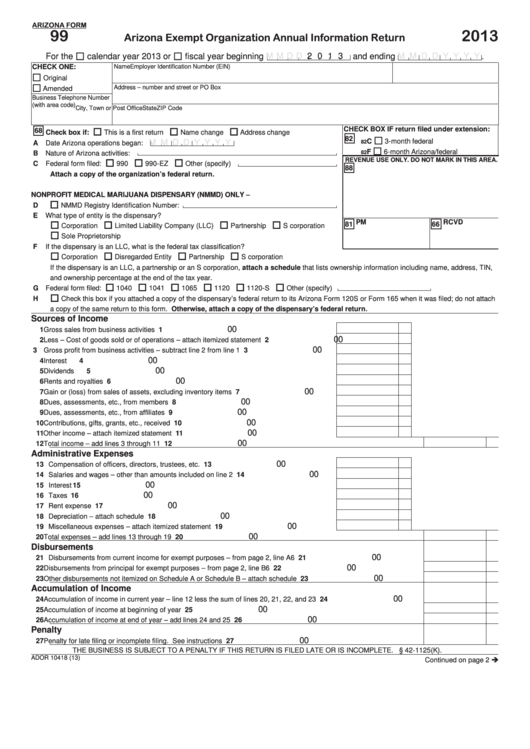

ARIZONA FORM

99

2013

Arizona Exempt Organization Annual Information Return

For the

calendar year 2013 or

fiscal year beginning

M M D D

2 0 1 3 and ending

M M D D Y Y Y Y

.

CHECK ONE:

Name

Employer Identification Number (EIN)

Original

Address – number and street or PO Box

Amended

Business Telephone Number

(with area code)

City, Town or Post Office

State

ZIP Code

CHECK BOX IF return filed under extension:

68

Check box if:

This is a first return

Name change

Address change

82

C

3-month federal

M M D D Y Y Y Y

A Date Arizona operations began:

82

F

6-month Arizona/federal

82

B Nature of Arizona activities:

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

C Federal form filed:

990

990-EZ

Other (specify)

88

Attach a copy of the organization’s federal return.

NONPROFIT MEDICAL MARIJUANA DISPENSARY (NMMD) ONLY –

D

NMMD Registry Identification Number:

E What type of entity is the dispensary?

81 PM

66 RCVD

Corporation

Limited Liability Company (LLC)

Partnership

S corporation

Sole Proprietorship

F If the dispensary is an LLC, what is the federal tax classification?

Corporation

Disregarded Entity

Partnership

S corporation

If the dispensary is an LLC, a partnership or an S corporation, attach a schedule that lists ownership information including name, address, TIN,

and ownership percentage at the end of the tax year.

G Federal form filed:

1040

1041

1065

1120

1120-S

Other (specify)

H

Check this box if you attached a copy of the dispensary’s federal return to its Arizona Form 120S or Form 165 when it was filed; do not attach

a copy of the same return to this form. Otherwise, attach a copy of the dispensary’s federal return.

Sources of Income

00

1 Gross sales from business activities .....................................................................................

1

00

2 Less – Cost of goods sold or of operations – attach itemized statement .............................

2

00

3 Gross profit from business activities – subtract line 2 from line 1 .........................................

3

00

4 Interest ..................................................................................................................................

4

00

5 Dividends ..............................................................................................................................

5

00

6 Rents and royalties ...............................................................................................................

6

00

7 Gain or (loss) from sales of assets, excluding inventory items .............................................

7

00

8 Dues, assessments, etc., from members .............................................................................

8

00

9 Dues, assessments, etc., from affiliates ...............................................................................

9

00

10 Contributions, gifts, grants, etc., received ............................................................................. 10

00

11 Other income – attach itemized statement ........................................................................... 11

00

12 Total income – add lines 3 through 11 ............................................................................................................................

12

Administrative Expenses

00

13 Compensation of officers, directors, trustees, etc. ................................................................ 13

00

14 Salaries and wages – other than amounts included on line 2 .............................................. 14

00

15 Interest .................................................................................................................................. 15

00

16 Taxes .................................................................................................................................... 16

00

17 Rent expense ........................................................................................................................ 17

00

18 Depreciation – attach schedule ............................................................................................ 18

00

19 Miscellaneous expenses – attach itemized statement .......................................................... 19

00

20 Total expenses – add lines 13 through 19 ......................................................................................................................

20

Disbursements

00

21 Disbursements from current income for exempt purposes – from page 2, line A6 .........................................................

21

00

22 Disbursements from principal for exempt purposes – from page 2, line B6 ...................................................................

22

00

23 Other disbursements not itemized on Schedule A or Schedule B – attach schedule .....................................................

23

Accumulation of Income

00

24 Accumulation of income in current year – line 12 less the sum of lines 20, 21, 22, and 23 ...........................................

24

00

25 Accumulation of income at beginning of year .................................................................................................................

25

00

26 Accumulation of income at end of year – add lines 24 and 25 .......................................................................................

26

Penalty

00

27 Penalty for late filing or incomplete filing. See instructions ............................................................................................

27

THE BUSINESS IS SUBJECT TO A PENALTY IF THIS RETURN IS FILED LATE OR IS INCOMPLETE. A.R.S. § 42-1125(K).

ADOR 10418 (13)

Continued on page 2

1

1 2

2 3

3