment

2. Select box

5. Partner’s Partnership Adjustment

4. Partner’s

1. Name of each partner. All partners must be listed.

3. Social Security Number

if Partner is

r Addition

r Subtraction

Share %

Use attachment if more than four.

nonresident

r

a)

|

|

|

|

|

|

|

|

%

00

r

b)

|

|

|

|

|

|

|

|

%

00

r

c)

|

|

|

|

|

|

|

|

%

00

r

d)

|

|

|

|

|

|

|

|

%

00

Total

100 %

00

Column 4 — Enter percentages from Federal Form 1065, Schedule K-1. Round percentages to whole numbers.

Column 5 — Enter Missouri partnership adjustment from Part 1, Line 17 or 18. Multiply each percentage in Column 4 by the total in Column 5. Indicate at the top of

Column 5, whether the adjustments are additions or subtractions. A copy of this part (or its information) must be provided to each partner. The amount after each

partner’s name in Column 5 must be reported as a modification on his or her

Form

MO-1040, Individual Income Tax Return, Part 1 of the

Form

MO-A, as an addition to,

or subtraction from, the federal adjusted gross income. Each partner must attach an explanation for the adjustment to his or her return.

Preparer’s Phone Number

I

authorize the Director of Revenue or delegate to discuss my return

r

r

(

)

and attachments with the preparer or any member of his or her firm.

YES

NO

___ ___ ___

___ ___ ___-___ ___ ___ ___

Under penalties of perjury, I declare that the above information and any attached supplement is true, completed, and correct.

Signature of General Partner

Preparer’s Signature (Other than taxpayer)

FEIN, SSN, OR PTIN

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY)

Phone Number

Preparer’s Address and Zip Code

Date (MM/DD/YYYY)

(__ __ __)__ __ __-__ __ __ __

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

Attach copy of Federal Form 1065 and all its schedules including K-1

Form MO-1065 (Revised 12-2013)

Mail to:

Taxation Division

Phone: (573) 751-3505

Visit

P.O. Box 3000

TDD: (800) 735-2966

for additional information.

Jefferson City, MO 65105-3000

Fax: (573) 526-7939

E-mail:

income@dor.mo.gov

1

1 2

2