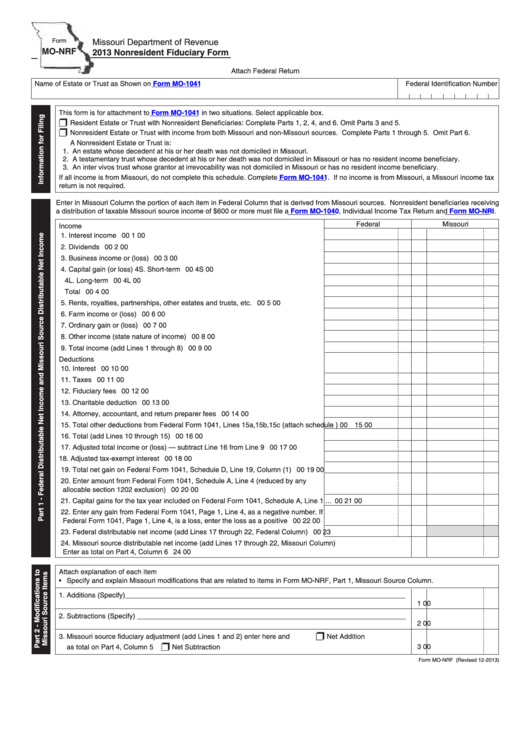

Missouri Department of Revenue

Form

MO‑NRF

2013 Nonresident Fiduciary Form

Attach Federal Return

Name of Estate or Trust as Shown on Form

MO‑1041 Federal Identification Number

MO‑1041 in two situations. Select applicable box.

This form is for attachment to Form

r

Resident Estate or Trust with Nonresident Beneficiaries: Complete Parts 1, 2, 4, and 6. Omit Parts 3 and 5.

r

Nonresident Estate or Trust with income from both Missouri and non‑Missouri sources. Complete Parts 1 through 5. Omit Part 6.

A Nonresident Estate or Trust is:

1. An estate whose decedent at his or her death was not domiciled in Missouri.

2. A testamentary trust whose decedent at his or her death was not domiciled in Missouri or has no resident income beneficiary.

3. An inter vivos trust whose grantor at irrevocability was not domiciled in Missouri or has no resident income beneficiary.

MO‑1041. If no income is from Missouri, a Missouri income tax

If all income is from Missouri, do not complete this schedule. Complete Form

return is not required.

Enter in Missouri Column the portion of each item in Federal Column that is derived from Missouri sources. Nonresident beneficiaries receiving

a distribution of taxable Missouri source income of $600 or more must file a Form MO‑1040, Individual Income Tax Return and Form

MO‑NRI.

Federal

Missouri

Income

1. Interest income . ........................................................................................................

00 1

00

2. Dividends .................................................................................................................

00 2

00

3. Business income or (loss) ........................................................................................

00 3

00

4. Capital gain (or loss)

4S. Short‑term . ...................................................................

00 4S

00

4L. Long‑term . ....................................................................

00 4L

00

Total ...................................................................................

00 4

00

5. Rents, royalties, partnerships, other estates and trusts, etc. ...................................

00 5

00

6. Farm income or (loss) ..............................................................................................

00 6

00

7. Ordinary gain or (loss) . .............................................................................................

00 7

00

8. Other income (state nature of income) . ....................................................................

00 8

00

9. Total income (add Lines 1 through 8) ......................................................................

00 9

00

Deductions

1 0. Interest .....................................................................................................................

00 10

00

1 1. Taxes .......................................................................................................................

00 11

00

1 2. Fiduciary fees . ..........................................................................................................

00 12

00

1 3. Charitable deduction ................................................................................................

00 13

00

1 4. Attorney, accountant, and return preparer fees .......................................................

00 14

00

1 5. Total other deductions from Federal Form 1041, Lines 15a,15b,15c (attach schedule )

00 15

00

1 6. Total (add Lines 10 through 15) ...............................................................................

00 16

00

1 7. Adjusted total income or (loss) — subtract Line 16 from Line 9 . ..............................

00 17

00

18. Adjusted tax‑exempt interest . ...................................................................................

00 18

00

1 9. Total net gain on Federal Form 1041, Schedule D, Line 19, Column (1) . ................

00 19

00

2 0. Enter amount from Federal Form 1041, Schedule A, Line 4 (reduced by any

allocable section 1202 exclusion) ............................................................................

00 20

00

2 1. Capital gains for the tax year included on Federal Form 1041, Schedule A, Line 1 ...

00 21

00

2 2. Enter any gain from Federal Form 1041, Page 1, Line 4, as a negative number. If

Federal Form 1041, Page 1, Line 4, is a loss, enter the loss as a positive number....

00 22

00

2 3. Federal distributable net income (add Lines 17 through 22, Federal Column) ........

00 23

2 4. Missouri source distributable net income (add Lines 17 through 22, Missouri Column)

Enter as total on Part 4, Column 6 ........................................................................................................................ 24

00

Attach explanation of each item

• Specify and explain Missouri modifications that are related to items in Form MO‑NRF, Part 1, Missouri Source Column.

1. Additions (Specify)________________________________________________________________________

1

00

2. Subtractions (Specify) _____________________________________________________________________

2

00

r

3. Missouri source fiduciary adjustment (add Lines 1 and 2) enter here and

Net Addition

r

3

00

as total on Part 4, Column 5 . ..................................................................................

Net Subtraction . ..................

Form MO‑NRF (Revised 12‑2013)

1

1 2

2