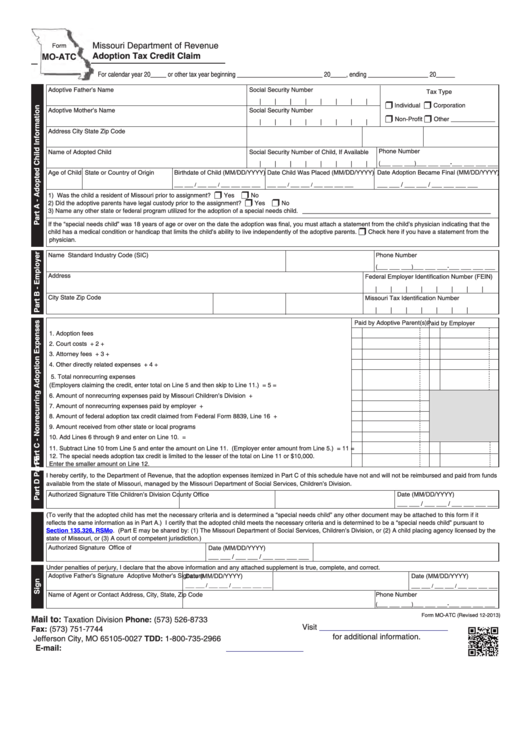

Missouri Department of Revenue

Form

Adoption Tax Credit Claim

MO-ATC

For calendar year 20_____ or other tax year beginning ___________________________ 20_____, ending ___________________ 20______

Adoptive Father’s Name

Social Security Number

Tax Type

|

|

|

|

|

|

|

|

r

r

Individual

Corporation

Adoptive Mother’s Name

Social Security Number

r

r

Non-Profit

Other _____________

|

|

|

|

|

|

|

|

Address

City

State

Zip Code

Phone Number

Name of Adopted Child

Social Security Number of Child, If Available

(___ ___ ___)___ ___ ___-___ ___ ___ ___

|

|

|

|

|

|

|

|

Birthdate of Child (MM/DD/YYYY)

Date Child Was Placed (MM/DD/YYYY)

Date Adoption Became Final (MM/DD/YYYY)

Age of Child State or Country of Origin

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

r

r

1) Was the child a resident of Missouri prior to assignment? ....................................................................................................................................

Yes

No

r

r

2) Did the adoptive parents have legal custody prior to the assignment? .................................................................................................................

Yes

No

___________________________________________

3) Name any other state or federal program utilized for the adoption of a special needs child.

If the “special needs child” was 18 years of age or over on the date the adoption was final, you must attach a statement from the child’s physician indicating that the

r

child has a medical condition or handicap that limits the child’s ability to live independently of the adoptive parents.

Check here if you have a statement from the

physician.

Name

Standard Industry Code (SIC)

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Address

Federal Employer Identification Number (FEIN)

|

|

|

|

|

|

|

|

City

State

Zip Code

Missouri Tax Identification Number

|

|

|

|

|

|

|

Paid by Adoptive Parent(s)

Paid by Employer

1. Adoption fees ...................................................................................................................................................

1

1

2. Court costs .......................................................................................................................................................

2 +

2 +

3. Attorney fees ....................................................................................................................................................

3 +

3 +

4. Other directly related expenses .......................................................................................................................

4 +

4 +

5. Total nonrecurring expenses

(Employers claiming the credit, enter total on Line 5 and then skip to Line 11.) .............................................

5 =

5 =

6. Amount of nonrecurring expenses paid by Missouri Children’s Division .........................................................

6 +

7. Amount of nonrecurring expenses paid by employer ......................................................................................

7 +

8. Amount of federal adoption tax credit claimed from Federal Form 8839, Line 16 ...........................................

8 +

9. Amount received from other state or local programs .......................................................................................

9

10. Add Lines 6 through 9 and enter on Line 10. ...................................................................................................

10 =

11. Subtract Line 10 from Line 5 and enter the amount on Line 11. (Employer enter amount from Line 5.) ........

11 =

11 =

12. The special needs adoption tax credit is limited to the lesser of the total on Line 11 or $10,000.

Enter the smaller amount on Line 12. ..............................................................................................................

12

12

I hereby certify, to the Department of Revenue, that the adoption expenses itemized in Part C of this schedule have not and will not be reimbursed and paid from funds

.

available from the state of Missouri, managed by the Missouri Department of Social Services, Children’s Division

Date (MM/DD/YYYY)

Authorized Signature

Title

Children’s Division County Office

___ ___ / ___ ___ / ___ ___ ___ ___

(To verify that the adopted child has met the necessary criteria and is determined a “special needs child” any other document may be attached to this form if it

reflects the same information as in Part A.) I certify that the adopted child meets the necessary criteria and is determined to be a “special needs child” pursuant to

Section 135.326,

RSMo. (Part E may be shared by: (1) The Missouri Department of Social Services, Children’s Division, or (2) A child placing agency licensed by the

state of Missouri, or (3) A court of competent jurisdiction.)

Authorized Signature

Office of

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Adoptive Father’s Signature

Adoptive Mother’s Signature

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

Name of Agent or Contact

Address, City, State, Zip Code

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Form MO-ATC (Revised 12-2013)

Mail to:

Phone: (573) 526-8733

Taxation Division

Visit

P.O. Box 27

Fax: (573) 751-7744

for additional information.

TDD: 1-800-735-2966

Jefferson City, MO 65105-0027

E-mail:

income@dor.mo.gov

1

1 2

2