Reset Form

Print Form

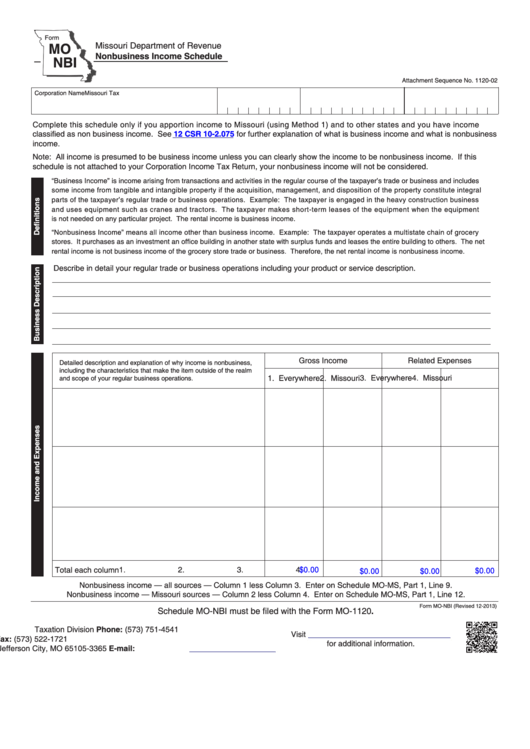

Form

MO

Missouri Department of Revenue

Nonbusiness Income Schedule

NBI

Attachment Sequence No. 1120-02

Corporation Name

Missouri Tax I.D. Number

Charter Number

Federal Employer I.D. Number

Complete this schedule only if you apportion income to Missouri (using Method 1) and to other states and you have income

12 CSR 10-2.075

classified as non business income. See

for further explanation of what is business income and what is nonbusiness

income.

Note: All income is presumed to be business income unless you can clearly show the income to be nonbusiness income. If this

schedule is not attached to your Corporation Income Tax Return, your nonbusiness income will not be considered.

“Business Income” is income arising from transactions and activities in the regular course of the taxpayer’s trade or business and includes

some income from tangible and intangible property if the acquisition, management, and disposition of the property constitute integral

parts of the taxpayer’s regular trade or business operations. Example: The taxpayer is engaged in the heavy construction business

and uses equipment such as cranes and tractors. The taxpayer makes short-term leases of the equipment when the equipment

is not needed on any particular project. The rental income is business income.

“Nonbusiness Income” means all income other than business income. Example: The taxpayer operates a multistate chain of grocery

stores. It purchases as an investment an office building in another state with surplus funds and leases the entire building to others. The net

rental income is not business income of the grocery store trade or business. Therefore, the net rental income is nonbusiness income.

Describe in detail your regular trade or business operations including your product or service description.

Gross Income

Related Expenses

Detailed description and explanation of why income is nonbusiness,

including the characteristics that make the item outside of the realm

1. Everywhere

3. Everywhere

4. Missouri

2. Missouri

and scope of your regular business operations.

$0.00

1.

2.

3.

4.

$0.00

Total each column

$0.00

$0.00

Nonbusiness income — all sources — Column 1 less Column 3. Enter on Schedule MO-MS, Part 1, Line 9.

Nonbusiness income — Missouri sources — Column 2 less Column 4. Enter on Schedule MO-MS, Part 1, Line 12.

Form MO-NBI (Revised 12-2013)

Schedule MO-NBI must be filed with the Form MO-1120.

Taxation Division

Phone: (573) 751-4541

Visit

P.O. Box 3365

Fax: (573) 522-1721

for additional information.

E-mail:

corporate@dor.mo.gov

Jefferson City, MO 65105-3365

1

1