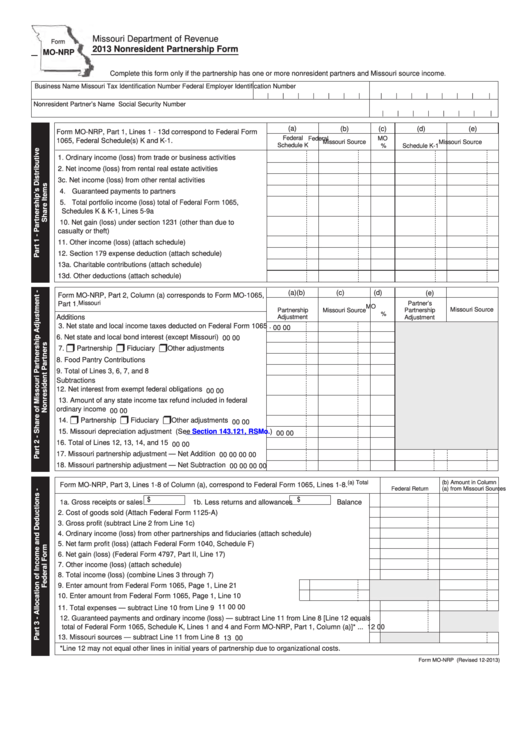

Missouri Department of Revenue

Form

2013 Nonresident Partnership Form

MO-NRP

Complete this form only if the partnership has one or more nonresident partners and Missouri source income.

Business Name

Missouri Tax Identification Number

Federal Employer Identification Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident Partner’s Name

Social Security Number

|

|

|

|

|

|

|

|

(a)

(b)

(c)

(d)

(e)

Form MO-NRP, Part 1, Lines 1 - 13d correspond to Federal Form

Federal

MO

Federal

1065, Federal Schedule(s) K and K-1.

Missouri Source

Missouri Source

Schedule K

%

Schedule K-1

1. Ordinary income (loss) from trade or business activities ..........

00

00

00

00

2. Net income (loss) from rental real estate activities ....................

00

00

00

00

3c. Net income (loss) from other rental activities .............................

00

00

00

00

4. Guaranteed payments to partners ............................................

00

00

00

00

5. Total portfolio income (loss) total of Federal Form 1065,

Schedules K & K-1, Lines 5-9a ...................................................

00

00

00

00

10. Net gain (loss) under section 1231 (other than due to

casualty or theft) ........................................................................

00

00

00

00

11. Other income (loss) (attach schedule) .......................................

00

00

00

00

12. Section 179 expense deduction (attach schedule) ....................

00

00

00

00

13a. Charitable contributions (attach schedule) ................................

00

00

00

00

13d. Other deductions (attach schedule) ..........................................

00

00

00

00

(a)

(b)

(c)

(d)

(e)

Form MO-NRP, Part 2, Column (a) corresponds to Form MO-1065,

Missouri

Part 1.

Partner’s

MO

Missouri Source

Partnership

Missouri Source

Partnership

%

Additions

Adjustment

Adjustment

3. Net state and local income taxes deducted on Federal Form 1065 .

00

00

6. Net state and local bond interest (except Missouri) ..................

00

00

r

r

r

7.

Partnership

Fiduciary

Other adjustments ................

00

00

8. Food Pantry Contributions .........................................................

00

00

9. Total of Lines 3, 6, 7, and 8 .......................................................

00

00

Subtractions

12. Net interest from exempt federal obligations .............................

00

00

13. Amount of any state income tax refund included in federal

ordinary income .........................................................................

00

00

r

r

r

14.

Partnership

Fiduciary

Other adjustments ................

00

00

15. Missouri depreciation adjustment (See

Section 143.121,

RSMo.)

00

00

16. Total of Lines 12, 13, 14, and 15 ...............................................

00

00

17. Missouri partnership adjustment — Net Addition ......................

00

00

00

00

18. Missouri partnership adjustment — Net Subtraction .................

00

00

00

00

(a) Total

(b) Amount in Column

Form MO-NRP, Part 3, Lines 1-8 of Column (a), correspond to Federal Form 1065, Lines 1-8.

Federal Return

(a) from Missouri Sources

1a. Gross receipts or sales $

1b. Less returns and allowances $

Balance .... 1c

00

00

2. Cost of goods sold (Attach Federal Form 1125-A) .............................................................................. 2

00

00

3. Gross profit (subtract Line 2 from Line 1c) .......................................................................................... 3

00

00

4. Ordinary income (loss) from other partnerships and fiduciaries (attach schedule) ............................. 4

00

00

5. Net farm profit (loss) (attach Federal Form 1040, Schedule F) ........................................................... 5

00

00

6. Net gain (loss) (Federal Form 4797, Part II, Line 17) .......................................................................... 6

00

00

7. Other income (loss) (attach schedule) ................................................................................................. 7

00

00

8. Total income (loss) (combine Lines 3 through 7) ................................................................................ 8

00

00

9. Enter amount from Federal Form 1065, Page 1, Line 21 ............................... 9

00

00

10. Enter amount from Federal Form 1065, Page 1, Line 10 ............................... 10

00

00

00

11. Total expenses — subtract Line 10 from Line 9 .................................................................................. 11

00

00

12. Guaranteed payments and ordinary income (loss) — subtract Line 11 from Line 8 [Line 12 equals

total of Federal Form 1065, Schedule K, Lines 1 and 4 and Form MO-NRP, Part 1, Column (a)]* ... 12

00

13. Missouri sources — subtract Line 11 from Line 8 ............................................................................... 13

00

*Line 12 may not equal other lines in initial years of partnership due to organizational costs.

Form MO-NRP (Revised 12-2013)

1

1 2

2