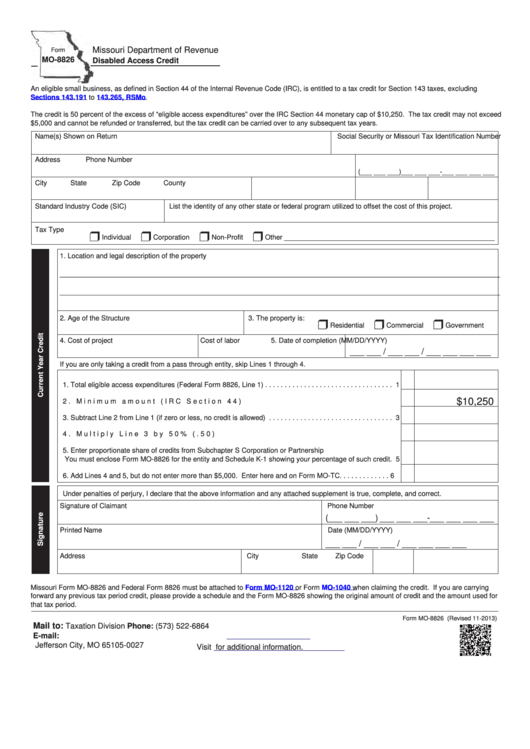

Missouri Department of Revenue

Form

MO-8826

Disabled Access Credit

An eligible small business, as defined in Section 44 of the Internal Revenue Code (IRC), is entitled to a tax credit for Section 143 taxes, excluding

Sections 143.191

to

143.265,

RSMo.

The credit is 50 percent of the excess of “eligible access expenditures” over the IRC Section 44 monetary cap of $10,250. The tax credit may not exceed

$5,000 and cannot be refunded or transferred, but the tax credit can be carried over to any subsequent tax years.

Name(s) Shown on Return

Social Security or Missouri Tax Identification Number

Address

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

City

State

Zip Code

County

Standard Industry Code (SIC)

List the identity of any other state or federal program utilized to offset the cost of this project.

Tax Type

r

r

r

r

Non-Profit

Individual

Corporation

Other ______________________________________________________

1. Location and legal description of the property

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

2. Age of the Structure

3. The property is:

r

r

r

Residential

Commercial

Government

4. Cost of project

Cost of labor

5. Date of completion (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

If you are only taking a credit from a pass through entity, skip Lines 1 through 4.

1. Total eligible access expenditures (Federal Form 8826, Line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

$10,250

2. Minimum amount (IRC Section 44) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Subtract Line 2 from Line 1 (if zero or less, no credit is allowed) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4. Multiply Line 3 by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Enter proportionate share of credits from Subchapter S Corporation or Partnership

You must enclose Form MO-8826 for the entity and Schedule K-1 showing your percentage of such credit.

5

6. Add Lines 4 and 5, but do not enter more than $5,000. Enter here and on Form MO-TC. . . . . . . . . . . . .

6

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature of Claimant

Phone Number

(___ ___ ___) ___ ___ ___-___ ___ ___ ___

Printed Name

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Address

City

State

Zip Code

Missouri Form MO-8826 and Federal Form 8826 must be attached to

Form MO-1120

or Form

MO-1040

when claiming the credit. If you are carrying

forward any previous tax period credit, please provide a schedule and the Form MO-8826 showing the original amount of credit and the amount used for

that tax period.

Form MO-8826 (Revised 11-2013)

Mail to:

Taxation Division

Phone: (573) 522-6864

P.O. Box 27

E-mail:

income@dor.mo.gov

Jefferson City, MO 65105-0027

Visit

for additional information.

1

1